Generating excess cash is, of course, a good problem to have. Company directors usually deal with this by employing one of the following strategies;

- Pay dividends.

- Repurchase the Company’s own shares.

- Reinvest organically into the business

- Conduct M&A.

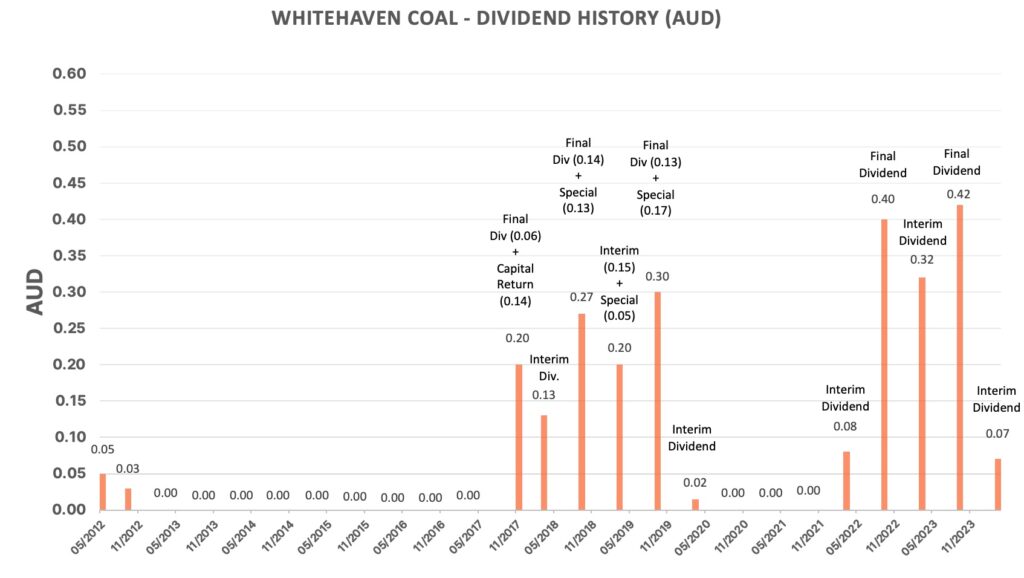

As shown in the chart below, Whitehaven Coal started making significant returns to shareholders in late 2017, by paying dividends. For FY 2018, the Company paid an interim dividend of A$0.13, a final dividend of A$0.14, and a special dividend of A$0.13, for a total dividend return of A$0.40. The share price traded at a high of A$5.89 in 2018, providing a yield, no worse than, 6.8% for that year.

Covid lockdowns understandably led to a curtailment of dividends through the later half of 2020 and into 2021, but then, as demand returned after lockdowns started to ease, coal prices took off and Whitehaven had another excess cash problem.

In early 2022, Indonesia’s ban of coal exports and Russia’s invasion of Ukraine sent coal prices higher still. Whitehaven responded by paying dividends again but it was generating so much cash this time that it decided to begin a share buy back program. In October 2022, the Company announced that between March 2022 and October 2022 it had bought back 103.3million shares at an average price of A$5.69, representing 10% of the share capital. On 26 October 2022, Whitehaven sought shareholder approval at their AGM to buy back 240 million shares (about 25% of the share capital) over the following 12 months.This time they really meant business. In FY 2023 (12 months to 30 June 2023), Whitehaven returned A$1.6billion to shareholders through dividends and buybacks.

The preferred use for excess cash often causes heated debate. And I’m going to throw my 2 pence worth into the hat too. I usually prefer resource companies to pay dividends but it ultimately depends on the situation. It’s not that I don’t like share buy backs, it just depends on the best use of the cash given the options available. In addition, resource companies have a tendency to act pro-cyclically rather than counter-cyclically. Ie. They buy back shares when the commodity price is high. But this is a big debate for another article perhaps.

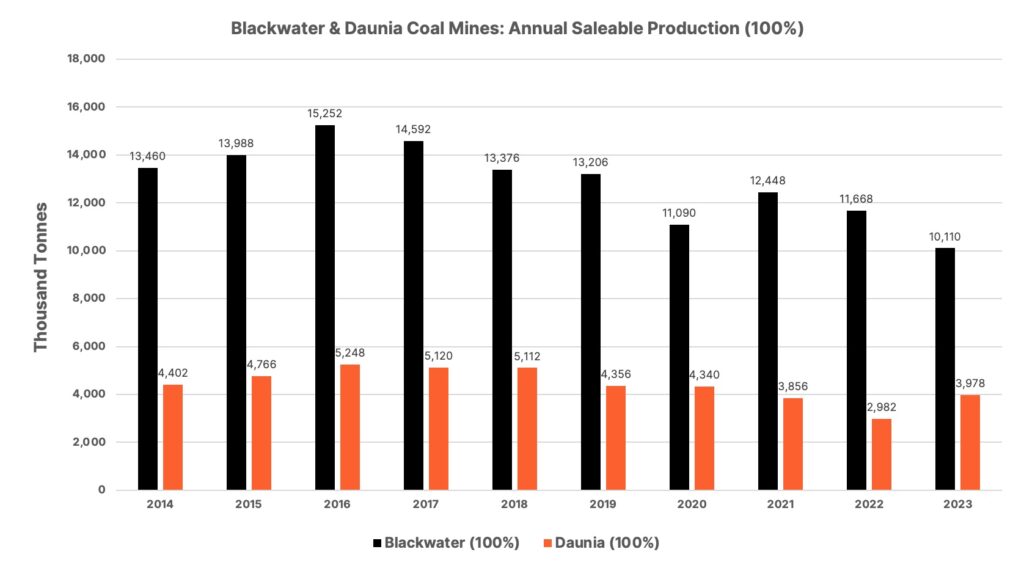

This is how Warren Buffett described share buy backs in Berkshire Hathaway’s 2022 Annual letter. As background, Berkshire Hathaway had repurchased 1.2% of Berkshire Hathaway shares that year:

Ultimately, as Buffett points out, it’s down to price.

For Whitehaven Coal, the decision about the best use for the excess cash became more involved when an opportunity to buy some major coal assets from BHP presented itself. Let’s take a closer look at the deal.

The Deal

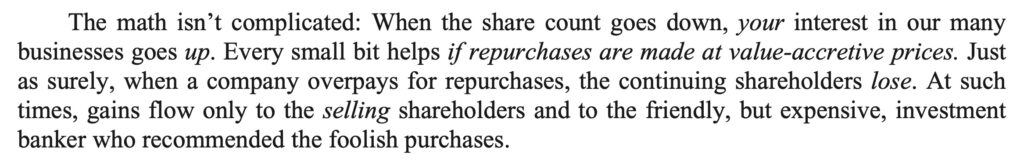

On Tuesday 2nd April 2024, Whitehaven Coal is set to complete the acquisition of 100% of the Blackwater and Daunia metallurgical coal mines and all of the shares in South Blackwater Coal Pty from BHP Mitsubishi Alliance (“BMA”). The deal, initially announced 18 October 2023, involves the aggregate cash consideration of $3.2billion cash comprising:

- US$2.1billion upfront consideration payable on completion, and

- US$500million, US$500million and US$100million in separate tranches of deferred consideration payable on the first, second and third anniversary of the completion date.

In addition, contingent payments of up to US$900million; comprised of three annual payments, dependent on realised pricing exceeding agreed thresholds, with annual contingent payments capped at US$350million.

Stamp duty and transaction costs are estimated at a total of US$276million. (According to page 10 of Whitehaven’s Transaction Investor Presentation, dated 18 October 2023).

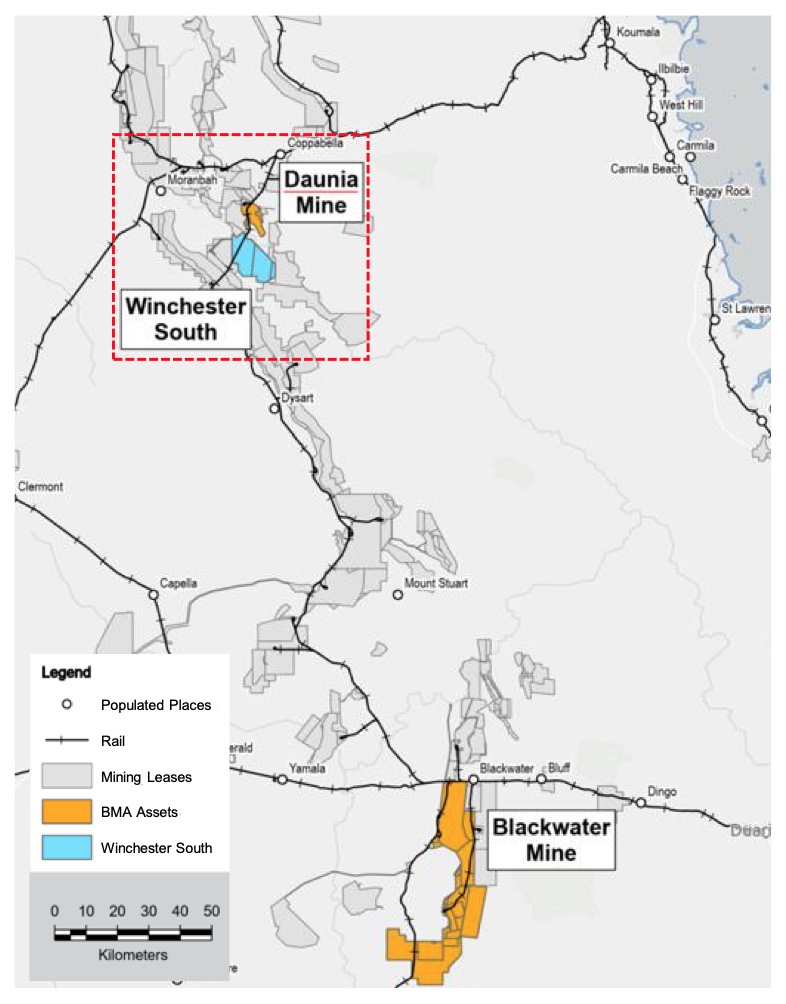

The acquisition is set to make Whitehaven a coal producing powerhouse on the east coast of Australia, with assets close to ports in both Queensland and New South Wales. Notice how the Daunia mine is conveniently located next to Whitehaven’s Winchester South (metallurgical & thermal coal) project, scheduled to begin construction in 2026.

The deal announcement brought a halt to the second buy back. An announcement on 26 October 2023, stated that 92,779,025 shares had been bought back at a consideration of AUD723,569,883 implying a share price paid of A$7.79 per share.

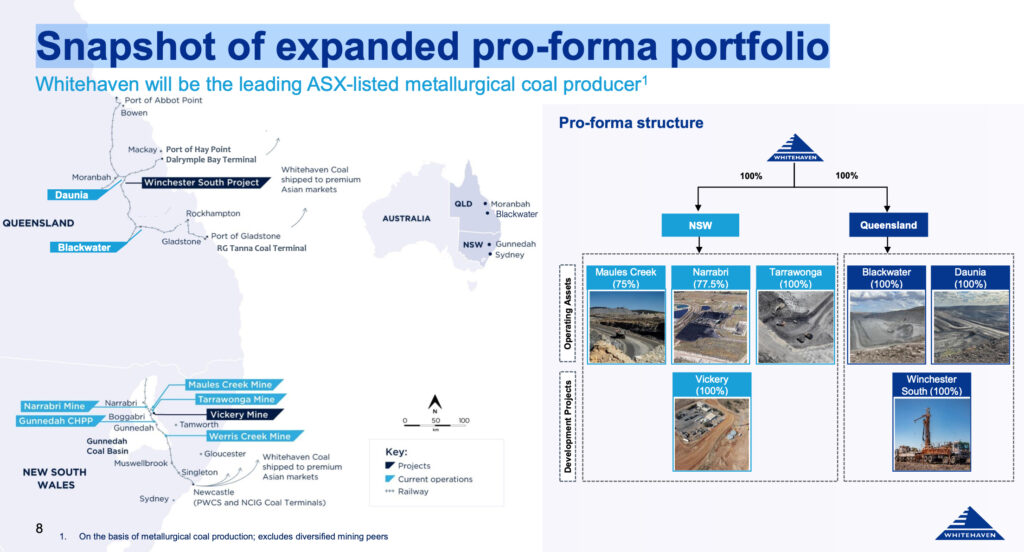

Blackwater & Daunia: Historic Production – 10 years

Now that we know the price tag for the coal assets, let’s look at what Whitehaven shareholders will get for their money. We’ll begin by looking at a 10 year history of coal production for the two key mines; Blackwater and Daunia.

Page 6 of the Investor Presentation on the Transaction (18 October 2023) suggests that ‘Based on FY24-FY28 expected production averages’ that Blackwater will produce approximately 12.4Mt of saleable production per annum and Daunia will produce 4.9Mt per annum.

To be on the safe side, I’m going to estimate that Blackwater produces 10Mt of saleable production in the first 12 months of ownership and that Daunia will produce a mere 3Mt.

Coal Prices

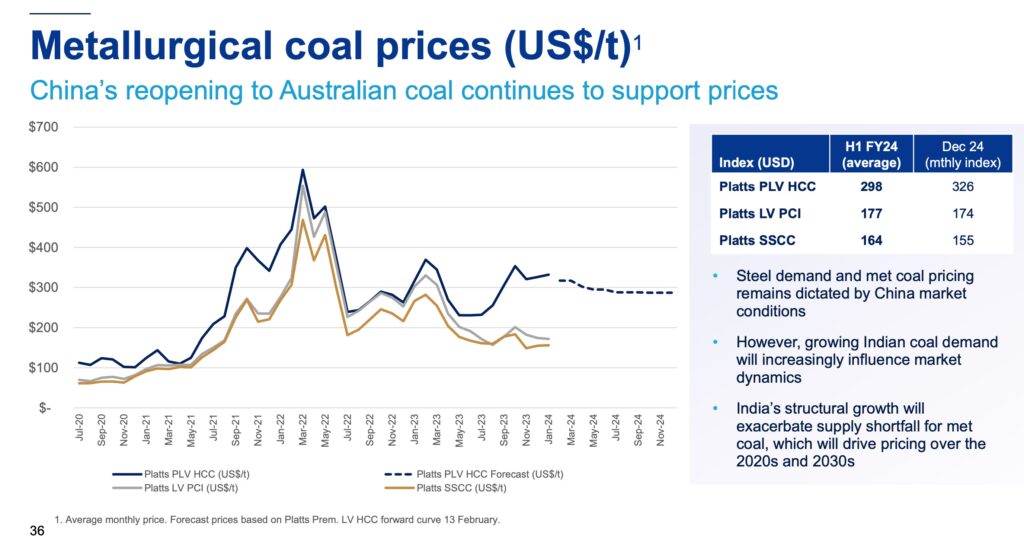

Next let’s look at the all important commodity prices. Whitehaven have provided the following slide in their deck on coal prices. The slide shows the two main price indexes that we’re going to need; Platts Premium Low Volatility (PLV) Hard Coking Coal (HCC) and Platts Low Vol (LV) Premium Coal for Injection (PCI). Notice the price spike in mid 2021 through into 2022 that led to over A$1.0billion being returned to shareholder in FY 2022.

Queensland Coal Royalty Rates

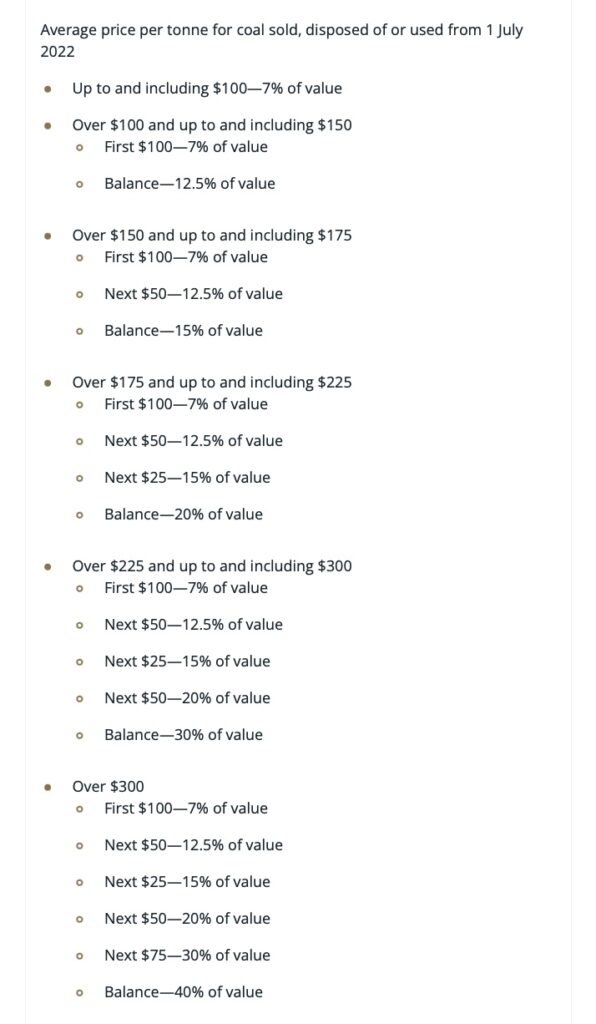

In June 2022, the Queensland state budget was presented by Treasurer Cameron Dick. He declared the existing royalty rate ‘not fit for purpose’ and announced an increased royalty burden on coal production. The revised tiered royalty rate would be calculated as follows;

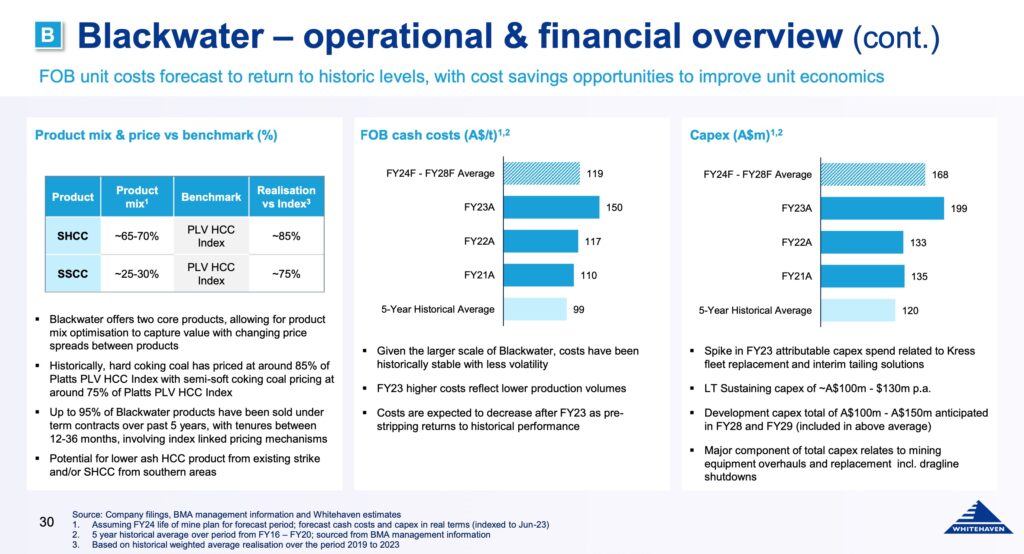

I’ll refrain from comments about preferring to keep things simple and plug some numbers into a spreadsheet. In the example below, if a coal producer in Queensland sells their coal product for an average price of A$378/T then the state of Queensland will receive A$80.7 in royalty.

It was this increased royalty, ‘without consultation’, that was the final straw for BHP. In their Interim report for the 6 months to 31 December 2022 they commented that Queensland had “become less conducive to long-life capital investment as a result of changes to the royalty regime.“. And eventually announced the deal with Whitehaven on 18 October 2023.

While BHP appeared unimpressed by the royalty increase. In reality the sale of Blackwater and Daunia was the continuation of BHP offloading its intermediate-quality coking coal mining assets while retaining those that produce higher-quality coking coal. The Daunia and Blackwater sale followed BHP’s earlier divestment in 2021, when it sold its 80% share in the South Walker Creek and Poitrel metallurgical coal mines to Stanmore Resources for about A$1.82billion.

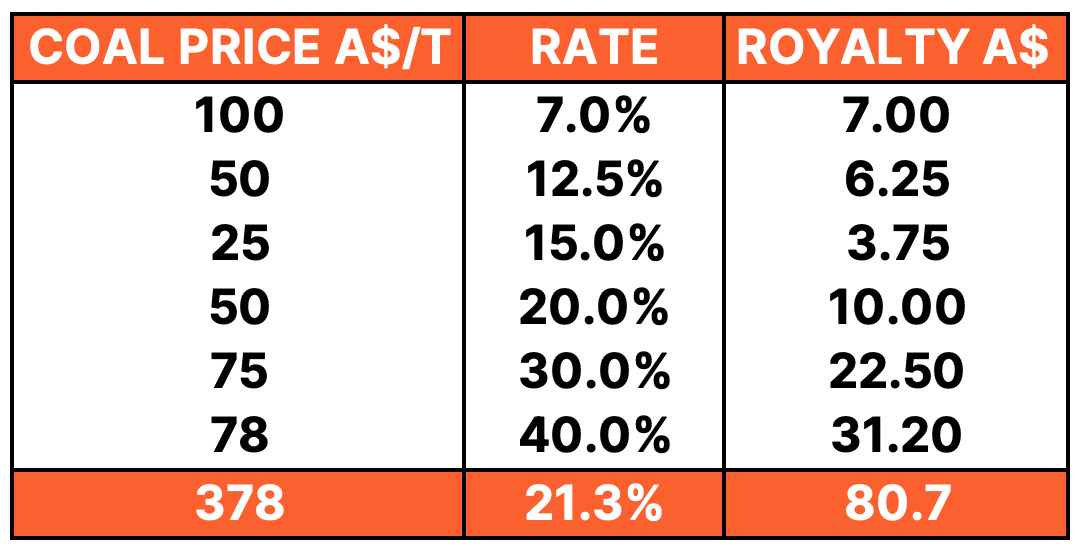

Blackwater: Benchmarks, Cash Costs & Capex

Page 30 of Whitehaven’s 18 October 2023 Transaction Presentation provides some very useful information for the Blackwater mine, including product mix, price realisation versus coal indices, FOB (Free On Board) cash costs and sustaining capex forecasts.

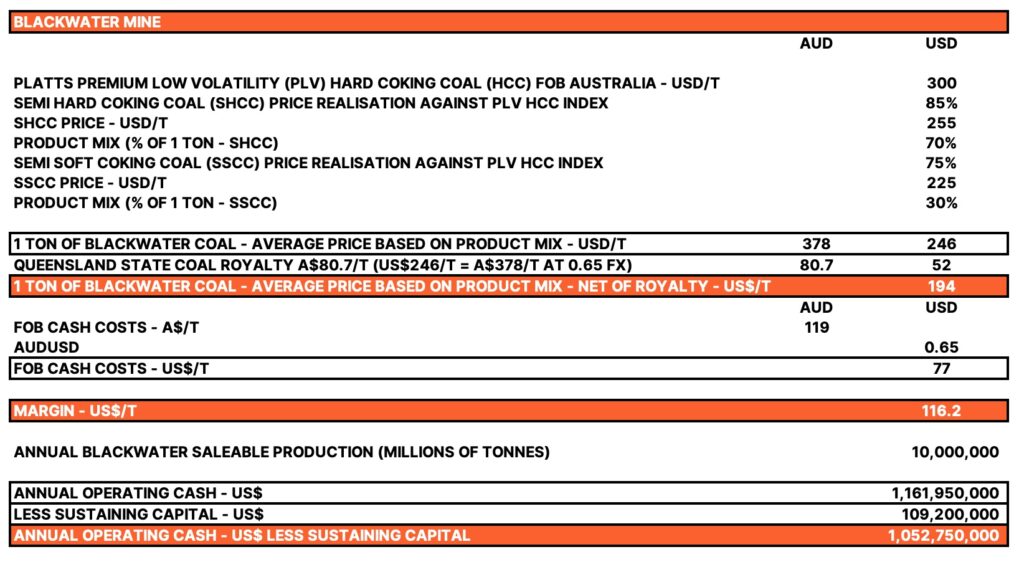

With the data we’ve looked at so far, we can start performing some back of the envelope calculations. Let’s start with the Blackwater mine. I’m going to work in US$, so that we can compare to the deal price which we’ve discussed in US$.

Blackwater: Back of Envelope Calculation

For simplicity, I’ve ignored thermal coal production at Blackwater, which according to BHP’s Reserve statement is approximately 2% of total production.

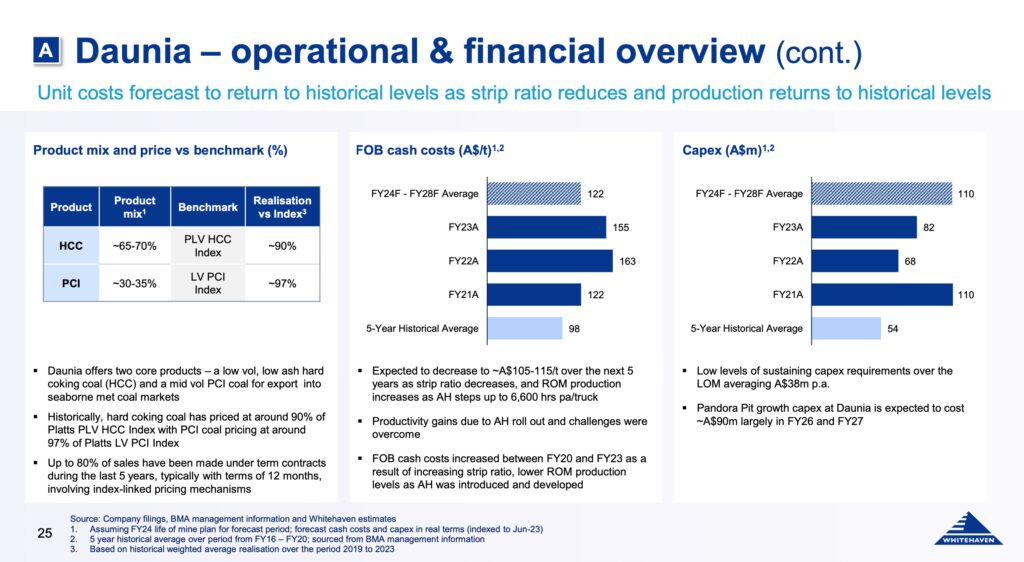

Daunia: Benchmarks, Cash Costs & Capex

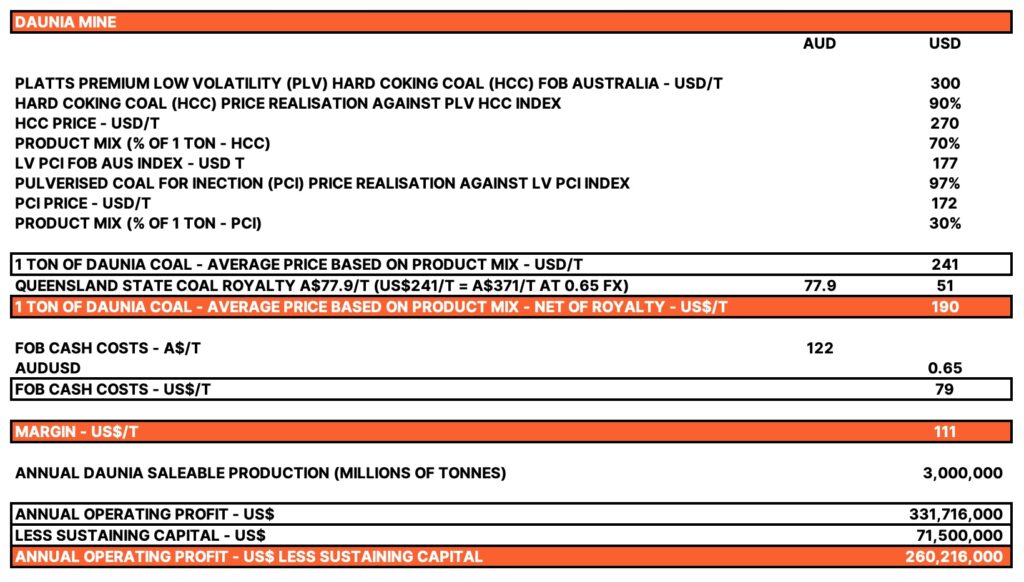

Daunia: Back of Envelope Calculation

For simplicity, I’ve ignored thermal coal production at Daunia, which according to BHP’s Reserve statement is approximately 8% of total production.

For the Blackwater and Daunia mines, I use conservative saleable production schedules (Blackwater: 10Mt, Daunia: 3Mt) using Whitehaven’s FOB cash cost per tonne projection FY24-FY28 AVERAGE (Blackwater: A$119/T or US$98/T, Daunia: A$122/T or US$79/T). I’m assuming that these FOB cash cost projections (taken from Whitehaven’s October 2023 presentation) do NOT include royalty payments, which is why I deduct royalties from the gross revenue line. I also assume Benchmark pricing of PLV HCC FOB Australia: US$300/T and PLV PCI FOB Australia US$177/T. The Blackwater and Daunia mines are expected to produce in the first 12 months of ownership approximately US$1.3billion in operating cash flow AFTER sustaining capex requirements.

Other Costs: Interest, Depreciation & Tax

To fully think this through, we need to consider what cash will be left after paying the tax man. This time, the federal tax man not the state tax man. I’m going to make a guesstimate that there’s a 12 month depreciation charge available against these two assets equivalent to the sustaining capital invested in 2024. ie. US$180.7m (US$109.2m + US$71.5m). I’m not assuming that this sustaining capex is all depreciated immediately but assuming that there is some capital investment that has not been fully depreciated on acquisition.

Whitehaven announced (18 December 2023) that they’ve taken out a US$1.1billion 5 year credit facility to help with the deal. I’m going to assume an interest deduction of 10% of US$1.1billion is available ie US$110million.

I’m then going to assume a Corporate tax rate of 30%.

Corporate Tax due for the first 12 months of ownership would be approximately: (US$1.3bln – US$110mln) * 30% = US$357million.

I may be wrong on these guesstimates for Interest, Depreciation and Tax. Please feel free to let me know in the comments section at the end of this article.

With cash payments for interest and tax (depreciation of course being non-cash), we can calculate an after-tax cash flow for the first 12 months of ownership for Blackwater and Daunia alone (not considering Whitehaven’s existing assets) of US$833million, which would go a long way to paying down the credit facility.

At this annual rate of after-tax cash generation, the assets would pay off the consideration in approximately 4 years. (Consideration: US$3.5billion (US$3.2billion + US$0.28bln (stamp + transaction costs) / US$833m = approximately 4.2 years).

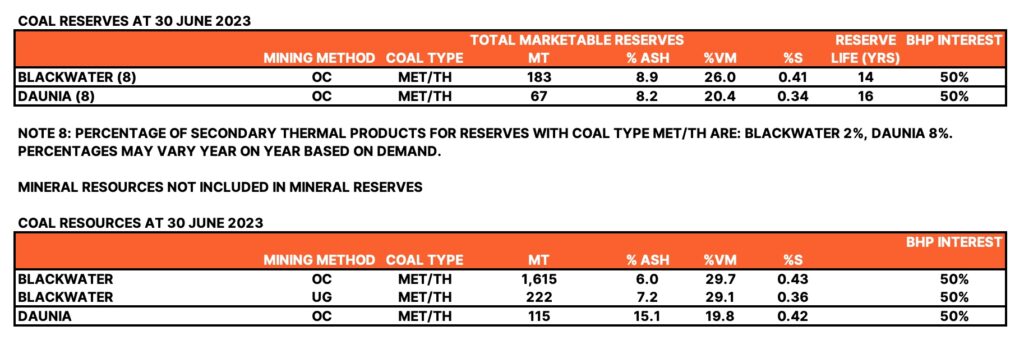

But how long will these assets last for? Let’s take a look at the Reserve & Resource statement as set out in BHP’s FY 2023 Annual Report.

Blackwater & Daunia: Reserves + Resources

I’ve summarised the key numbers below:

Notice how Blackwater has a Reserve life of 14 years but an additional 1.6billion tonnes of Resources. Daunia has a Reserve life of 16 years with an additional 115million tonnes of Resource.

According to slide 17 of the Acquisition Investor Presentation (18 October 2023), Whitehaven note that ‘Blackwater mine life could extend beyond 50 years‘ (based on conceptual mine planning). This seems credible given the size of the Resource base. And that ‘Daunia production is expected to FY 40‘. Note: their comment on Daunia more or less matches BHP’s Reserve statement of 16 years Reserve life.

I’ve included the pages from BHP’s FY 2023 annual report, pages 228 – 231, so that you can inspect the full Reserve and Resource statement for Blackwater & Daunia yourself.

Slide 17 also mentions their Winchester South project, which has been ‘scoped >20 years.‘

Winchester South

Winchester South was acquired from Rio Tinto Coal Australia (75%) and Scentre Group (25%) in 2018 for total cash consideration of US$200million. The project is conveniently located next door to the Daunia mine.

The mine will produce a primary metallurgical coal product and a secondary thermal coal product for energy generation – and create about 500 jobs.

The mine according to Whitehaven’s website “will produce up to 17 million tonnes per annum of run-of-mine (ROM) production to supply the international market.” It will require A$1.0billion of investment and with 380million tonnes of JORC Reserves, it’s expected to have a 30 year mine life.

On 8 February 2024, Whitehaven Coal announced that they welcomed ‘the decision by Queensland Department of Environment, Science and Innovation (DESI) to approve Winchester South Coal Mine Draft Environmental Authority. This follows the recommendation by the Queensland Government’s Coordinator General, as announced on 24 November 2023.’

Whitehaven Coal appear to be making progress with this substantial growth option. Should they be able to move forward to construction, owning the nearby Daunia mine will be a considerable advantage.

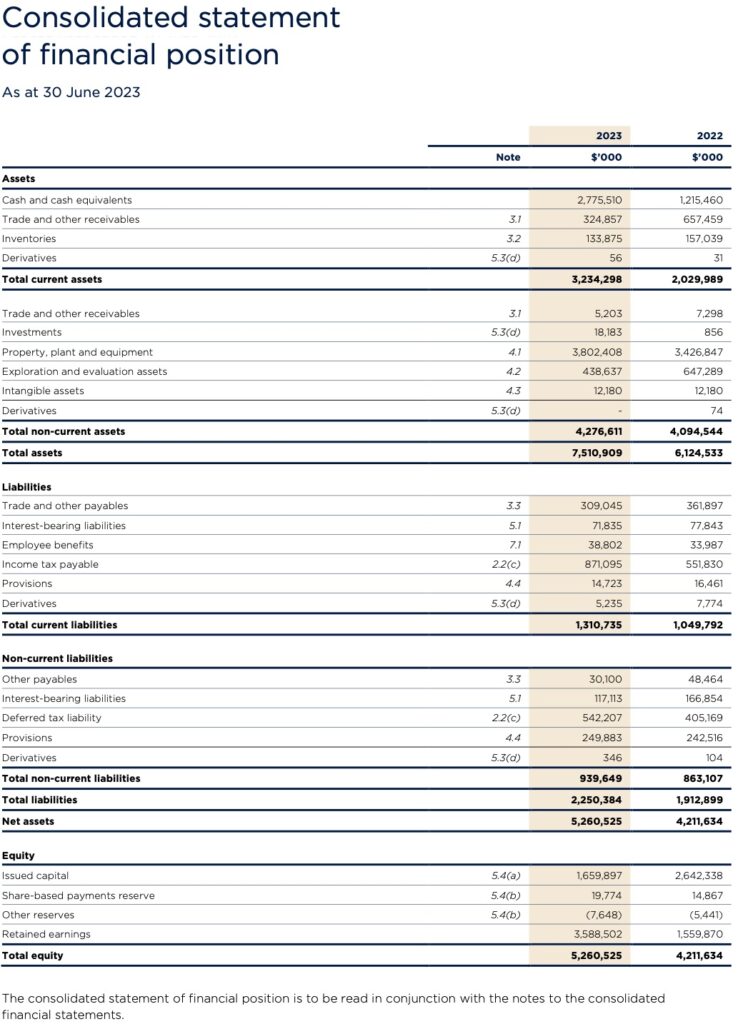

Last Balance Sheet as at 30 June 2023

Whitehaven’s last available balance sheet as at 30 June 2023 showed A$2.78billion of cash and cash equivalents with a tax bill of A$871million due before the end of 2023, which will now have been paid down.

The cash flow statement for the year to 30 June 2023 showed that the legacy thermal coal assets generated A$3.6billion in net cash from operating activities. It’s no wonder that Whitehaven still plan to pay a dividend.

In the acquisition announcement (18 October 2023) they stated;

“Return Capital to Shareholders: During the deferred payment period, Whitehaven expects to maintain franked dividends within the target payout ratio of 20-50% of NPAT generated from Whitehaven’s existing operations (i.e. excluding the acquired assets). Cashflows from the acquired business will be directed to retiring vendor finance. The share buy-back is similarly expected to remain on hold and the Board will make a decision regarding the resumption of the buy-back at the appropriate time. The acquisition is expected to support strong Total Shareholder Returns (TSR) including providing an opportunity for a significant step up in capital returns when deferred payments are made and surplus capital is available.“

Blackwater – 20% Sell down

With the Q2 results released 19 January 2024, Whitehaven announced that they were exploring a potential sell down of about 20% of the Blackwater mine to global steel producers as strategic joint venture partners. But what might Whitehaven get for this 20% stake.

Discounted Cash Flow – Blackwater Mine

If we piece together all the data we’ve covered so far we can calculate a simple discounted cash flow at the project level. Here’s my calculation for 100% of the Blackwater mine using the 14 year mine life based on Reserves, as well as the other conservative estimates discussed above.

The discounted cashflows at a 10% discount rate sum to US$4.99billion. If I was Whitehaven, I’d be asking for a minimum of US$1.0bln for a 20% stake in Whitehaven. Let’s see what happens.

South32’s Illawarra Coal Sale – Comparison

On 29 February 2024, South32 announced the sale of their Illawarra Metallurgical Coal subsidiary, an entity owned by Golden Energy and Resources Pte Ltd (GEAR) and M Resources Pty Ltd (M Resources), which can provide some comparison to Whitehaven’s deal.

The consideration for the South32’s sale amounts to US$1,650M comprising: Upfront cash consideration of US$1,050M, payable at completion; Deferred cash consideration of US$250M, payable in 2030; and Contingent price-linked cash consideration of up to US$350M.

You can read the full ASX release below:

South32 point out that “The total consideration represents a multiple of approximately 7.2x average annual free cash flow for Illawarra Metallurgical Coal.” And note “Illawarra Metallurgical Coal annual average free cash flow over the period FY16 to FY23 of approximately US$229M. Calculated as Underlying earnings plus depreciation and amortisation less capital expenditure.”

If we ignore the contingent consideration then South32’s sale multiple comes to 5.7x average annual free cash flow.

This is more or less comparable to the 4.0x multiple that Whitehaven are paying for Blackwater and Daunia, that we calculated earlier. More evidence perhaps that Whitehaven have struck a good deal. It’s worth noting in the news release above that Bluescope Steel have pre-emption rights on Illawarra. It’ll be interesting to see what happens.

Conclusion

Coal is an out-of-favour sector for many institutional investors, which for contrarians makes it interesting. Many of the large diversified mining companies have been steadily jettisoning coal assets, to align with Net Zero government policies on carbon emissions. This widespread policy agenda is making it harder to obtain financing for new coal projects, particularly for thermal coal. Yet these political initiatives may cause demand to outpace supply in the years and decades ahead, before coal is no longer required for steel-making and energy generation.

The cash generating Blackwater and Daunia assets have been acquired for what looks like a reasonable price yet both have significant Reserve lives remaining. In addition, the mines provide a base in Queensland from which to progress their sizeable Winchester South project. At current coal prices vendor finance will be retired in short order, leaving the three deferred payments to deal with. This might be retired even quicker if a minority stake in Blackwater is sold. If contingent payments are required, it would simply mean that coal prices are rocketing again. I wouldn’t discount that prospect. It might not be long before Whitehaven are facing that same old problem again. Too much cash!

Excellent article. The quality of the piece shows the effort put into it. Well done indeed. Professor Emeritus, Penn State University

Frank,

Many thanks for your very kind feedback. It’s appreciated!

Best wishes,

Roger

Excellent write up. Big risk is commodity prices as you note. I go off the freely available prices below, which have dropped to around 230-250 from 300.

Even at the lower prices the multiples are very low.

Looking at YAL it is quite interesting that even a fully franked dividend yield of 10-15% seems to be reasonable for coal stocks. A bit like PNG banking duopoly, coal stocks seem to have structurally lower valuation multiples than other stocks. For that reason they and WHC I think that when they do eventually get to other side of transaction debt, my hope is more is returned via divs than buybacks predicated on valuations/multiples being too low.

https://www.barchart.com/futures/quotes/U7*0/futures-prices

Hi Nik,

Many thanks for your comment and feedback.

I completely understand why you use a lower price and it’s important to test out various scenarios.

Coal stocks do seem to have structurally lower valuation multiples. My guess is that this is caused by many major institutions shunning them. Which leaves these extraordinary yields. I think of this as a ‘Warren Buffett’ cigar butt type investment, only rather than picking up a cigar butt you pick up a whole cigar!

Thanks again for your comment.

Best wishes,

Roger

This is exactly the type of article i was hoping to read about this acquisition. Many thanks, it was a great read.

Hi SamuraiSteve,

Thanks for reading my article. I do appreciate the feedback.

Best wishes,

Roger

Great analysis . I am owner in whc btw . Your tax calc is a little out as you assume capex is fully deductible in year 1 but you didn’t allow for the full value of asset purchased to have any depreciation . You might find deprec is somewhat higher even per annum . Anyway minor quibble , great analysis . You have me thinking I should top up as at circa 7 Aussie it’s far to cheap when you consider how much cash it will be generating in a few years once black water bedded down and Winchester also pumping along plus the underlying business . You could be 6+ dollars per share in annual earnings .

Hi Paul Farmer,

Many thanks for your feedback and your interesting point about depreciation. I hadn’t thought of that and I appreciate the debate.

Best wishes,

Roger

Thank you Roger..an excellent effort….Lord Bell

Hi Lord Bell,

You’re welcome. Many thanks for your comment. Much appreciated.

Best wishes,

Roger

Thanks for laying out your thoughts. I’ve had a comb through and reckon the actual payback period is closer to 6 or 7 years than 4. My notes…

# The assumptions look to have QLD royalty driven from price of coal in USD, not AUD. Royalty costs will be higher than assumed, cash flow will be lower.

# Looks like assumptions double count depreciation and sustaining capex from the tax calculation, resulting in less tax being calculated. Cash flow will be lower.

# At the assumed coal prices (~US$245 realised) the contingent payments will be payable – so there’s an extra US$900M cash outflow for consideration

# I wonder if payback calculations need to be adjusted to be consistent with debt funding – calcs are currently based on cash flows after debt service, but the full enterprise price (not just the equity portion) is being used as the numerator. This would also make comparison with other transactions, eg S32, more consistent.

# I’ve also had a look based on US$250/t benchmark prices and less conservative production figures of 12Mt and 4Mt for BW and Daunia

Stepping through the impact on payback period (payback based on unlevered cash flows):

Assumed: 3.9 years (3.6 years)

Adj for higher royalties: 4.9 years (4.4 years)

+Adj for higher tax: 5.3 years (4.8 years)

+Adj for higher contingent consideration payable: 6.7 years (6.0 years)

Above adjustments and scenario at US$250/t and higher production: 7.8 years (6.9 years)

I think the attractiveness for Whitehaven is more around deal structure (no equity raising required) and overnight transition to met than outright price.

Michael,

A sincere thanks for your comments. I will review this weekend, when I’ll also get a chance to review the recent quarterly.

Best wishes,

Roger

Michael,

Many thanks for taking the time to look at my calculations and sincere thanks for your observations.

1) On QLD royalty. Agreed. I’ve adjusted this.

2) On Depreciation and Sustaining Capex. Agreed and I’ve adjusted to calculate the tax due. I’m also assuming that there will be some un-depreciated assets remaining on acquisition.

3) Agreed on the contingent payments. I ignored contingent payments to help simplify but US$900m will be due over three years above prescribed thresholds, capped at US$350m per annum. This will of course slow down payback.

4) I’ll have a think about this.

5) I’ve stuck with conservative saleable production numbers but adjusted to use company guidance for FOB cash costs FY24F – FY28F Average as per October 2023 Investor Presentation, rather than prior year numbers.

With these changes, I still come to the conclusion that Whitehaven management ask for US$1.0b for 20% of Blackwater.

I understand your comments on payback period, particularly when considering contingent payments.

No equity and the transformation to a majority met coal producer is certainly helpful.

Thanks again for your thought through comments. Much appreciated.

Best wishes,

Roger