An ASX announcement from Ausgold caught my attention recently.

Board Changes

On 20 May 2024, the company revealed several changes to the board of directors that included the appointment of John Dorward as Executive Chairman. I met John a number of years back when he was CEO of TSX-listed Roxgold Inc and building the high-grade Yaramoko gold mine in Burkina Faso. John and his team poured first gold at Yaramoko in May 2016 with a head grade of 15 g/t gold. The Roxgold board eventually sold the company in 2021 to Fortuna Silver Mines Inc in an all-share deal valued at US$884 million. I like leadership that can let go of the company levers, if the price is right!

The May 2024 Ausgold news release revealed that Adrian Goldstone from Dundee Corporation had joined the board as a Nominee Director. He appears to have a technical role at Dundee. This announcement followed an April 2024 release where experienced mine engineer, Mark Turner, joined the board as a Non-Executive Director. The capable geologist Dr Matt Greentree remains Managing Director and London-based mining magnate Richard Lockwood stepped down from the Chairman’s role after over a decade guiding the board and the company. He remains a large shareholder.

A$38 Million Capital Raising

It seems that I wasn’t the only person who viewed these board changes as significant. A few weeks later Ausgold announced a A$38million capital raising, supported by institutional investors Jupiter Asset Management and Dundee Corporation. As an aside, Jupiter Asset Management’s Gold & Silver team is led by Ned Naylor-Leyland. Ned’s views on the gold and silver market can be viewed here starting at 37 minutes and 48 seconds.

Summary

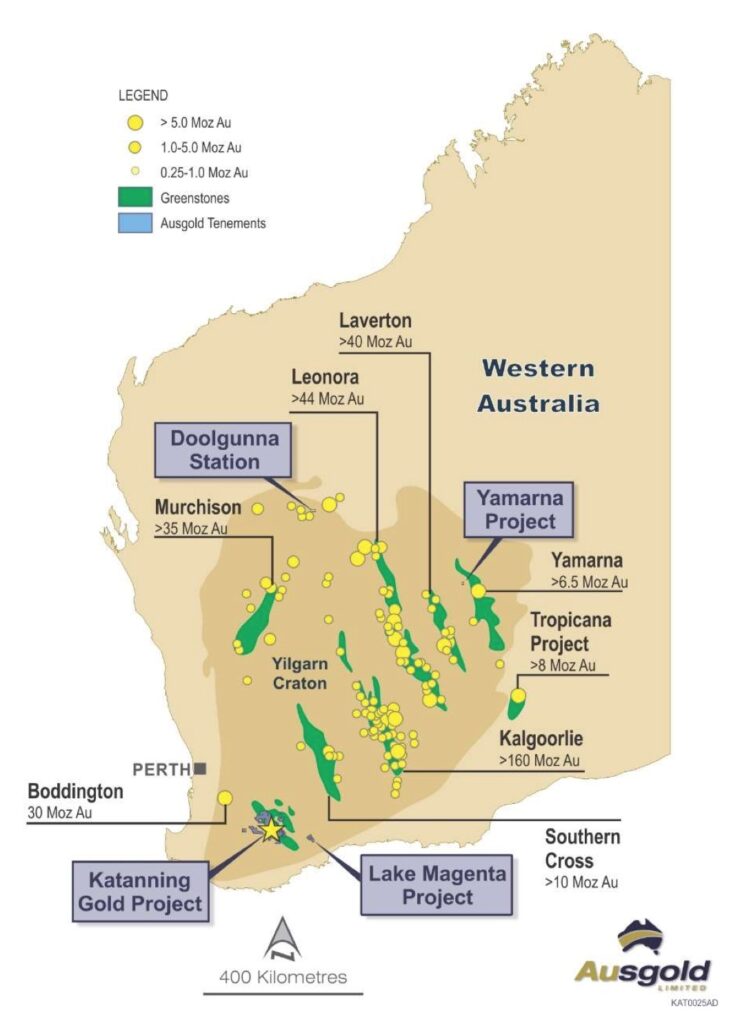

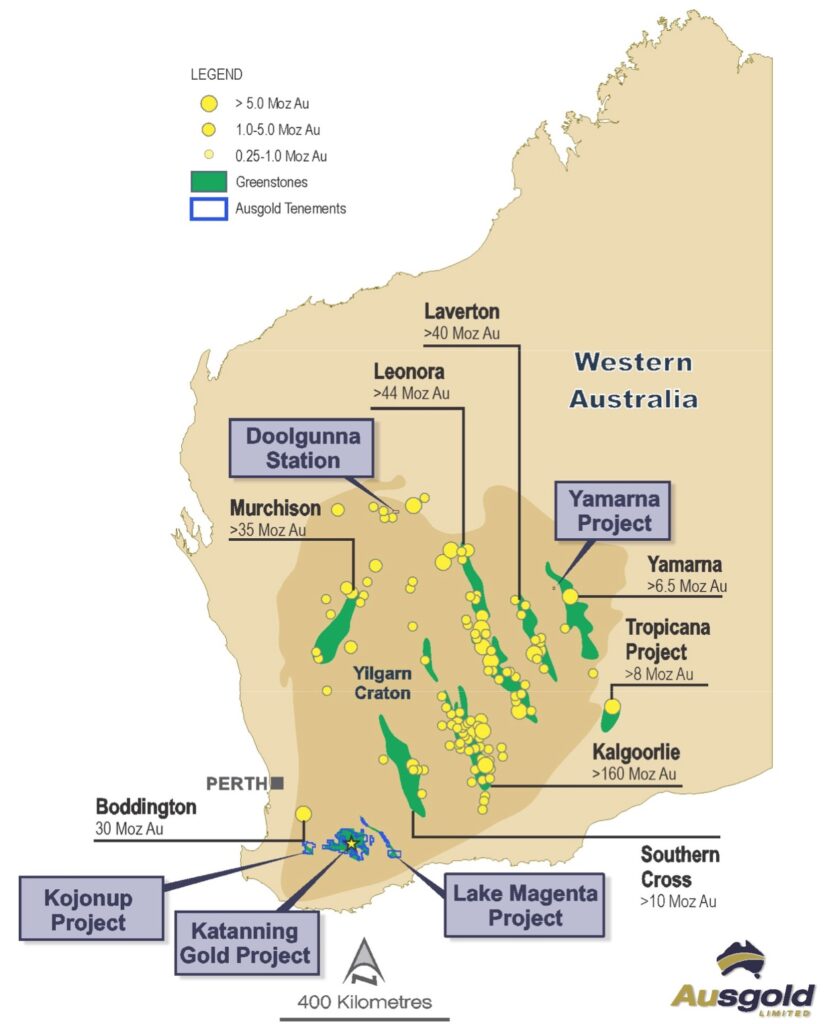

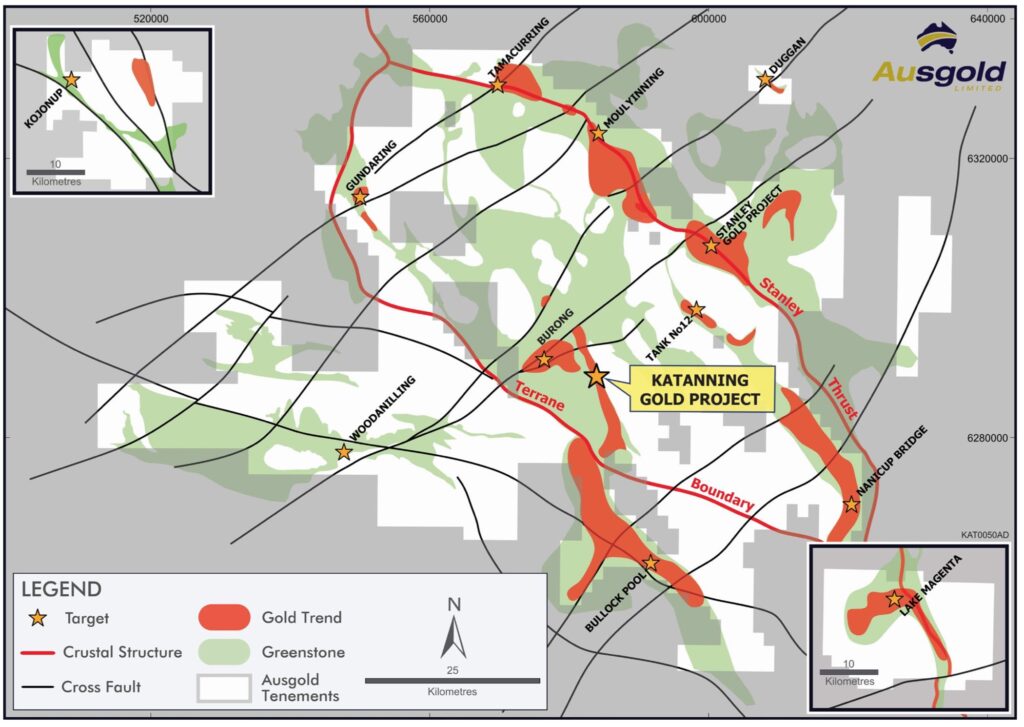

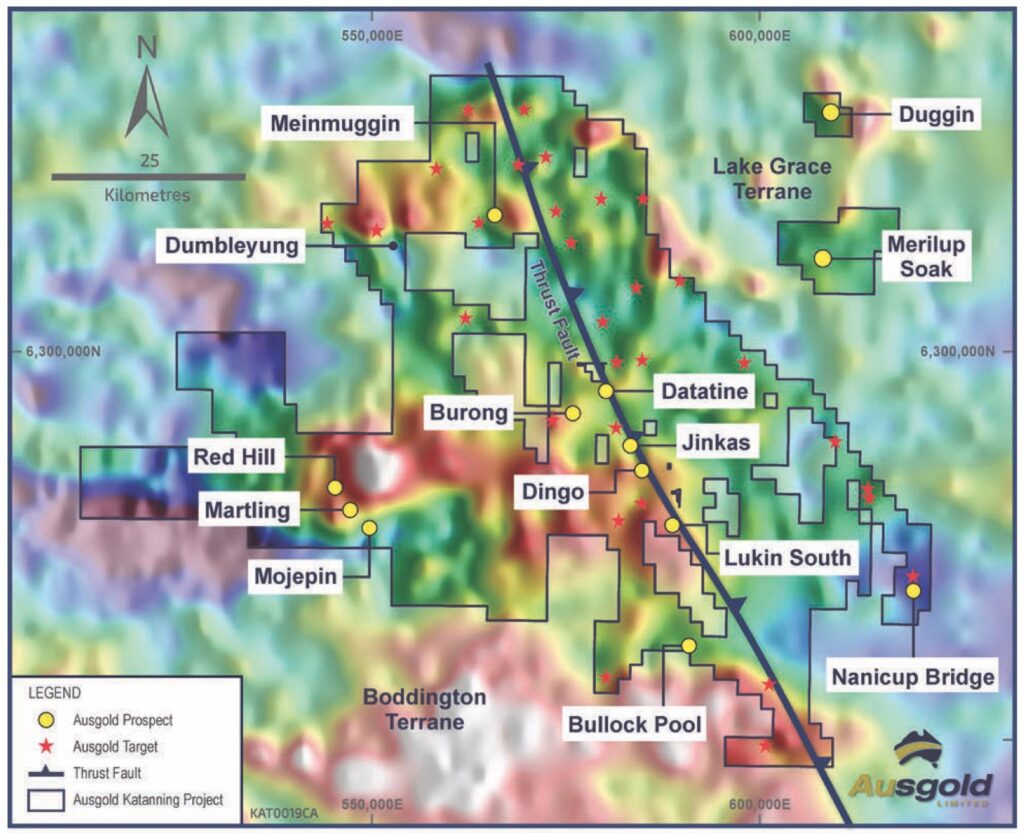

The key reasons for my interest in Ausgold are as follows; Ausgold’s Katanning Gold Project has a large resource of over 3 million ounces of gold at over 1 gram per tonne; The resource, located in Western Australia, is shallow and appears to have clean metallurgy. Previous mining of the deposit, during the low gold price era of the late 90’s, has disturbed the ground already and the majority of the resource is located on existing mining licenses. Lockwood and his team made significant progress over the last decade defining the resource and progressing studies. A Definitive Feasibility Study (DFS) is currently underway. Ausgold’s market cap. on 19 May 2024, the day before the board reshuffle, was a mere A$60m. The company controls 5,500km2 of ground, across key structural features, in what appears to be a relatively under-explored region of the gold-enriched Yilgarn Craton. This seems to be a somewhat overlooked company.

I’ll go into further detail on the above but for now let’s find our bearings and look at the project location.

Ausgold Assets

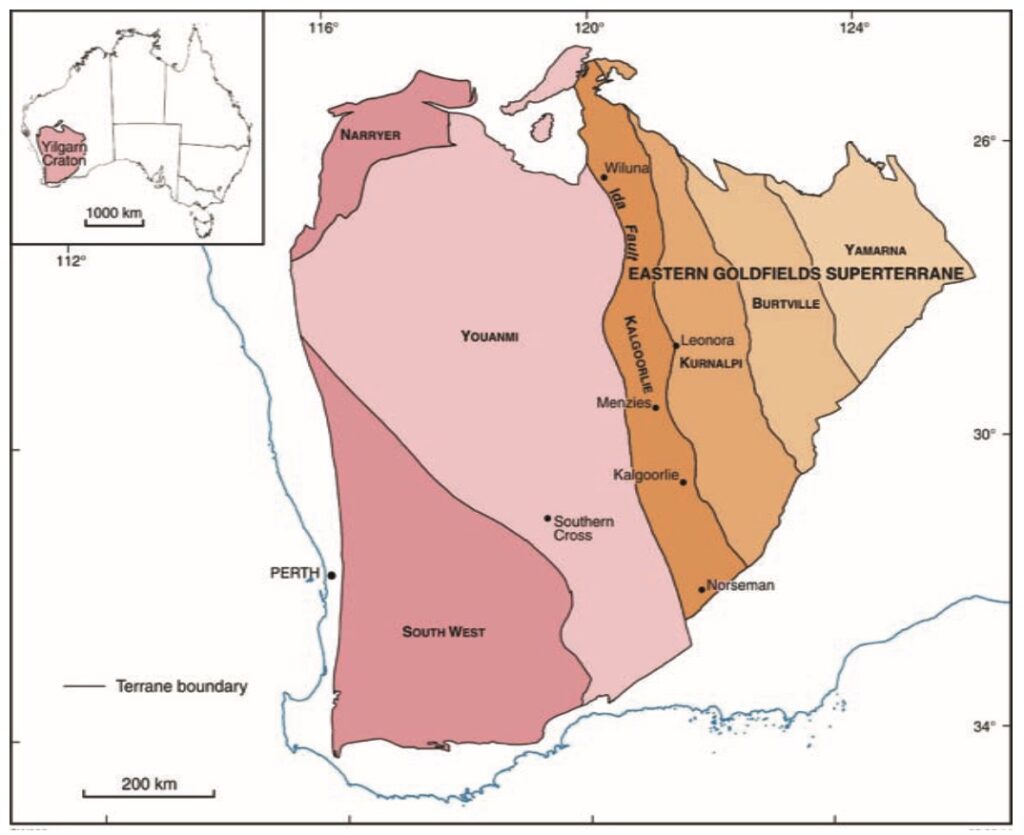

Ausgold has a number of projects, all located within the geological boundary of the Yilgarn Craton in Western Australia. It’s a geological feature enriched in some areas with gold, most famously, Kalgoorlie. For the purpose of this article, I’m going to focus on Ausgold’s most advanced project to date, the Katanning Gold Project, and ignore the other projects.

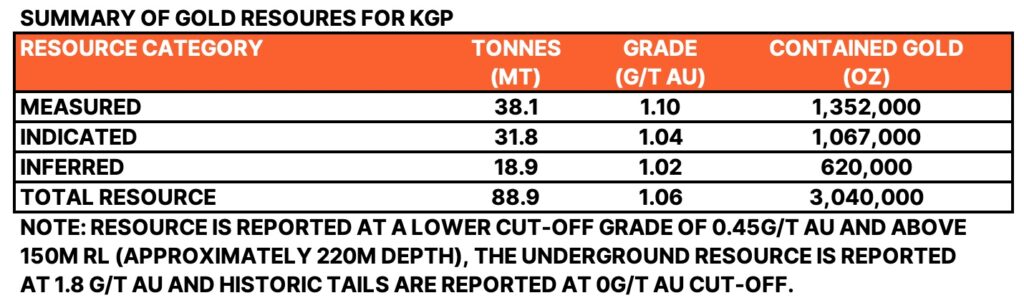

Mineral Resources and Reserves – KGP

As mentioned, Ausgold’s Katanning Gold Project has over 3 million ounces of gold in Resource. Notice that over 79% of these ounces are in the higher confidence categories of Measured & Indicated. The overall resource grade is a respectable 1.06 g/t Au.

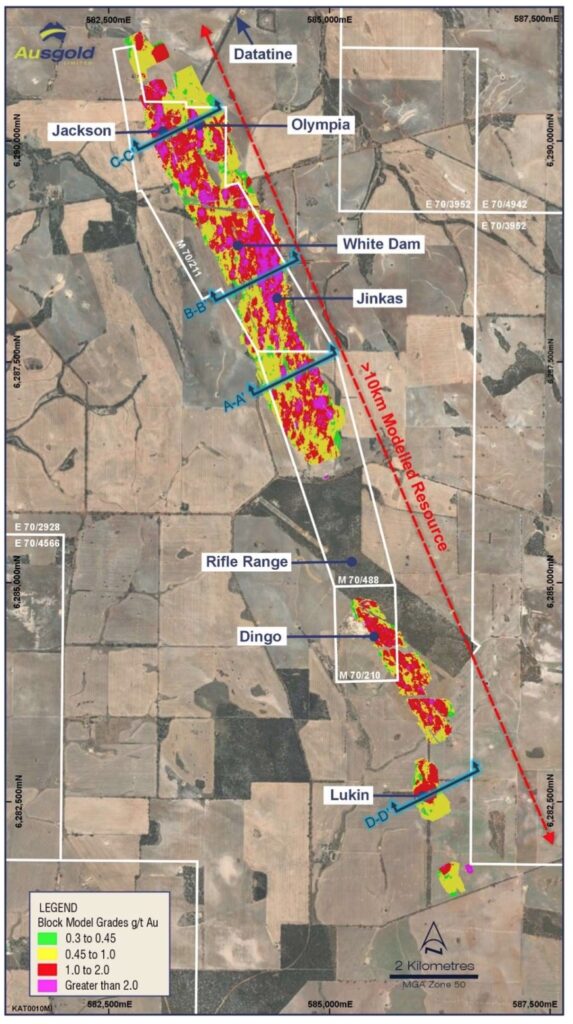

The following image shows the mineral resource of the project in plan view (looking down). The tenement boundaries are highlighted in white and the tenements with a serial number beginning with ‘M’ are the existing mining leases. There are currently three mining leases; M70/211, M70/488 and M70/210.

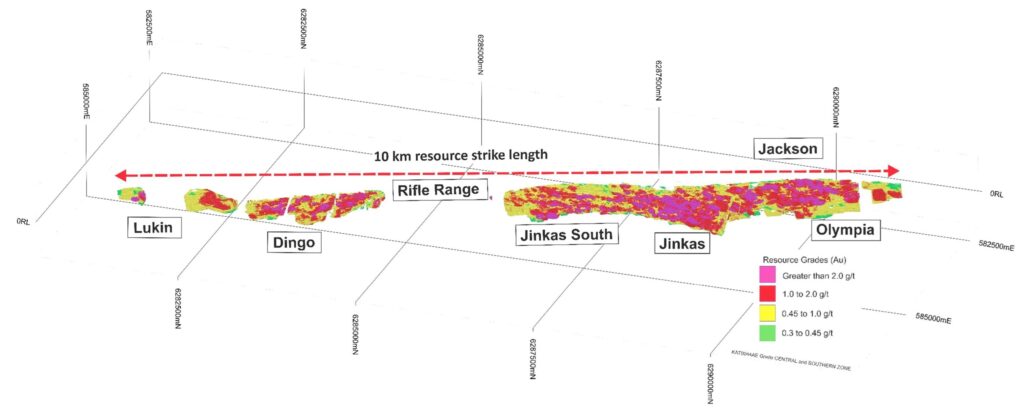

Here’s another view of the mineral resource as shown in the 4 September 2023 ASX release:

You can read the detailed Mineral Resource Statement for KGP by clicking here.

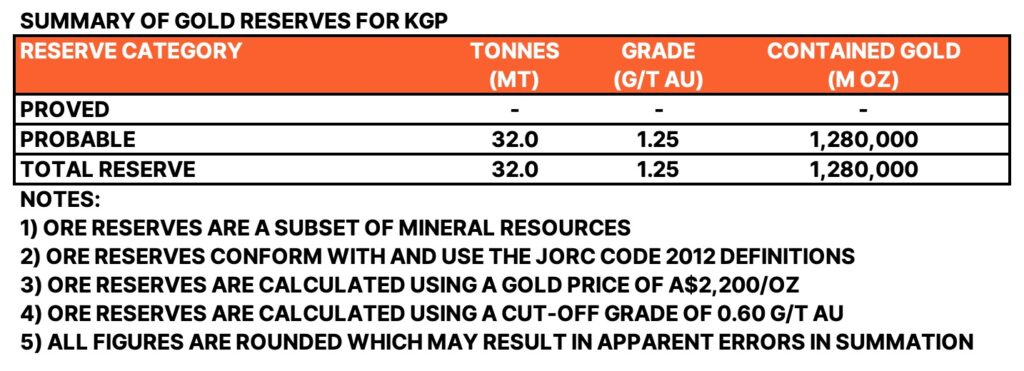

The Reserve Statement for the project is shown below. The key thing to understand is that technical studies have shown that over 1.2million ounces of gold are estimated to be economically recoverable at a grade of 1.25 g/t Au. Notice also the gold price of A$2,200/ounce used to calculate Reserves. As at 16 June 2024, the gold price in Australian Dollars is A$3,526/ounce.

Preliminary Feasibility Study (PFS) – Reserve Statement

The gold reserves shown above were released with Katanning’s Preliminary Feasibility Study (PFS) on 1 August 2022, and assumed open pit mining of 3 million tonnes of ore per year and processing using conventional gravity and CIL (Carbon In Leach). I’ve uploaded the study summary so you can take a closer look (see below) as it’s packed with useful information. Importantly, initial capital requirements are estimated at A$225million, and the project is forecast to generate a post-tax Internal Rate of Return (IRR) of 40.7% and a Post Tax NPV (5% discount rate) of A$364million.

Since this PFS was released, it appears that the project might grow in scale. In February 2023, the company announced that they were considering options for a bigger operation. Then in May 2023, it was announced that the “existing Prefeasibility Study (PFS) clearly indicates viability of a larger 5 Mtpa operation which will form the basis of the Definitive Feasibility Study (DFS)“

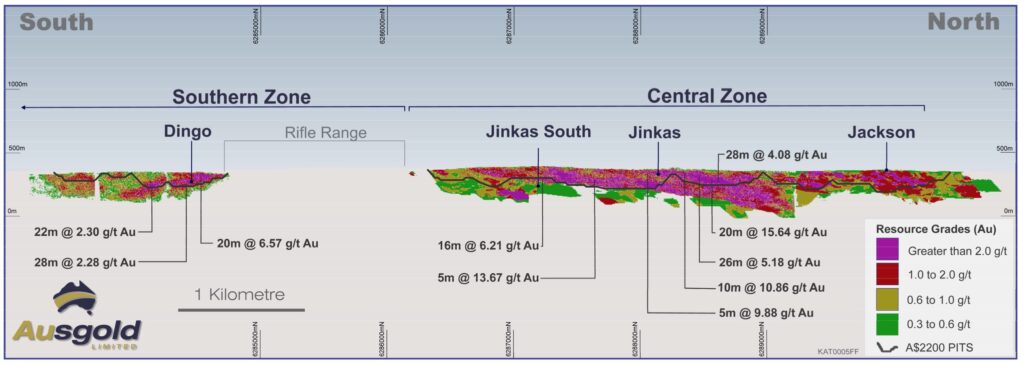

Going back to the PFS, it contains a long-section through the multiple project deposits that highlights the shallow nature of the deposit. If you look carefully you can see proposed A$2,200 pit shell (dark blue line) and the mineralisation that would be mined.

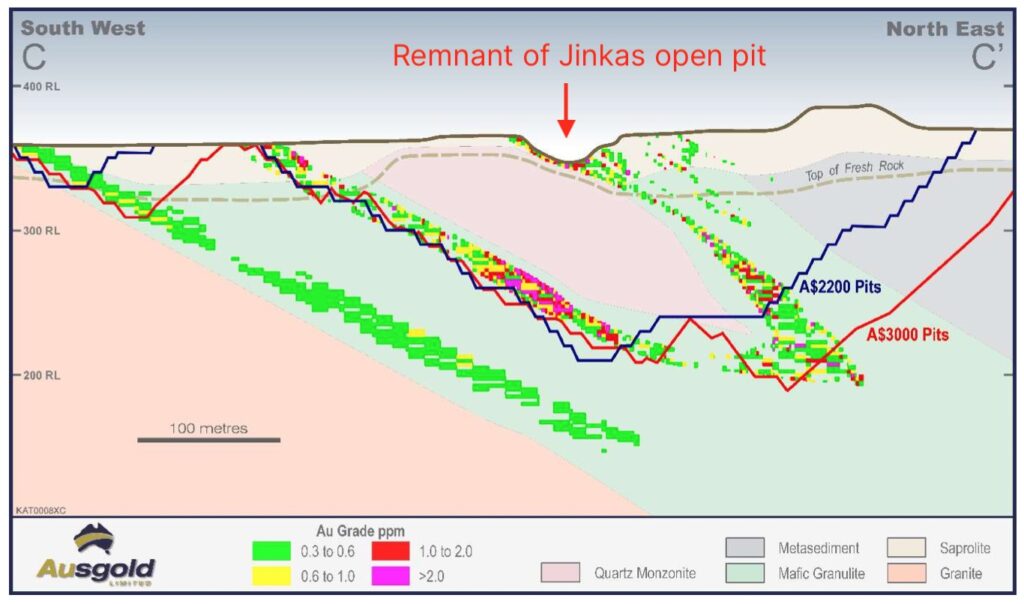

The PFS also contains the following cross-section through the Jinkas deposit. Notice how the mineralisation is contained within the Mafic Granulite rock (green). The Quartz Monzonite intrusion (pink) doesn’t contain any gold at all and the Mafic Granulite rock appears to be folded around this intrusion. The cross section shows a A$2,200/ounce pit shell as well as a A$3,000/ounce pit shell, which helps to understand the additional material that could be mined at A$3,000/ounce and above. Note also the saprolite (a clay enriched layer shown in beige) covering the deposit.

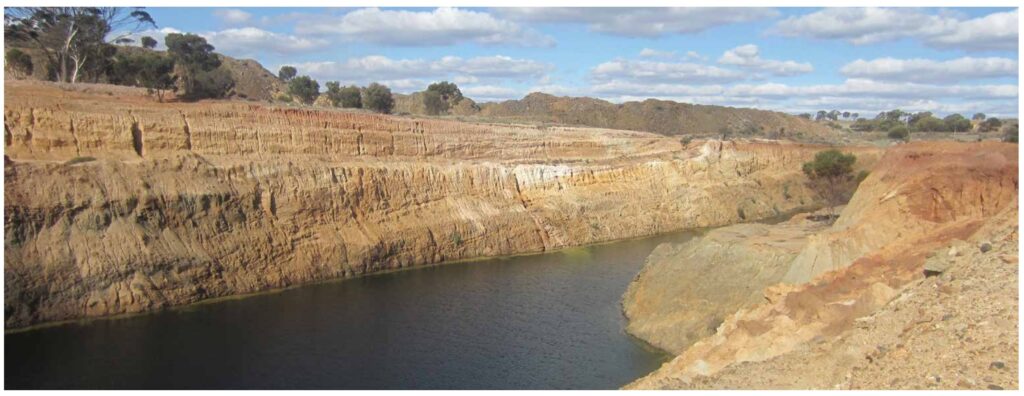

I’ve added a red arrow in the image above to highlight the old Jinkas open pit. Here are some actual photos that I’ve found:

History of the Katanning Gold Project

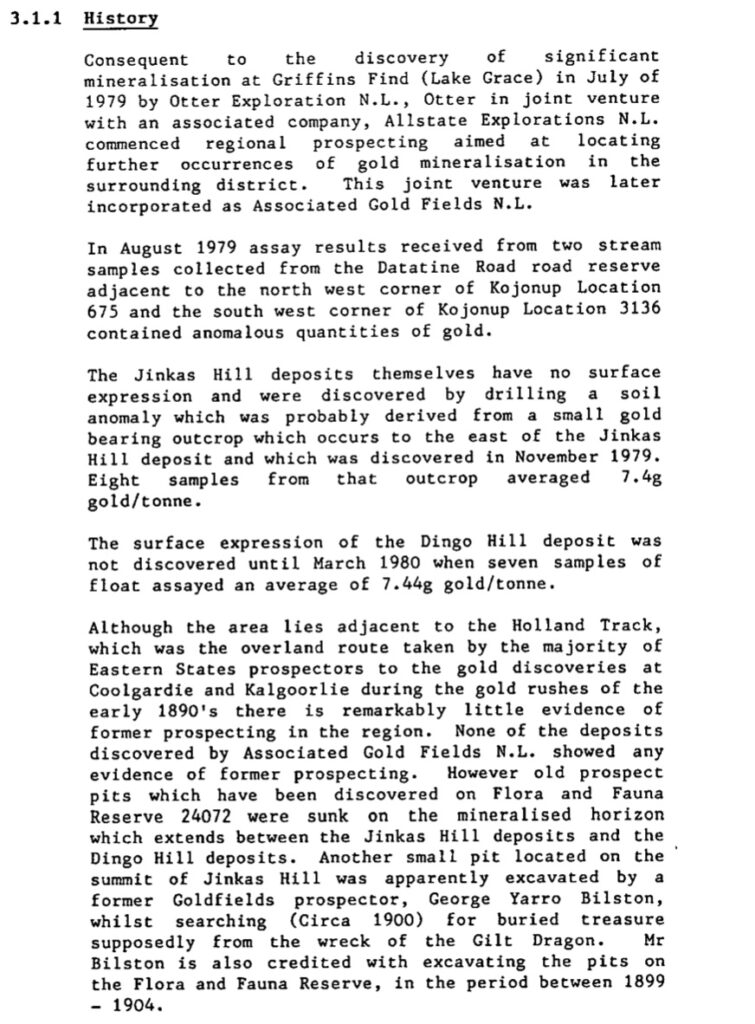

I wanted to find out more about the history of the project and after a bit of hunting I came across the following mining proposal by Glengarry Mining dated August 1988. The Katanning Gold Project was formerly known as the Badgebup Gold Project.

Section 3 of the document explains a history of the project. It’s interesting that the Jinkas Hill deposit is noted as having ‘no surface expression‘. Remember the saprolite covering the deposit in the cross section image above. It’s also interesting to note the comment that ‘there is remarkably little evidence of former prospecting in the region.’

It was a modest sized operation and the objective of the mining proposal was described as follows;

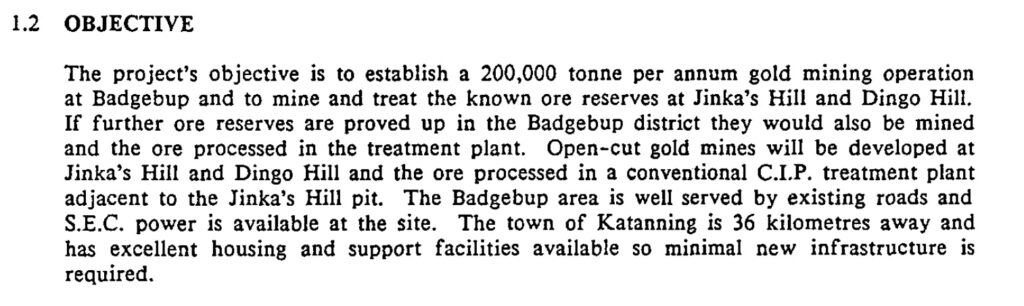

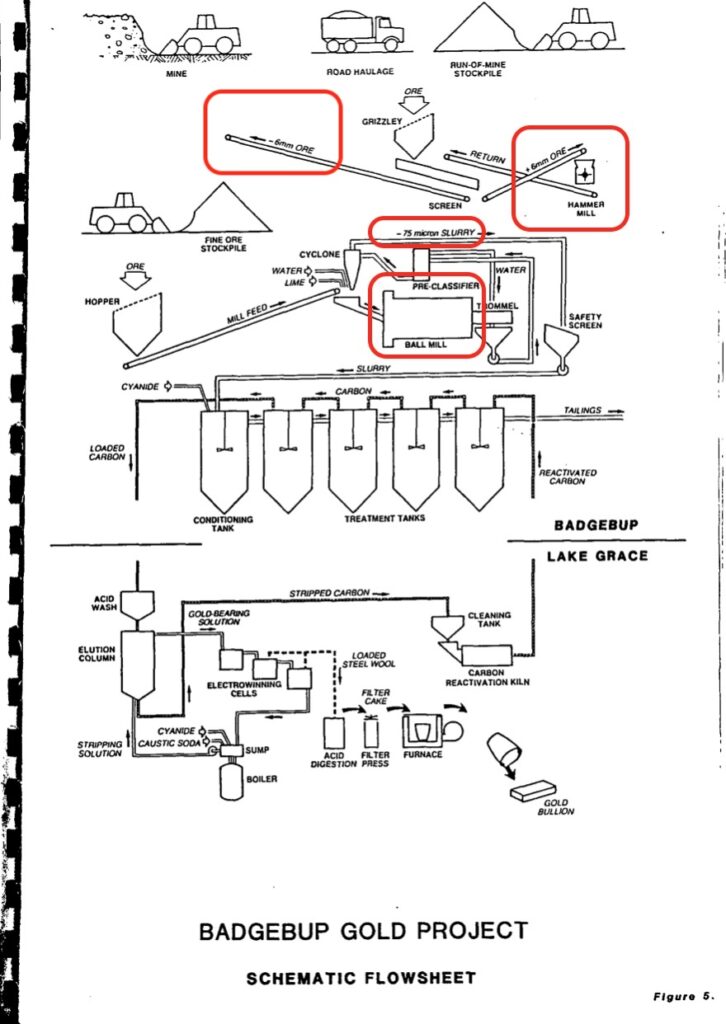

And in the following map of the Badgebup project you can see the proposed pits; Jinka’s Hill on Mining Lease M70/210 and Dingo Hill on M70/211.

Page 39 of Ausgold’s 2022 Pre Feasibility Study(PFS) provides some further history. “International Mineral Resources NL (IMR) purchased the mining leases and the Grants Patch treatment plant from Glengarry Mining NL in 1995 and commenced mining at the Jinkas deposit in December 1995. Ausgold understands the mine was closed in 1997 after producing approximately 20,000 oz of gold from the Jinkas and Dingo Hill open cuts at a head grade of approximately 2.4 g/t. It is understood that mine closure was brought about by a combination of the low gold price of the time (<US$400/oz) and the inability of the processing plant’s comminution circuit to process hard ore from below the base of weathering. Reports from the period indicate that the ore bodies were reasonably predictable in terms of grade and continuity and appeared to produce consistent and reproducible results from grade control. (Ravensgate, 1999).”

The following image shows the Dingo Hill pit in more recent times.

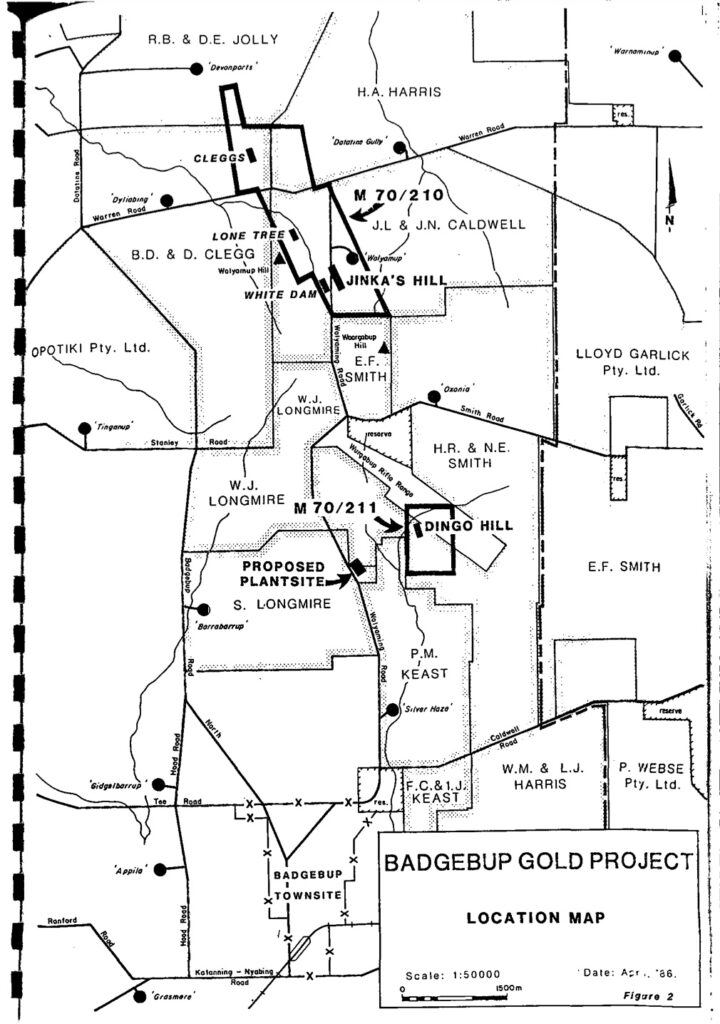

Hard Rock

The hard rock comment is interesting. Along with the comment about a low-gold prices, it helps us to understand what went wrong back in the 90’s. Which is why I dug a little deeper. Glengarry’s Mining Proposal in 1988 was an Addendum to a mining proposal lodged in May 1986 by Associated Gold Fields, which proposed the following flow sheet for the operation. It looks like primary crushing proposed a hammer mill rather than a jaw crusher. Notice also that the hammer mill is planned to take +6mm ore and return -6mm ore. It then targets grinding down to 75 microns by using a ball mill. I’ve highlighted the relevant parts of the flow sheet in red.

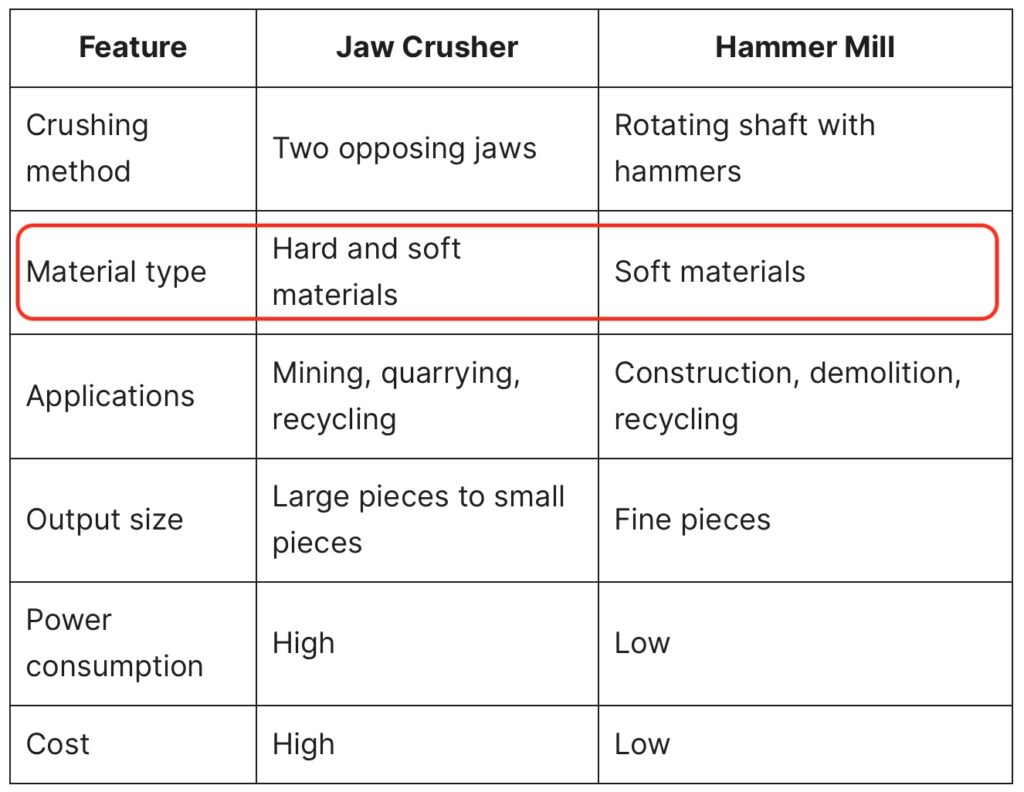

In general terms, hammer mills are better suited to softer material for primary crushing while jaw crushers are better suited to harder material. See the table below.

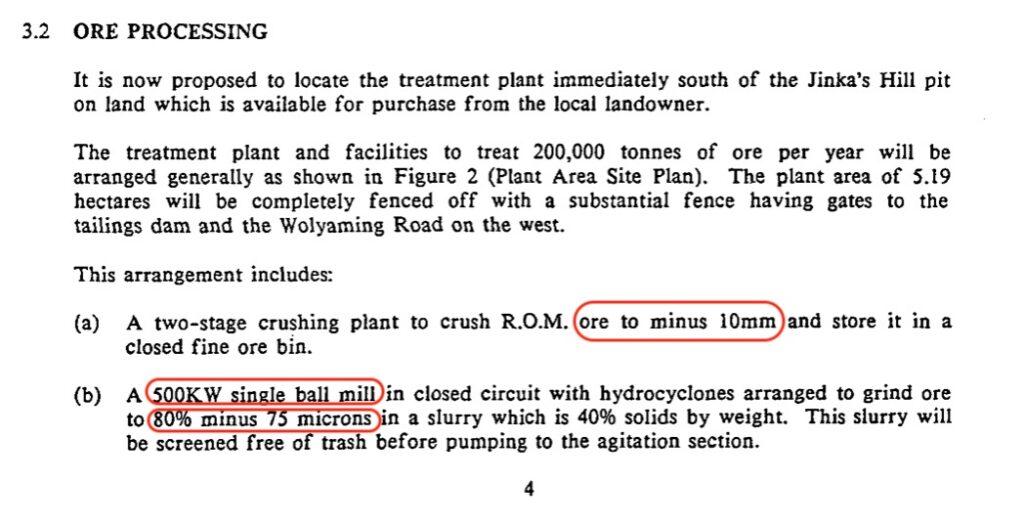

Interestingly, Glengarry Mining’s addendum to the initial mining proposal by Associated Gold Fields talks about crushing ore to -10mm rather than -6mm. It’s hard to know for sure with the information we have but perhaps Glengarry were starting to doubt the hammer mill’s ability to crush ore down to -6mm?

Notice also the power rating of the ball mill at 500KW.

Ausgold’s Plans to Handle Hard Rock

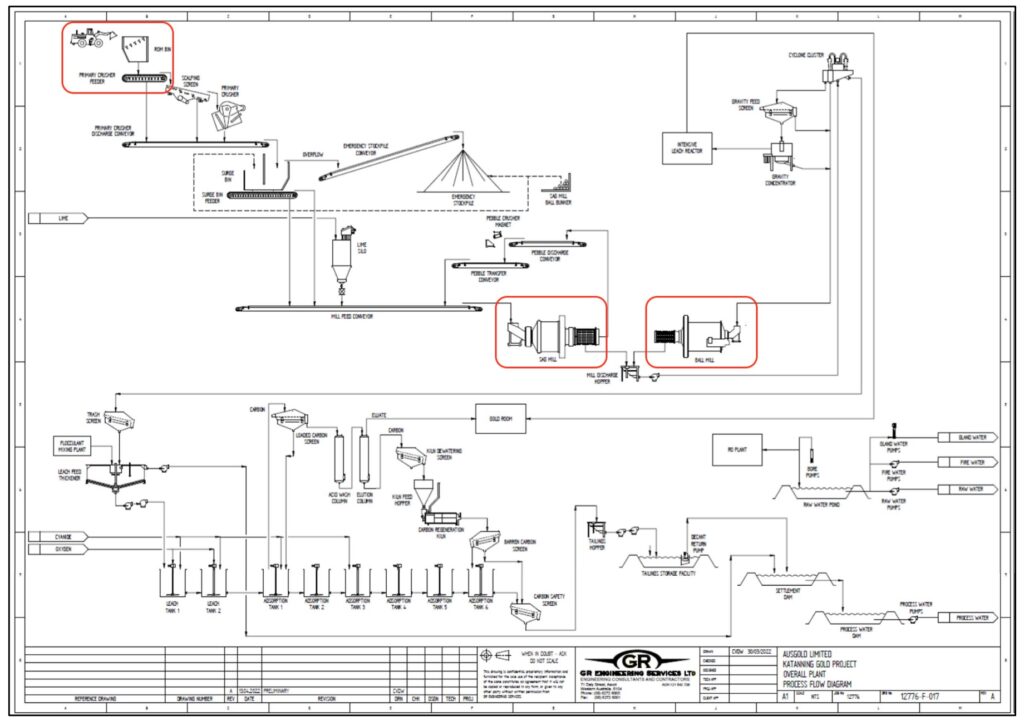

How does Ausgold propose to deal with the hard rock issue? Below is the process flow sheet from Ausgold’s Katanning Pre Feasibility Study (PFS) released in August 2022. The text might be difficult to read but I’ve denoted in red the primary crusher in the top left and the SAG (Semi Autogenous Mill) mill and ball mill towards the centre of the image below.

The PFS states that “The crushing circuit will be a conventional open circuit jaw crusher.” Ausgold go onto propose using a Semi AutoGenous (SAG) Mill and then a ball mill to grind the ore. The following three paragraphs are extracts from the PFS. Notice the 6,000kW power rating of the variable speed SAG mill and 7,000 kW rating of the ball mill.

“The SAG mill will have an 8.5 m diameter (inside shell) and 4.3 m effective grinding length. It will be a grate discharge, pinion drive mill fitted with a variable speed 6,000 kW motor. The SAG mill will be charged with 120 mm grinding media and designed to operate with a 15% ball charge. Slurry discharging from the SAG mill will be screened, with screen oversize being conveyed to a pebble crushing circuit. The pebble crushing circuit will include a single HP300 short head cone crusher. Pebble crusher product will be returned to the mill feed conveyor and recycled to the SAG mill.

The SAG mill’s variable speed drive will operationally compensate for changes in ore hardness. The design allows power consumption to be optimised for variations in the feed blend, assists in protecting the SAG mill liners from damage as a result of grinding media impact and minimises the mill motor current requirements on start-up. The variable speed drive will be configured to be used in the start-up for the ball mill, and once full rotational speed is achieved, the ball mill will be switched to direct online power. The variable speed drive will then be used to start and operate the SAG mill.”

“The ball mill will have a 6.4 m diameter (inside shell) and 9.6 m effective grinding length. It will be an overflow discharge, pinion drive mill fitted with a 7,000 kW motor.”

Hard ore is undoubtedly a challenge in mining but it’s surmountable with the correct equipment. Ausgold and their engineers appear to be aware of the challenge and seem to be selecting equipment to handle the unweathered hard ore.

Metallurgy

Ausgold’s PFS states the following on metallurgy, “Preliminary metallurgical studies were performed in the 1980s and 1990s. Commentary in the study reports indicated recoveries exceeding 90% with modest reagent consumption, and that the gold was not refractory.”

Further comments on metallurgy from the PFS are as follows;

“In 2022 as part of Prefeasibility Studies Ausgold completed a comprehensive metallurgical test work program on five composites from 13 diamond drill holes in the Central and Southern Zones. Initial results were received from ALS Metallurgy under the supervision of an independent metallurgical consultant.

Leach tests were completed on five composites. Three of these composites are from the Central Zone (Jinkas and Jinkas South lodes) and the Southern Zone (Dingo deposit). Recoveries from these samples indicate a consistently high gravity component from all samples with recoveries ranging between 40% up to 69% of total gold recovered. Leach test work indicates between 88-94% recoveries based on a 75 micron grind and 24 hour CIL residence time, with a low residue (tail) grade of 0.15g/t gold across the project. At a 53 micron grind and 48 hour residence, overall average gold recovery increases to 91-96%.”

So far, indications seem to be that the ore can be processed effectively, provided the correct grind size can be achieved. I’ve seen no evidence of refractory ore and given a choice between refractory ore or hard ore, in my experience, I’d choose hard ore as the main challenge.

Low Gold Price

Looking back at previous attempts to mine the gold at Katanning, it seems understandable that International Mineral Resources NL (IMR) ran into difficulty processing the ore, especially if they used an under capitalised mill and given the low gold price environment in the mid to late 1990’s. It’s worth pointing out that the gold price, when IMR started mining, closed the year in 1995 at US$386.70 per ounce, (according to macrotrends.net). By the end of 1996 it was US$369.55 per ounce and then by the end of 1997 it had dropped to US$289.20 per ounce.

Geology – Exploration Potential

Under the Geology section of the Pre Feasibility Study (PFS) released 1 August 2022 it says that ‘Gold mineralisation is hosted by medium to coarse-grained mafic gneisses, which dip at around 30° – 45° towards grid east (68°). These units represent Archaean greenstones metamorphosed to granulite facies.“

I spoke to geologist Sam Ekins from Wildcat Resources about greenstone-belt gold deposits and he helpfully explained the following;

“In many respects the principles that govern gold deposition in greenstones are similar to petroleum deposits. They require a source, usually an enriched I-type granite/granodiorite rock that has spent time at the base of the mantle; Conduits, usually second order structures/back thrusts splaying off long-lived crustal scale faults; and traps comprising reactive often brittle rocks (oxidised or reduced depending on the type of source fluid) with favourable structural geometries such as anticlines or domes (I note the giant Timmins deposit in Canada and the Super Pit/Fimiston deposit in Australia form on big anticlines that have been truncated by thrusts).”

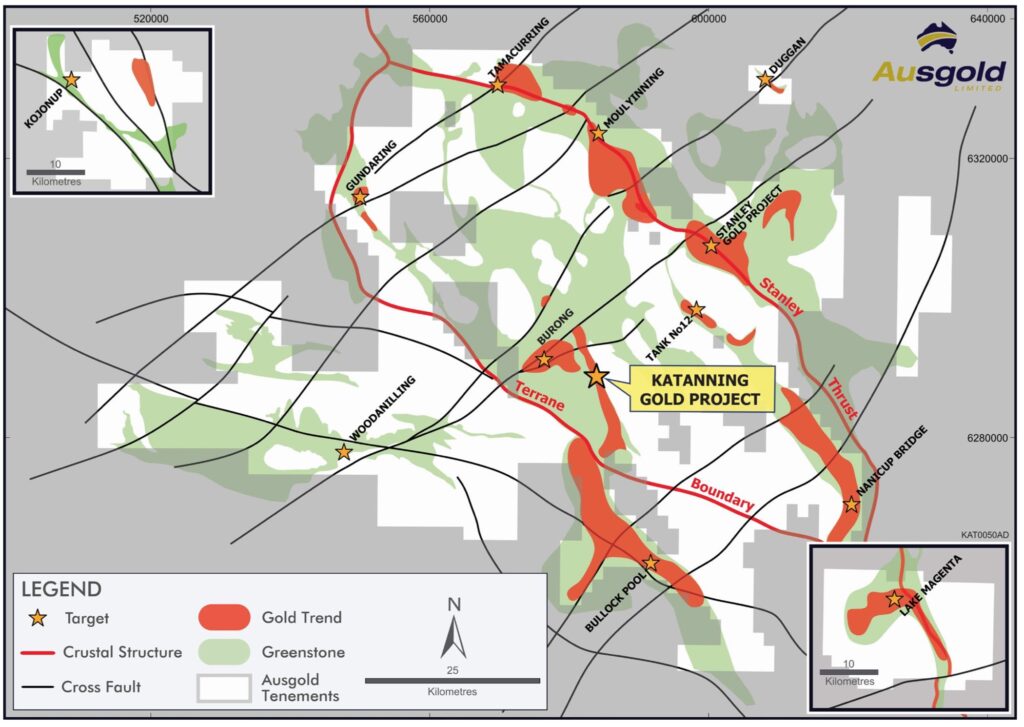

The key thing that interests me about the exploration potential for Ausgold is that they control 5,500km2 of ground across some key geological structures i.e. conduits.

Before we look closer at Ausgold’s exploration potential we need to understand some terminology.

Archean

Sometimes spelled Archaean or even described Archaeozoic (this is my favourite description but it’s fallen out of use apparently!). I’m going to use Archean but what does it mean?

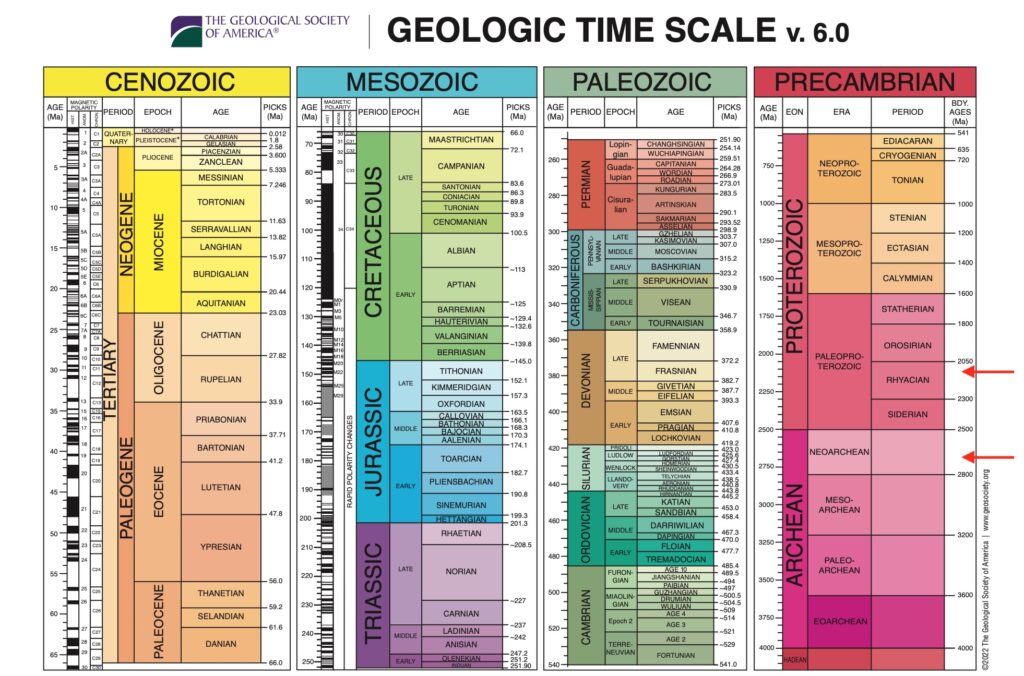

Our planet is believed to have formed 4.5 billion years ago. Geologists call the time frame between 4.5 billion and 4.0 billion years ago the Hadeon Eon, named after the Greek ruler of the Underworld, Hades. You might just be able to read the HADEON label, in orange, at the very bottom of the PRECAMBRIAN column. During this period, our planet is believed to have had a partially molten surface characterised by volcanism. But after half a billion years the planet would have cooled down enough for crustal rocks to form and the Archean Eon began. Archean is simply Greek for ‘ancient’.

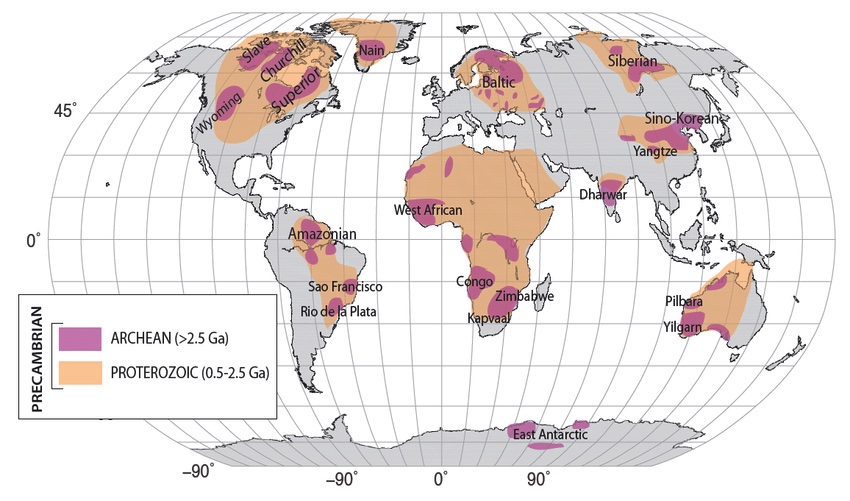

Remnants of these Archean-age ‘continental nuclei’ can be found scattered around the world and are called cratons. Where the craton’s rock is exposed at Earth’s surface, we call it a ‘shield.’ Areas where the craton is present, but buried beneath a sedimentary blanket, are called ‘platforms’. (open geology.org). The purple blobs in the image below are where these remnants of the continental crusts, formed back in the Archean Eon, are located today.

The Archean Eon is important because “the majority of the greenstone belt gold deposit formed in two main pulses at the end of the Archean and in the early Proterozoic. I.e. around 2.7 billion years ago and 2.1 billion years ago”. Andrew Jackson, 911 Metallurgist.com. I’ve added red arrows to the geological timescale image above to show when these two pulses are believed to have occurred. From what I understand, the Archean-age lower crust (30-50km depth) had become favourably enriched with gold and when this lower crust melted again, it would produce a gold-enriched magma ready to find it’s way to the surface. This matches Sam Ekins‘ comment about a “source, usually an enriched I-type granite/granodiorite rock that has spent time at the base of the mantle.” Notice the Yilgarn Craton, where Ausgold’s Katanning Gold Project is located, shown in Australia in the map above. It’s the correct aged rock where the base of the mantle might have provided the source for the gold.

Greenstone Belts

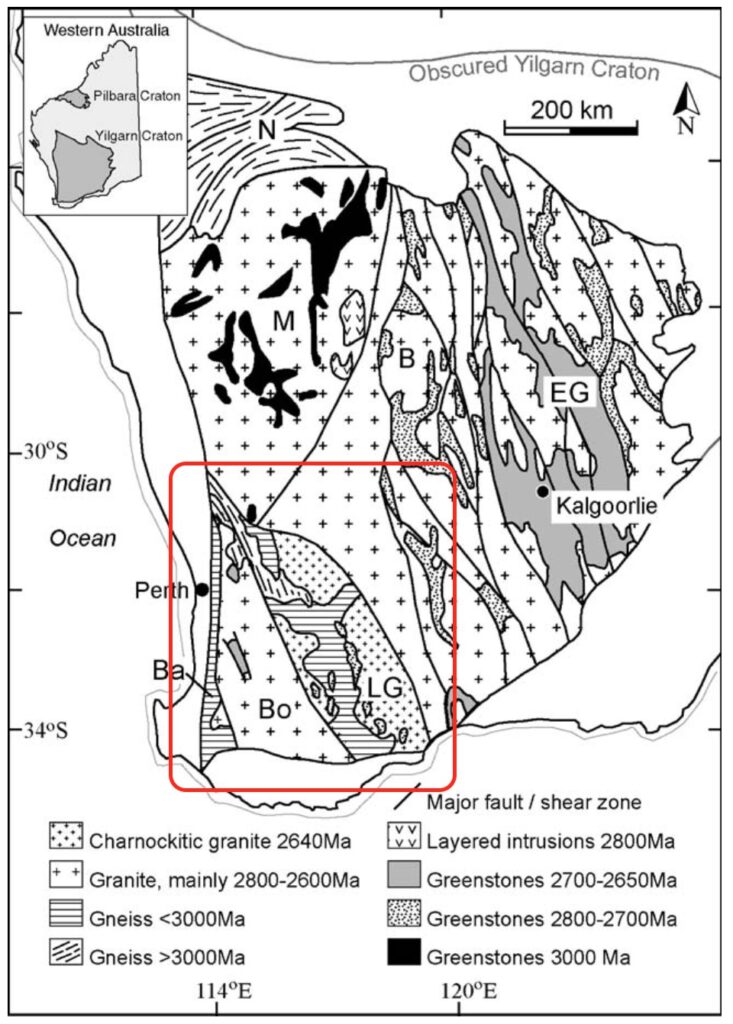

‘Greenstone belts are interpreted as the remains of ancient ocean basins, which were squashed between ancient proto-continental terranes. Once they collided, they often stayed stuck together, resulting in a granite/greenstone belt/granite horizontal sequence.’ open geology.org. If you look at the map of the Yilgarn Craton below you can see this granite/greenstone belt/granite pattern, most noticeably in the northwest to southeast direction.

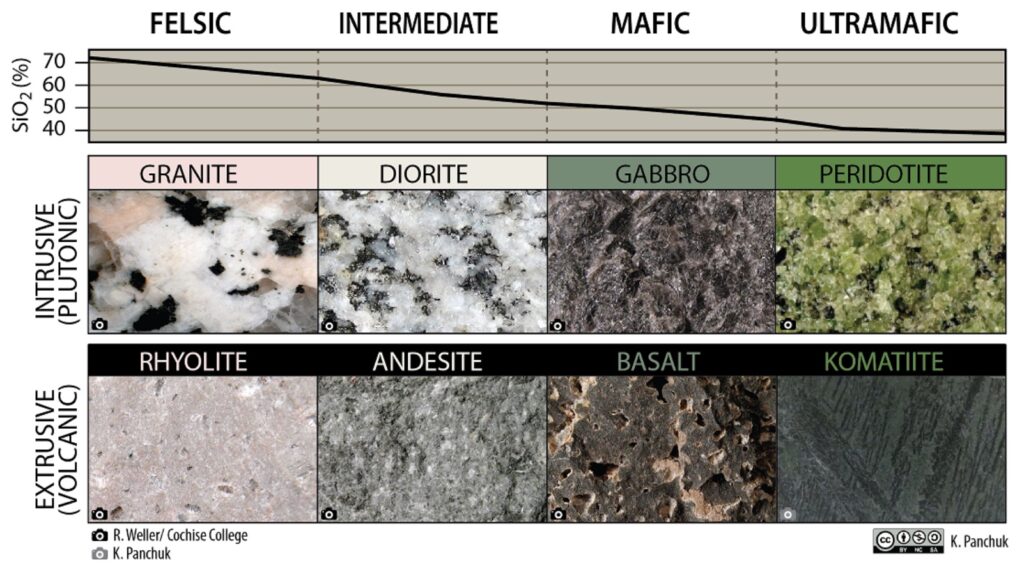

Greenstone belts are zones of metamorphosed mafic / ultramafic volcanic rocks with associated sedimentary rocks. For non-geologists this is a lot to take in. But let’s go back to the Archean Eon. Remember this is just after the Hadean Eon when the planet was more or less a blob of extremely hot molten magma. In the Archean Eon things had started to cool down a bit.

Mafic and ultramafic volcanic rocks are formed from magmas low in silica. These magmas were far more common in the Archean Eon, when our planet was a lot hotter and volcanically active than it is today. Greenstone belts started to form when these low-silica lavas would erupt and spread over the ocean floors. Then over millions of years sedimentary rocks would be laid down on top. Then perhaps another mafic / ultramafic eruption etc. As the layers built up over time, the rock would get buried and eventually would be cooked by the heat and pressure underground. This process is known as metamorphosis. The cooking of these volcanic and sedimentary rocks can create new minerals, such as chlorite, that gives the rock a somewhat greenish colour, hence the name greenstone.

The following chart defines the different types of igneous rocks formed from magma. Notice the silica content increasing from right to left. Notice also the importance of magma either erupting at surface (volcanic) or the magma remaining inside the earth’s crust and solidifying (plutonic). Rhyolite is simply silica rich magma that has erupted at surface. Had it remained underground and solidified it would have become granite.

Structure

Sam Ekins pointed me in the direction of the following paper on greenstone belts by Roberts et. al.

It emphasises the importance of structure. Have a look at the following comment from the above paper.

“Structurally, gold deposits in both cratons are universally associated with shear zones, faults, or folds. Such an association reflects a strong structural control on the localization and development of mineralization and also the tendency for less-competent altered rocks to localize subsequent deformation (Robert and Poulsen, 2001).” Gold Metallogeny of the Superior and Yilgarn Craton, Robert et. al. (2005).

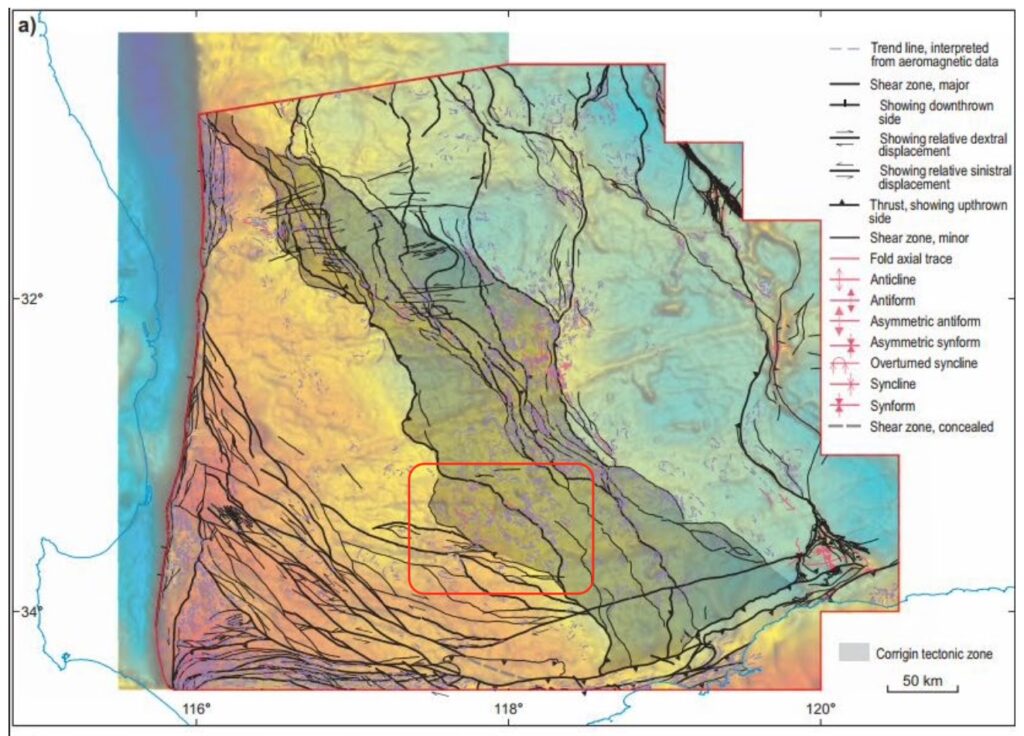

Then have a look at the crustal scale structures shown in the slide below, also showing Ausgold’s exploration tenements.

Robert made the following comment about structure in an earlier paper from 1990;

“The crustal scale faults are thought to represent the main hydrothermal pathways towards higher crustal level. However, the deposits are spatially and genetically associated with higher order compressional reverse-oblique to oblique brittle-ductile high-angle shear zones commonly located less than 5 km away and best developed in the hanging wall of the major fault.” (Robert, 1990)

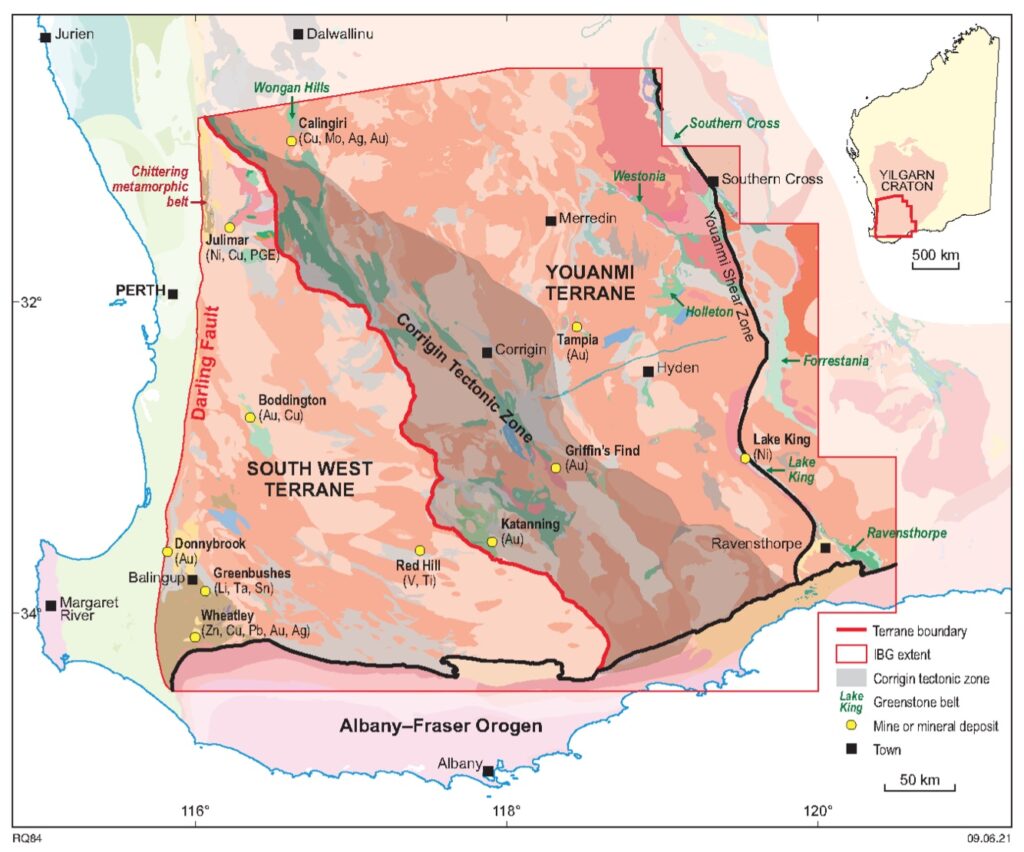

Terrane Boundaries in the Yilgarn Craton

The Yilgarn Craton is believed to have formed during the Archean Eon when continental crusts collided and stuck together. These initially individual continental crusts are what are known as terranes. Terrane boundaries have traditionally been interpreted as follows;

From what I understand, in a paper dated 1996, Simon Wilde et. al. proposed the further subdivision of the South West terrane.

“The shear zones define the boundaries of three terranes which, from west to east, are herein defined as the Balingup, Boddington and Lake Grace terranes.” Wilde et. al. (1996).

The following map shows the boundaries of the Ballingup (Ba), Boddington (Bo) and Lake grace (LG) terranes proposed by Wilde et. al.

The following map by Ausgold also shows the major subdivision of the South West Terrane into the Lake Grace terrane and the Boddington terrane. In addition, it shows Ausgold’s ground relative to this boundary. Importantly it lies across the structural boundary.

Ausgold’s 2021 Annual Report (Page13) also makes reference to the geological boundary, “Ausgold holds exploration rights …..along a significant geological boundary separating the Boddington and Lake Grace Terranes. Faults along this boundary are the same as those that host the gold mineralisation within the KGP.”

An older comment from Tetlaw (1994) also highlights the importance of the terrane boundary;

“The terrane boundary coincides with the strike of gold mineralization at Badgebup (Jinkas Hill and Dingo Hill open cuts)” (Tetlaw, 1994)

A New Interpretation

Gromard et. al. put forward a new interpretation of the Yilgarn’s terrane boundaries in 2021. They make reference to the ‘informal Balingup, Boddington and Lake Grace terranes of Wilde et. al (1996)’ but subdivide the South West terrane differently.

Gromard et al. interpret the following terrane boundary in red between the Youanmi and South West terranes. Notice Katanning’s location close to it. The Lake Grace terrane is more or less interpreted as the Corrigin Tectonic Zone. Wilde’s Boddington and Balingup terranes are more or less defined as the South West terrane.

Gromard et. al. also show interpreted structures / major shear zones across this part of the Yilgarn. Notice the oval structure that exists around Katanning. (I’ve highlighted this in red).

Here’s the image I showed earlier showing the deep crustal structures around Katanning. Notice the same oval shaped structure.

The point of these maps is to show the importance of Katanning’s location near to crustal scale structures that might have acted as a conduit for mineralised fluids carrying gold to make its way from the depths and deposit gold in the surrounding greenstone belts.

Conclusion

Ausgold have an advanced gold project at Katanning with over 3 million ounces in resource and over 1 million ounces in reserve at over 1 g/t Au. The deposit is shallow and amenable to open pit gold mining. Mining of the deposit was attempted between 1995 and 1997 but an under capitalised mill appears to have caused difficulties, especially in a low-gold price environment. Ausgold have adjusted plans to grind the ore to 75 microns, allowing further processing to recover 88-94% of the gold. The PFS study from August 2022, showed favourable economics that could improve further with a larger throughput.

Greenstone gold deposits in Archean-aged rocks require geological structures to allow the gold to rise towards the surface to form deposits. Ausgold holds over 5,500km2 of tenements on and around a key crustal scale structure in greenstone belt territory. While the company continues to progress the Katanning Gold Project towards DFS, it has significant further ground to explore. A reinvigorated board, with the appointment of John Dorward (Executive Chairman) and the ongoing leadership from geologist Dr Matthew Greentree (MD) seems like the right combination of talent to take this company forward. I’m looking forward to reading further progress from the new Ausgold team, as they move the project towards Definitive Feasibility Study (DFS). In my opinion, this is an under-appreciated stock.