There was a time when the market didn’t care too much for lithium. Other metals, like tantalum for example, held more appeal. I’ll come back to this point. For now, have a look at the share price chart for Wildcat Resources:

If you haven’t been following Wildcat, you might be wondering what on earth happened! In brief, the company, led by Sam Ekins (Managing Director) and Matthew Banks (Executive Director), has made a near-surface lithium discovery at their Tabba Tabba Lithium Project in the north of Western Australia (WA), relatively near to infrastructure. What makes this discovery particularly appealing is that the deposit sits on GRANTED mining leases. Following a series of excellent drill results, they announced on 1 November 2023 that Mineral Resources had bought a 19.9% stake in the company. Then on 10 November 2023 Wildcat announced they’d raised A$100million in a share placement.

Not bad progress for a 6 month period.

If we go back to early 2020, the main focus for Wildcat Resources – then named Fraser Range Metals – was the Mount Adrah gold project in the Fraser Range region of south WA. But spurred on by De Grey Mining’s remarkable Hemi gold discovery up in the Pilbara, they moved their focus north and applied for tenements in ‘the new Pilbara gold province’.

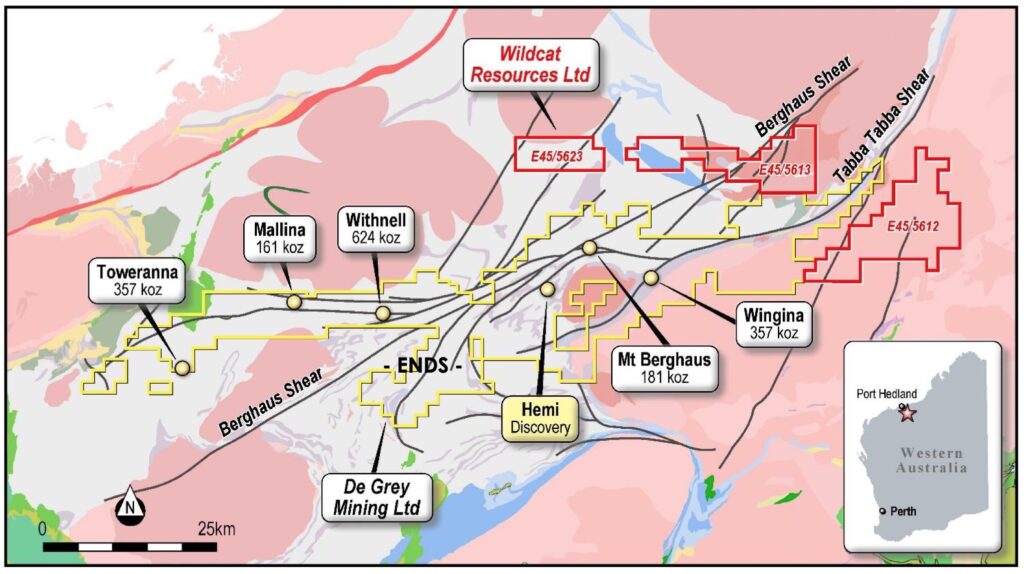

The map shown below is from a November 2020 news release and shows the location of Wildcat tenements at that time (shown in red) in relation to De Grey Mining’s tenements (shown in yellow) and their Hemi gold discovery. Notice the Tabba Tabba Shear in the top right of the image.

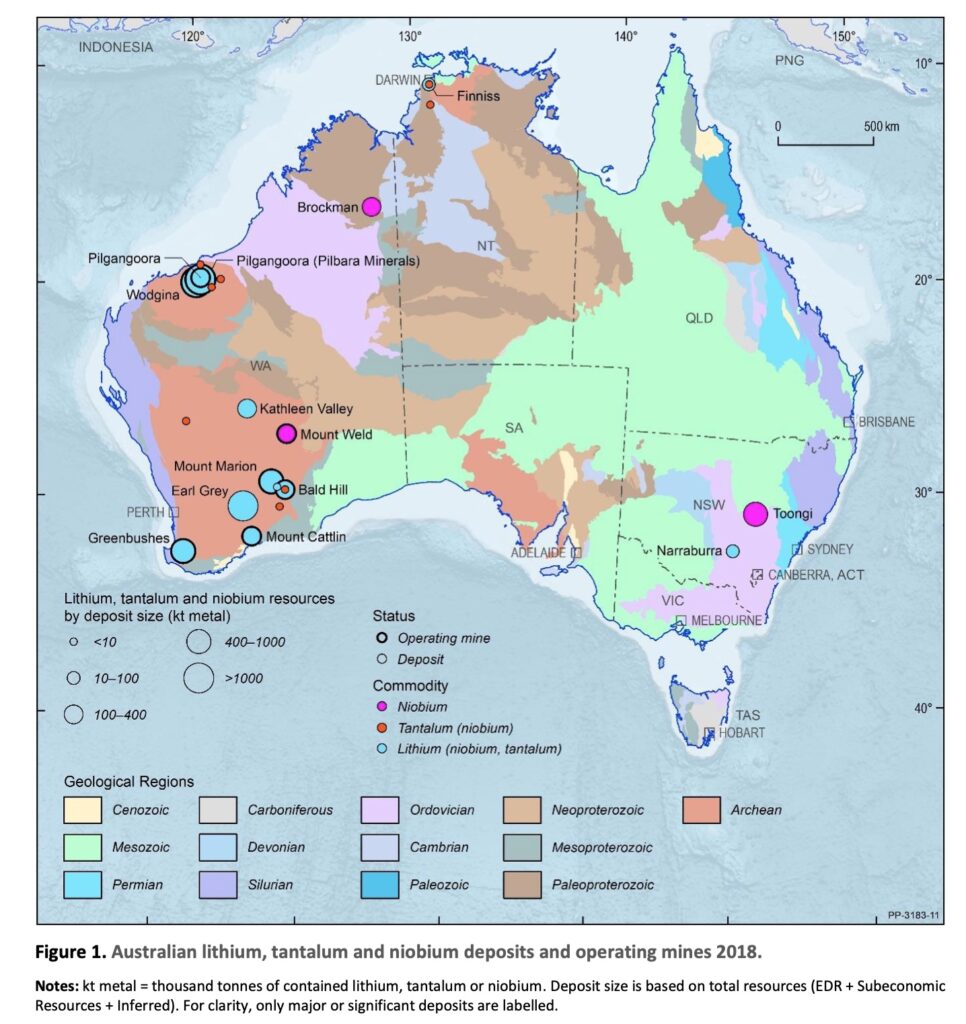

What was fortuitous about Wildcat’s buccaneering move north was that these tenements placed Wildcat smack bang in the middle of lithium country. To help get our bearings, here is a map of major lithium deposits in Australia represented by the light blue coloured circles. The map is somewhat dated now (2018) but it shows the prolific Greenbushes lithium mine south of Perth. In the north of WA you can see the Wodgina and Pilgangoora lithium mines. It’s next door to these two giant lithium deposits in the north that the Wildcat team had pitched up looking for gold.

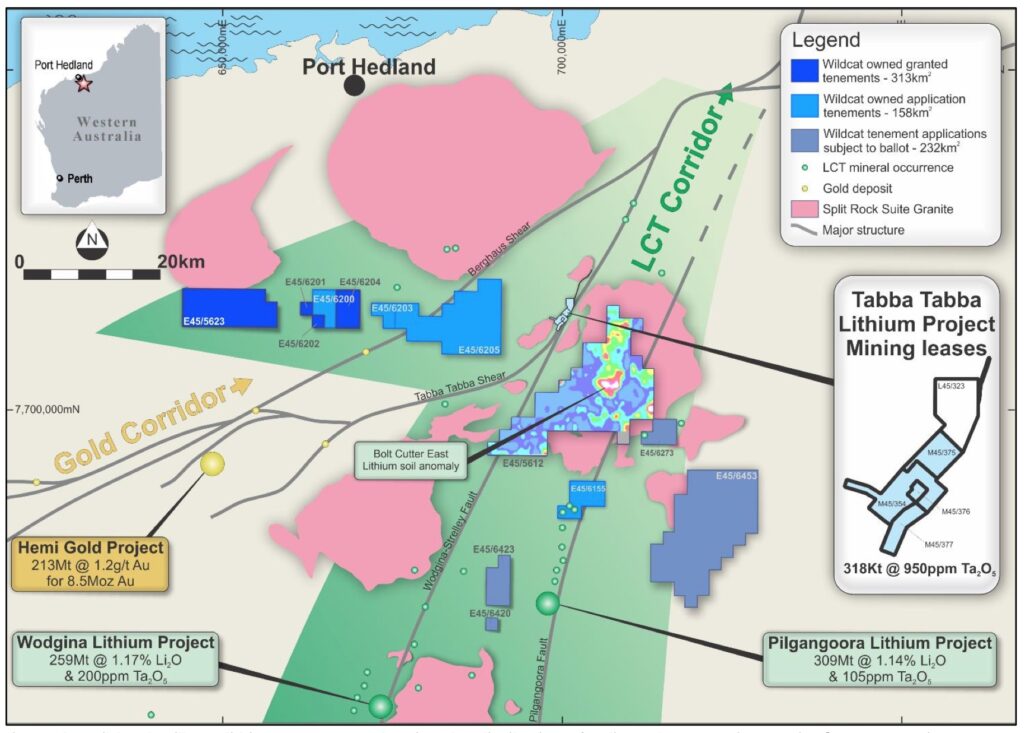

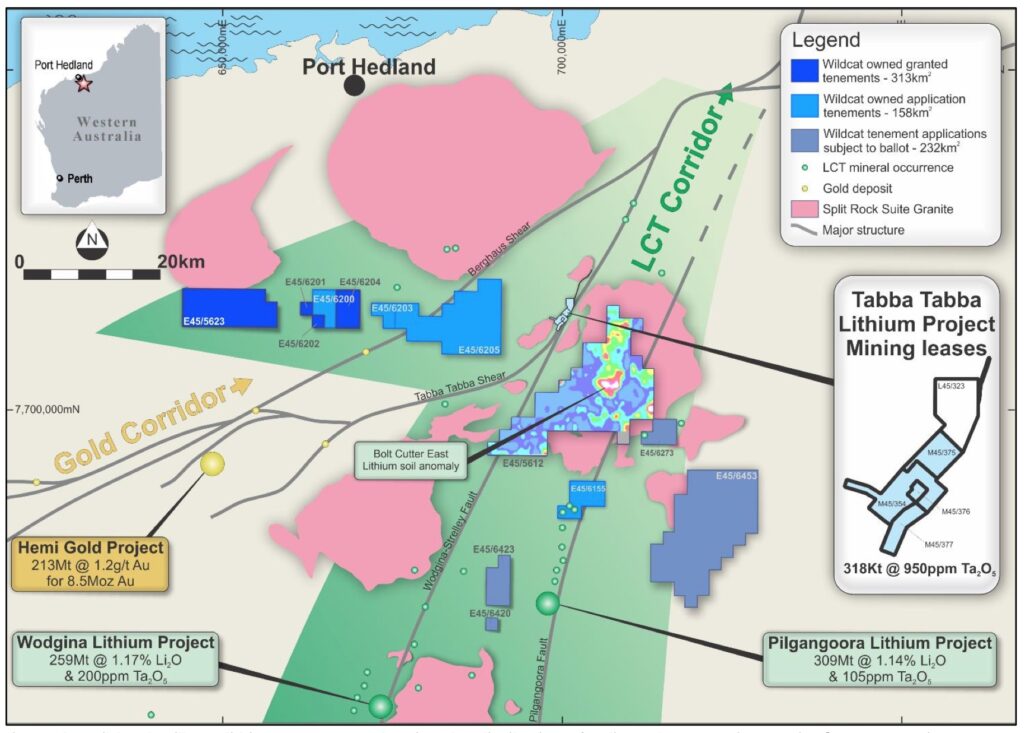

If we fast forward to 2023, the following map is useful. It shows the location of Wildcat tenements as they were at 17 May 2023. Notice De Grey Mining’s Hemi gold discovery on the left. Notice also the Wodgina lithium mine and the Pilgangoora lithium mine at the bottom of the map (green circles).

The pink blobs littered around the map are granite intrusions. Lithium deposits often form on the margins of granite intrusions. Granite itself is a coarse-grained intrusive igneous rock composed mostly of quartz, alkali feldspar, and plagioclase. It forms from magma with a high content of silica and alkali metal oxides that slowly cools and solidifies underground. The black lines on the map above represent big cracks in the earth. It’s along these cracks that magmatic fluids, driven by the heat of the granite intrusion, can travel, carrying alkali metals in solution. As the fluid slowly cools various metals are fractionated out of solution, in a similar fashion to how good ole whisky is distilled. If large enough quantities of minerals are fractionated out of solution, mineral deposits can form. Notice how the Wodgina lithium deposit is located ON / ALONGSIDE the Wodgina-Strelley Fault and how the Pilgangoora lithium deposit is located ON / ALONGSIDE the Pilgangoora Fault.

For non-geologists, one more important thing to mention: The LCT in ‘LCT Corridor’ in the map above stands for Lithium, Caesium, Tantalum and it’s this corridor where the conditions are believed to be right for ‘LCT Pegmatite’ deposits to form. These odd-ball or incompatible elements lithium, caesium and tantalum, along with other unsociable metals like tin, resist forming chemical bonds with other elements and are amongst the last elements to fractionate out of solution. Since they stay in solution the longest they tend to be found furthest from the heat source. Additionally, they’re often found in close proximity to each other and hence the name for these types of geological deposits – LCT Pegmatites.

The alkali metals mentioned above, lithium and caesium are shown in the left hand column of the period table. Tantalum is in fact a Transition Metal and tin is a Post-Transition Metal but both similarly resist fractionating out of solution as long as possible.

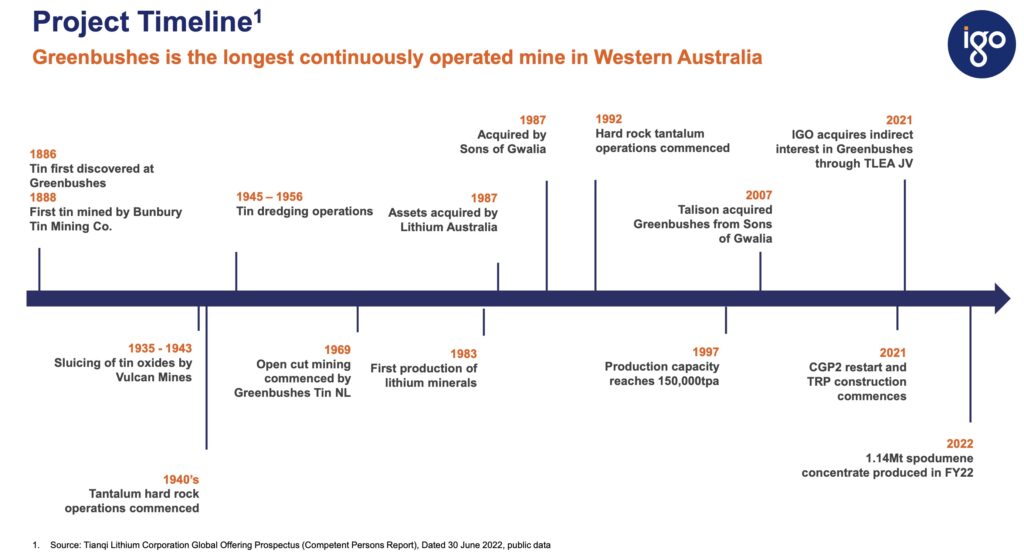

Now that we know a little bit about LCT-type deposits, we can go back to my initial remarks about lithium’s popularity. Greenbushes today is a giant lithium producer but if we explore its history, starting in the 1880’s, it was initially mined for tin. Tantalum production began in the 1940’s. It wasn’t until a century later that lithium production commenced in 1983.

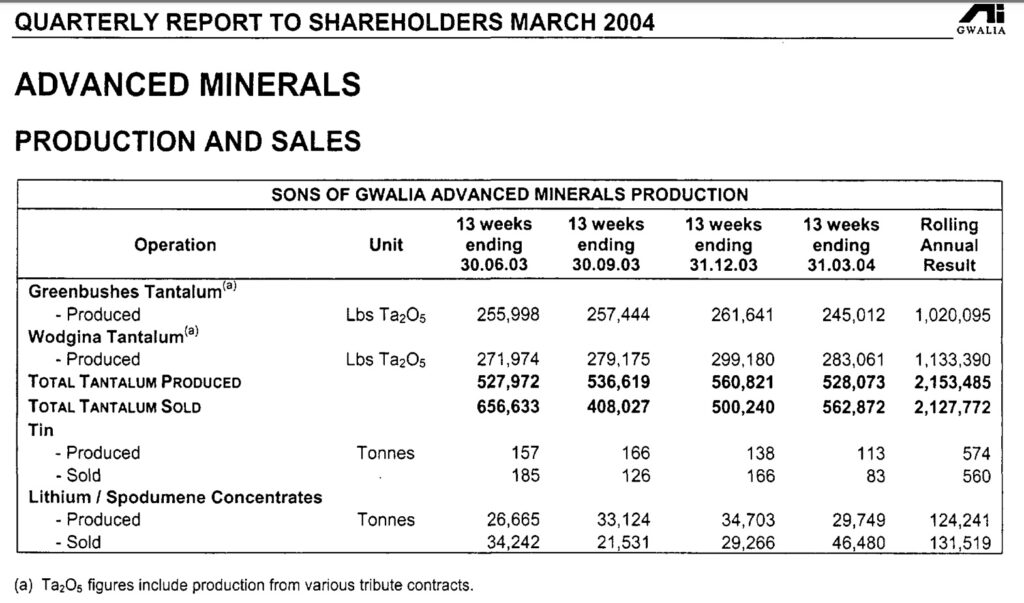

Notice that mining company Sons of Gwalia, known to many as a gold miner, owned Greenbushes for 30 years. The company went into administration in August 2004 and their assets were eventually sold. But around 2004, Sons of Gwalia was a significant tantalum producer from their Greenbushes and Wodgina mines. See their production figures below. The path to administration was facilitated by high debt levels and hedging losses. The tantalum mines were in fact a profitable part of their business.

In 2004, Greenbushes produced tantalum, tin and lithium while Wodgina only produced tantalum. Wodgina’s lithium was lurking nearby undisturbed.

The Sons of Gwalia 2004 quarterly report went onto say that; ‘The Company’s sales of lithium mineral concentrates increased to 46,480 tonnes which is a quarterly record driven by growing demand for lithium batteries in China for mobile phones and laptop computers.‘ Electric vehicle demand is nowhere to be seen! The report also states; ‘Lithium concentrate is encroaching on the current operating capacity of the plant given the current range of products. Ways to cost effectively increase lithium concentrate production are currently being examined given the strong market fundamentals.‘ Lithium was ‘encroaching’ on the main cash generator, which was tantalum. How times have changed!

As Wildcat Resources point out on their website, in the early 2000’s, Sons of Gwalia owned four significant tantalum projects: Greenbushes, Wodgina, Pilgangoora and Tabba Tabba. These assets were sold out of administration in 2007 to a consortium of investment funds led by Resource Capital Fund IV LP (RCF). The new company holding these assets was called Talison Minerals. Then in late 2009, RCF split Talison Minerals into two. Talison Lithium was formed, which retained the lithium mining rights at Greenbushes. The rights to tantalum and tin at Greenbushes, as well as ALL of the remaining assets, including the lithium rights (ex-Greenbushes), were put into Talison Tantalum, that later renamed as Global Advanced Metals (GAM).

As demand for lithium gained traction, first driven by mobile phone and laptop demand, and then later by electric vehicle demand, GAM sold off their assets. In 2014, Pilbara Minerals acquired Pilgangoora for an undisclosed amount but GAM retained a 2.5% Net Smelter Royalty on future production. In 2016 Mineral Resources acquired Wodgina from GAM for an undisclosed amount but retained the rights to the tantalum.

Greenbushes, Pilgangoora and Wodgina have all become significant lithium producers, eclipsing their former days as tantalum producers / projects. But what about Sons of Gwalia’s fourth tantalum project, Tabba Tabba?

GAM did a deal on Tabba Tabba with Pilbara Minerals and a mineral processing company called NAGROM in 2014. Under the deal, GAM retained ownership of the tenements and the rights to the tantalum production, while Pilbara Minerals and NAGROM received the economic benefit from mining the tantalum. A modest sized tantalum operation was planned. According to Pilbara Minerals 2015 annual report, ‘Approvals were received for the Works plan, Mining plan, and Mine Closure Plan in July 2015, which enabled the Company to commence site works and mine development.‘

By September 2015 the following equipment was in place:

In the run up to production Pilbara bought out NAGROM’s share of the venture. But then things started to go wrong. Pilbara Minerals’ quarterly ASX update released 28 January 2016 stated the following on Tabba Tabba:

‘On 30 October 2015, the WA Department of Water granted Pilbara’s wholly-owned subsidiary Tabba Tabba Tantalum Pty Ltd (“TTT”) approval to take water from Ground Water Licence 181791. This approval enabled wet commissioning and initial operations to commence at Tabba Tabba in November. During the commissioning process, Pilbara’s operational team identified areas of the plant that require modification and rectification in order to allow it to run to optimal (design) levels. These include the ball mill and the coarse recovery section of the plant, namely the primary and secondary jigs.

While the repairs and modifications are not considered to be major, they have prevented the plant from achieving design throughput and achieving a representative recovery rate during commissioning. Accordingly, the Company in early January decided to suspend commissioning to allow an engineering assessment to be undertaken with the assistance of independent consulting engineers in order to identify the most timely and cost effective pathway to implement the requisite changes.‘

Eventually Pilbara Minerals threw the towel in at Tabba Tabba. They were having enormous success at Pilgangoora drilling for lithium on tenements that they owned. This problem at Tabba Tabba was a distraction and they didn’t own the tenements, nor have access to the lithium rights. Pilbara’s 2016 annual report notes:

‘As a result of the decision to suspend operations indefinitely, the Company expects to return all mineral rights back to GAM for no consideration and accordingly all capitalised project development costs ($7.66 million) have been impaired to nil.’

In the meantime, the original buccaneers, Matthew Banks and Alex Hewlett, who steered Wildcat Resources’ focus north to the Pilbara were working hard. They expanded the Wild Bunch to include geologist Sam Ekins (Managing Director) and Jeff Elliott (Non Executive Chairman). Sam Ekins then wisely brought over a sharp-shooting geologist Torrin Rowe (Exploration Manager) to join the team, whom he’d previously worked with while at Evolution Mining. Torrin won the IMDEX Exploration Geologist of the year award in 2018 and was noted for his ‘natural talent for exploration with a high degree of geological insight, coupled with a massive work ethic, and a hunger to make discoveries.’ Torrin is pictured in the middle with an award celebration kit:

The Wildcat Resources team realised that Tabba Tabba was the only project, of Sons of Gwalia’s original back catalogue of four tantalum projects, that hadn’t been properly explored for lithium. And it lay dormant between two of their properties. As an LCT Pegmatite deposit, it was geologically similar to Greenbushes, Wodgina and Pilgangoora. The chances of a lithium deposit were favourable. In fact in 2013, four holes had been drilled outside of the Tabba Tabba tantalum resource and intersected pegmatite that was host to high-grade lithium intercepts of:

- 8m at 1.42% Li2O from 4m (TDRC02),

- 16m at 0.9% Li2O from 10m (TDRC03) and,

- 1m at 2.00% Li2O from 40m to EOH (TDRC04).

Based on the Introduction Fee Options approved at the recent AGM, it appears that Alex Hewlett (Non Executive Director) made the connection with GAM. And on 17 May 2023, a deal to acquire Tabba Tabba from GAM was announced to the market.

If we go back to the map shown earlier, that was released on the day that the deal was announced, you can see the Tabba Tabba Lithium Project mining leases sitting neatly on the junction where the Tabba Tabba Shear meets the Wodgina Strelley Fault. A promising location with an excellent plumbing system for the magmatic fluids to travel down, hopefully carrying large amounts of alkali metal oxides.

Fieldwork commenced in late May 2023 and new pegmatites were quickly identified:

Drilling then got underway in July 2023 and a second rig was added in August. On 13 September 2023, the stock went into a Trading Halt. An ASX announcement was made a few days later (18 September 2023) titled: MAJOR LITHIUM DISCOVERY AT TABBA TABBA. The Company’s first assays from their maiden drill program at Tabba Tabba returned:

- 85m at 1.1% Li2O from surface (TARC086) (down-hole length) including 59m at 1.5% Li2O from surface.

- 218m at 0.8% Li2O from 16m (TARC089) (down-hole length) – estimated true width of approximately 53m

The central pegmatite zone was estimated to be more than 1.2km long at true widths of 50m and up to 132m. Wildcat were onto something.

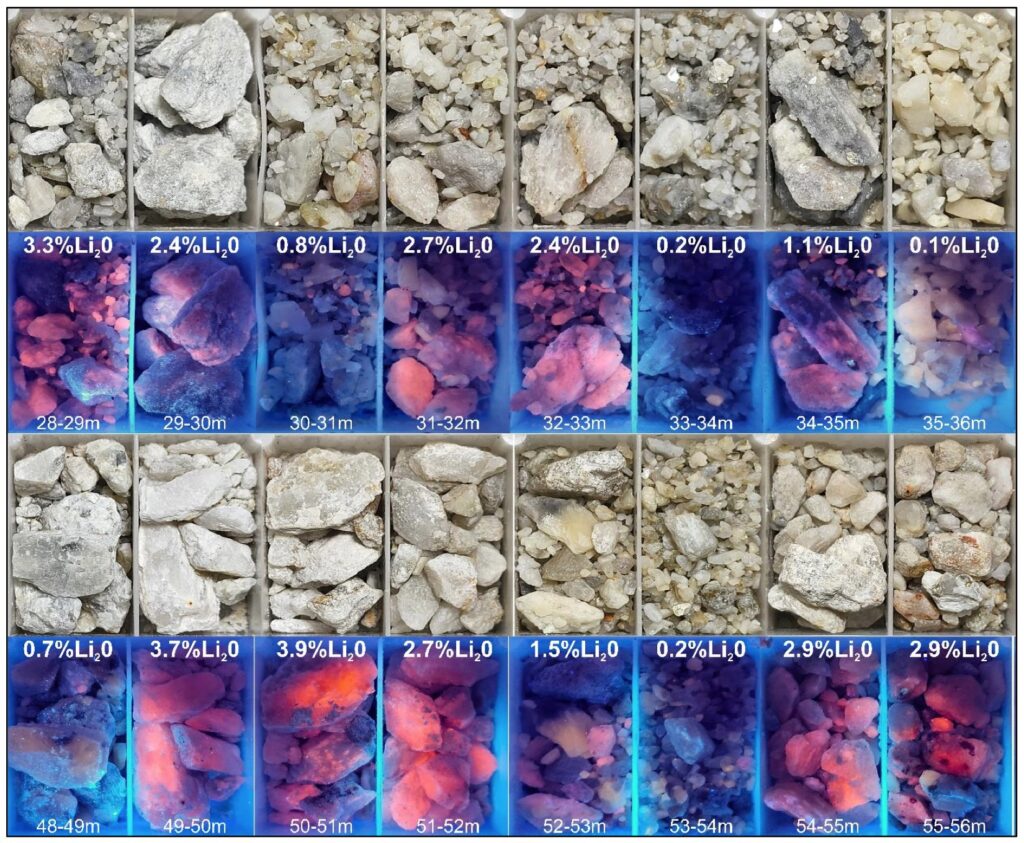

Not only this, but the lithium mineralisation appeared to be the right kind. For non-geologists, there are a large number of lithium-containing minerals. For example, petalite, lepidolite, elbaite, cookeite, polylithionite, etc. The list is long. The mineral that you want to find is spodumene, since processing is currently the easiest, and best understood. Lithium minerals like petalite and lepidolite can be more problematic to process.

The news release went onto say: ‘The dominant lithium mineral species in TARC086 is interpreted to be spodumene based on the vibrant salmon orange fluorescence of the rock chips under ultraviolet light in conjunction with supporting lithium analytical data. Little to no lepidolite was observed during logging across all major pegmatites.’

Excellent drill results have continued and on 12 October 2023, and after reporting 52m at 1.3% Li2O from 117m (TARC131) (est. true width) and 35m at 1.5% Li2O from 200m (TARC024) (est. true width), Sam Ekins commented that ‘the central pegmatite cluster appears to be getting better with depth‘.

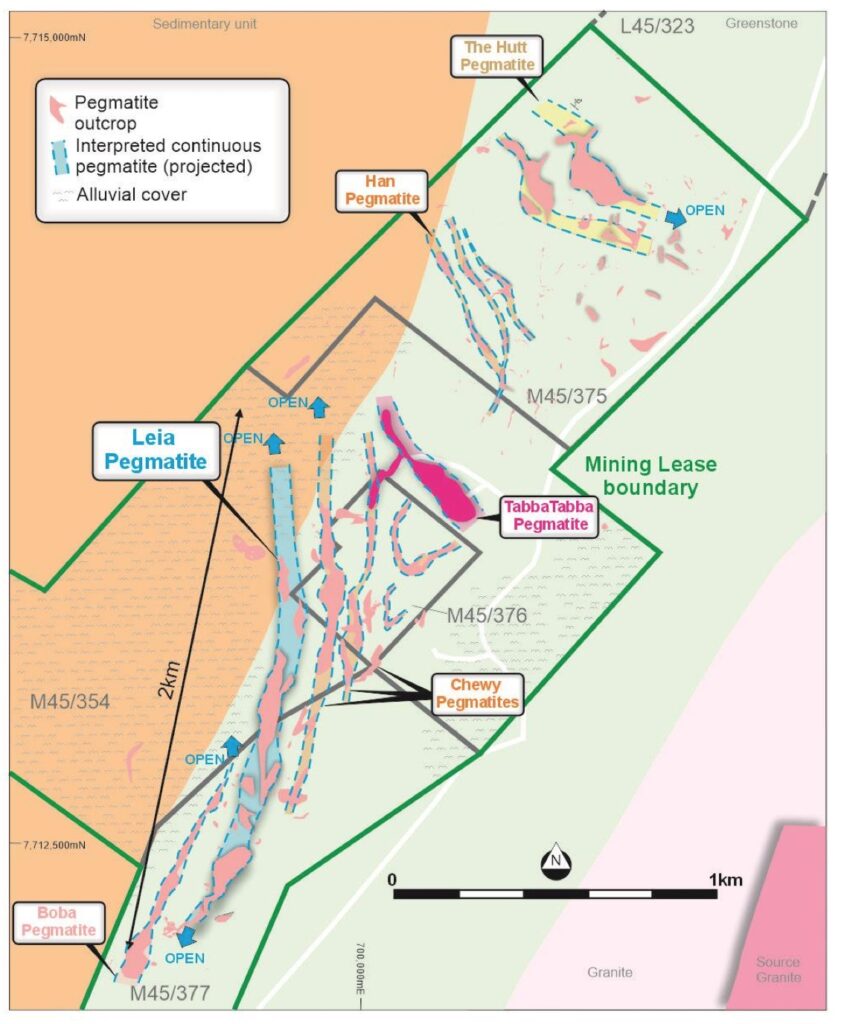

A drilling update on 21 December 2023, showed the following plan view with the six main prospects and the central pegmatite zone now estimated to be 2km long.

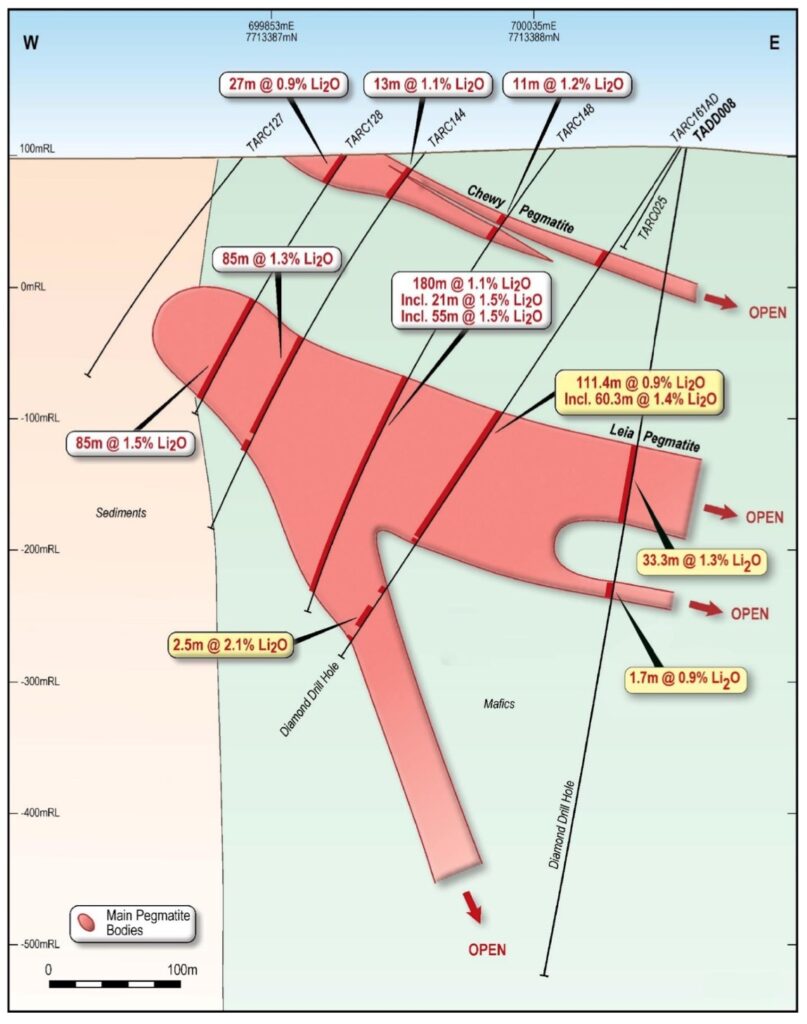

The following cross section also helps to visualise Sam Ekins’ hypothesis that the central cluster appears to be getting better with depth:

According to the 21 December 23 news release, Wildcat has now ‘completed 174 RC drill holes, 24 diamond tails and four full length diamond drill holes for 42,838m since drilling commenced at Tabba Tabba in July 2023.’ 36 drill holes into Leia are awaiting assay and continued ramp of of drilling is planned in early 2024. It’s important to remember that it’s still early days from a drilling perspective and particularly early days from a mineralogical perspective. Much work is still to be done. But things are looking good.

The location of the discovery in Australia AND on existing mining leases is especially favourable. Particularly when you consider how Atlantic Lithium’s Ewoyaa lithium project in Ghana has recently been given a mining license but at the expense of the lithium royalty increasing from 5% to 10%. Jurisdiction is often critical.

Wildcat Resources’ leap into the big league has been nothing short of remarkable and I can’t help but admire the progress of these spirited explorers. They did their homework and put themselves in the right place to seize a big opportunity. This is a fascinating story currently unfolding. I’ll be watching closely.