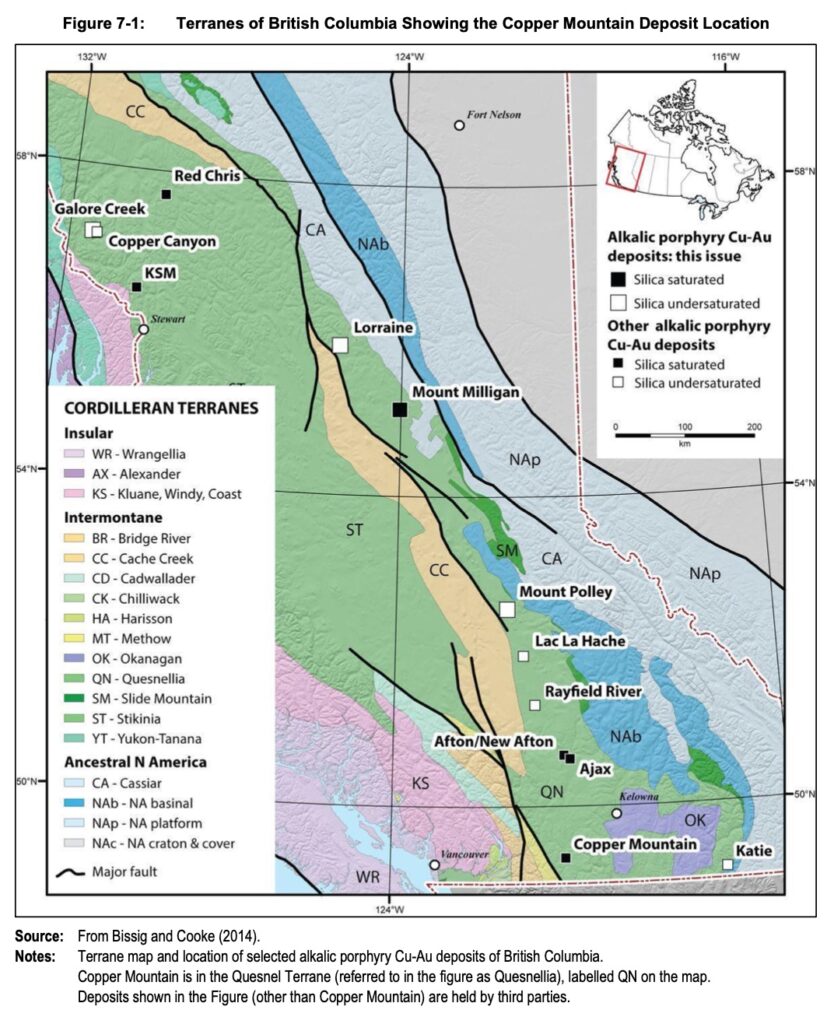

Exploration is a risky and expensive business and it’s essential to reduce risk where possible. For example, rather than searching in under-explored frontiers, it might be preferable, and perhaps lower risk, to search ‘along trend‘ of some known geological deposits. The map of British Columbia below shows the major porphyry deposits located from Galore Creek and Red Chris in the northwest down to Copper Mountain and Katie in the southeast. This northwest – southeast pattern might be one such trend worth exploring further, especially with the infrastructure already in place.

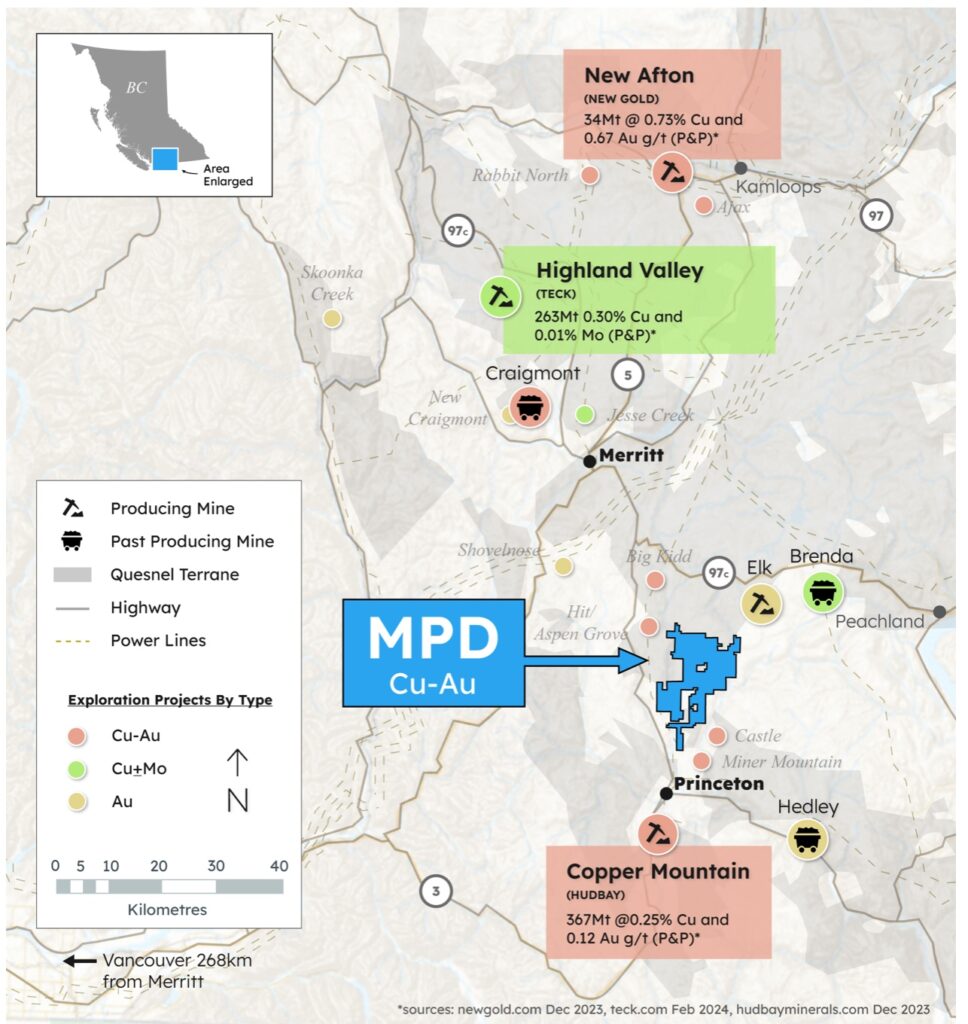

If we focus on the southern part of British Columbia, notice how Kodiak Copper have secured ground along this trend, between New Afton and Copper Mountain. Teck’s Highland Valley copper mine is also located along the broader regional trend. The Highland Valley mine is one of the largest base metal mines in Canada. Operations began in 1962 and have continued across several separate mines until the present day. The mine has capacity to process 155,000 tonnes of ore per day and is forecast to produce between 112,000 to 125,000 tonnes of copper in 2024.

Grade

One of the first things you might notice about Copper Mountain, Highland Valley and New Afton is the grade.

- Copper Mountain’s Proven & Probable Reserves: 367Mt at 0.25% copper and 0.12 g/t gold.

- Highland Valley’s Proven & Probable Reserves: 263Mt at 0.30% copper and 0.01% molybdenum.

- New Afton’s Proven & Probable Reserves: 34Mt at 0.73% copper and 0.67 g/t gold.

These are relatively lower grade deposits compared to global standards, particularly for Copper Mountain and Highland Valley. New Afton has a higher grade but is an underground mine.

Hudbay’s Acquisition of Copper Mountain

On 13 April 2023, Hudbay announced that they would acquire 100% of Copper Mountain Mining Corporation (CMMC) in a stock deal, that valued the equity consideration at US$439million based on Hudbay’s closing price on 12 April 2023. Copper Mountain Mining Corporation owns 75% of the Copper Mountain Mine. The other 25% is owned by Mitsubishi Materials Corporation. This would imply a transaction price of about US$585million for 100% of the Copper Mountain Mine.

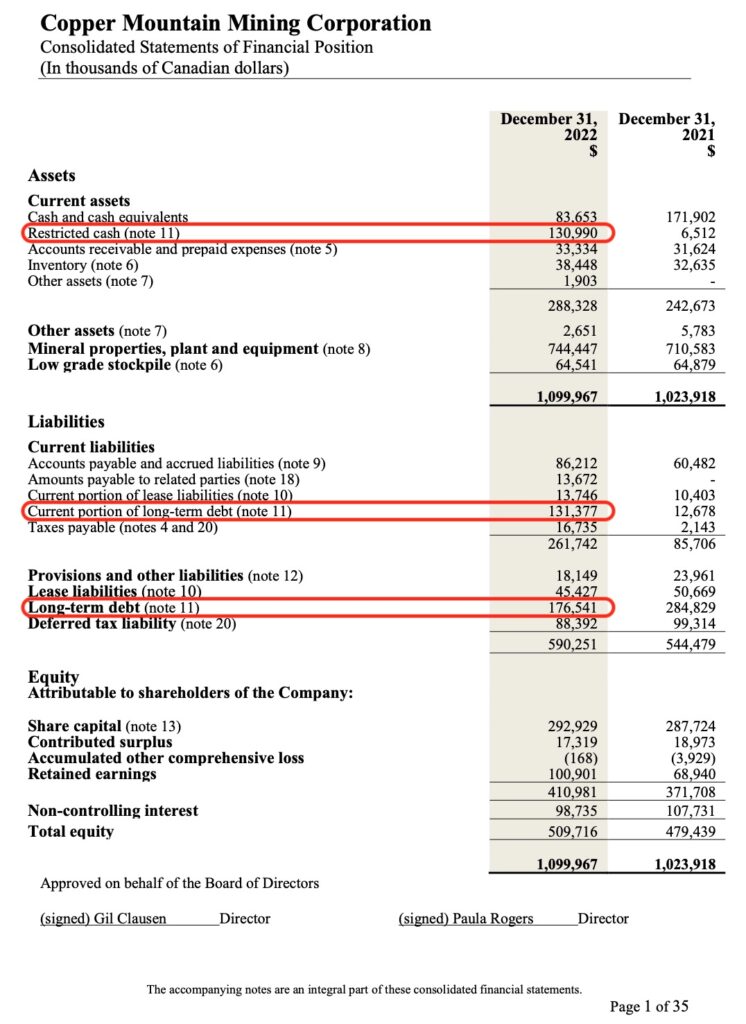

On closer inspection, it seems that Copper Mountain got their balance sheet in a tangle. At 31 December 2022, they had debts of C$308million. The ‘restricted cash’ of C$130million was required for debt service of the bonds and the ‘cash and cash equivalents’ of C$83.6million was needed to pay the ‘accounts payable’ lines of approximately C$100million combined.

Hudbay’s Plans for Copper Mountain

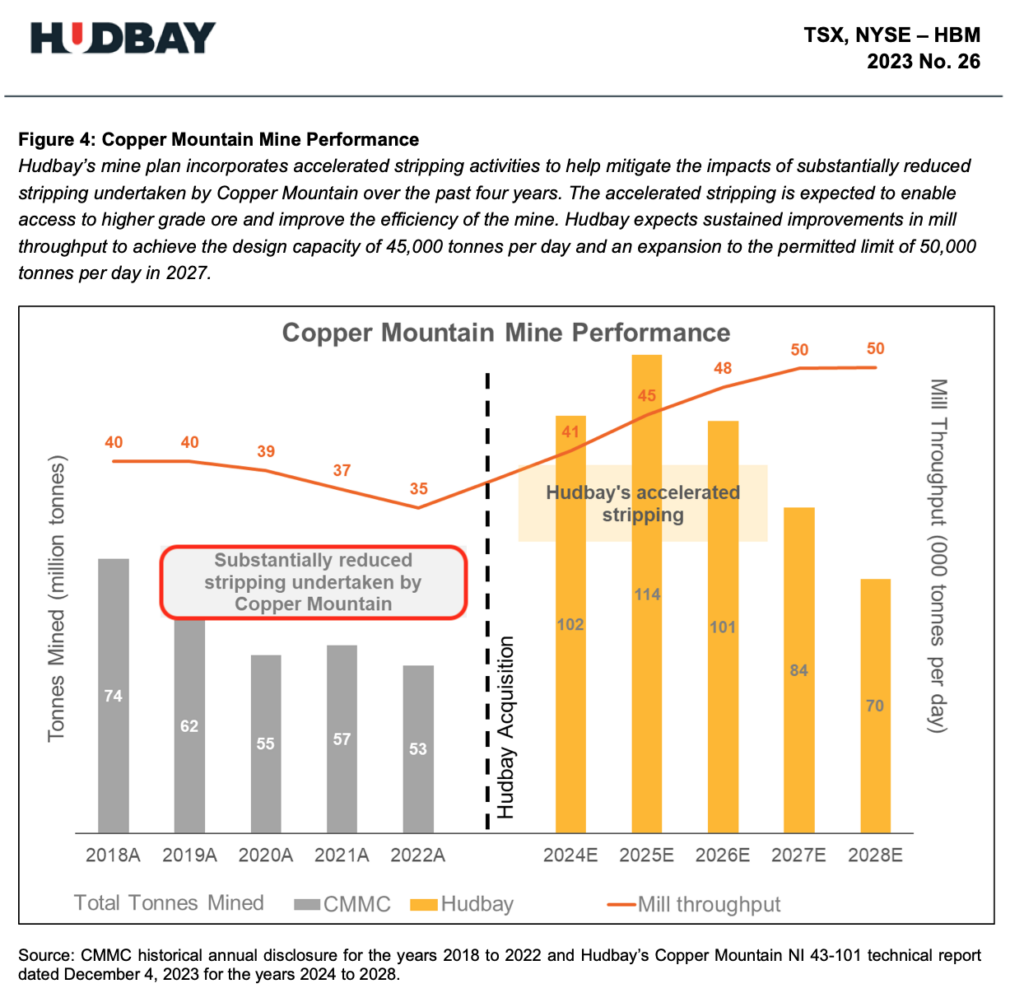

Hudbay’s news release on 5 December 2023, announced their plans for the mine. It also suggested years of ‘substantially reduced stripping‘ by the Copper Mountain Mining Company leading to lower levels of tonnes mined in the years prior to acquisition. This underinvestment seems understandable in light of CMMC’s constrained balance sheet. Hudbay’s plans are; to accelerate the required stripping, improve copper recoveries as well as other operational efficiencies, increase mill throughput and ultimately drive down operating costs.

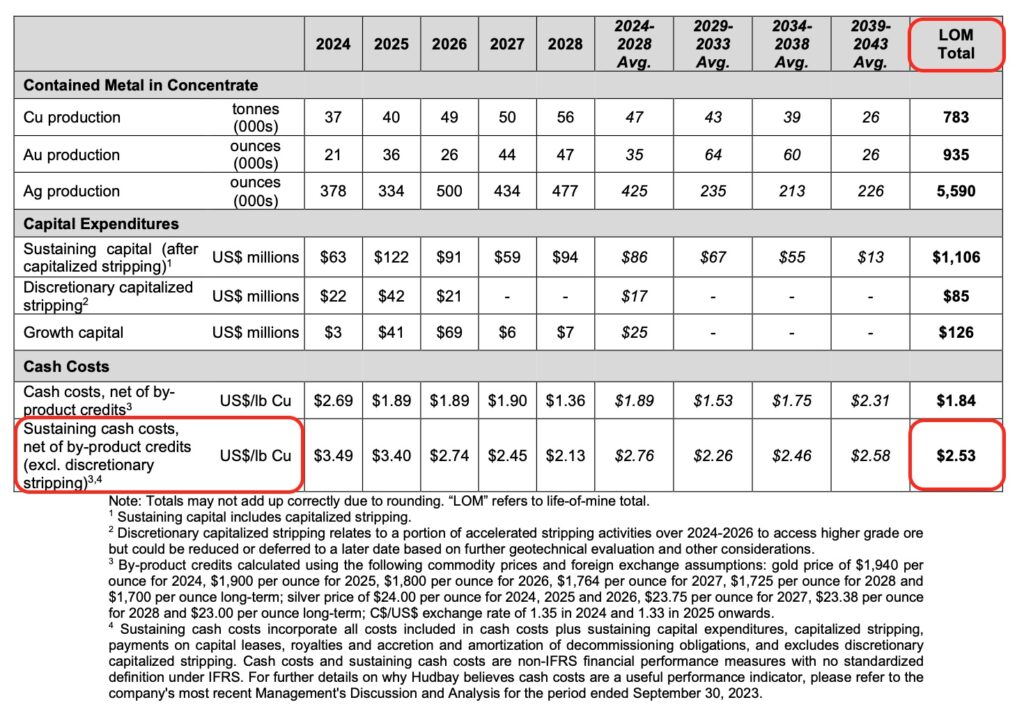

Based on this plan, Hudbay have forecast lowering Sustaining Cash Costs for the 21 year Life Of Mine (LOM) to US$2.53/lb of copper.

Copper Mountain has the longest Reserve life of any asset in Hudbay’s portfolio. It would appear they envisage a long and profitable future for the mine.

Hudbay’s Technical Report – Copper Mountain

Further details can be found in the full technical report.

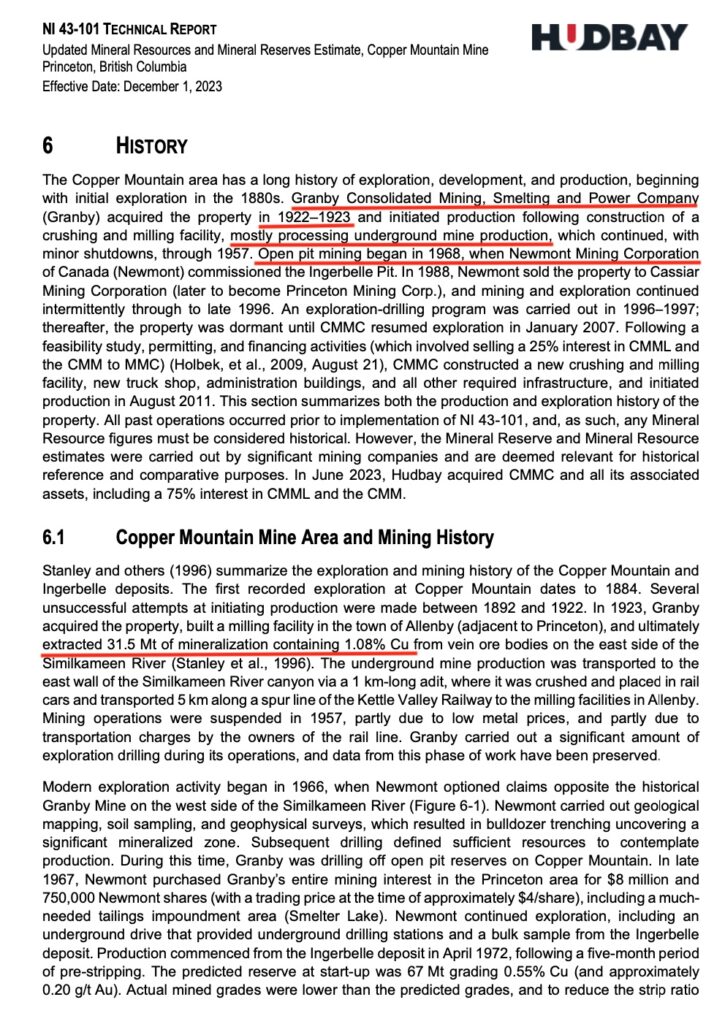

I searched for the history section which I’ve reproduced below. Production was initiated by the wonderfully named Granby Consolidated Mining, Smelting and Power Company (Granby). I had come to think of Copper Mountain as an open pit operation and was somewhat surprised to learn that it started life as an underground mine, back in the 1920’s. Over several decades of operation, Granby ‘extracted 31.5 Mt of mineralisation at 1.08% copper‘!

British Columbia Geological Survey Website

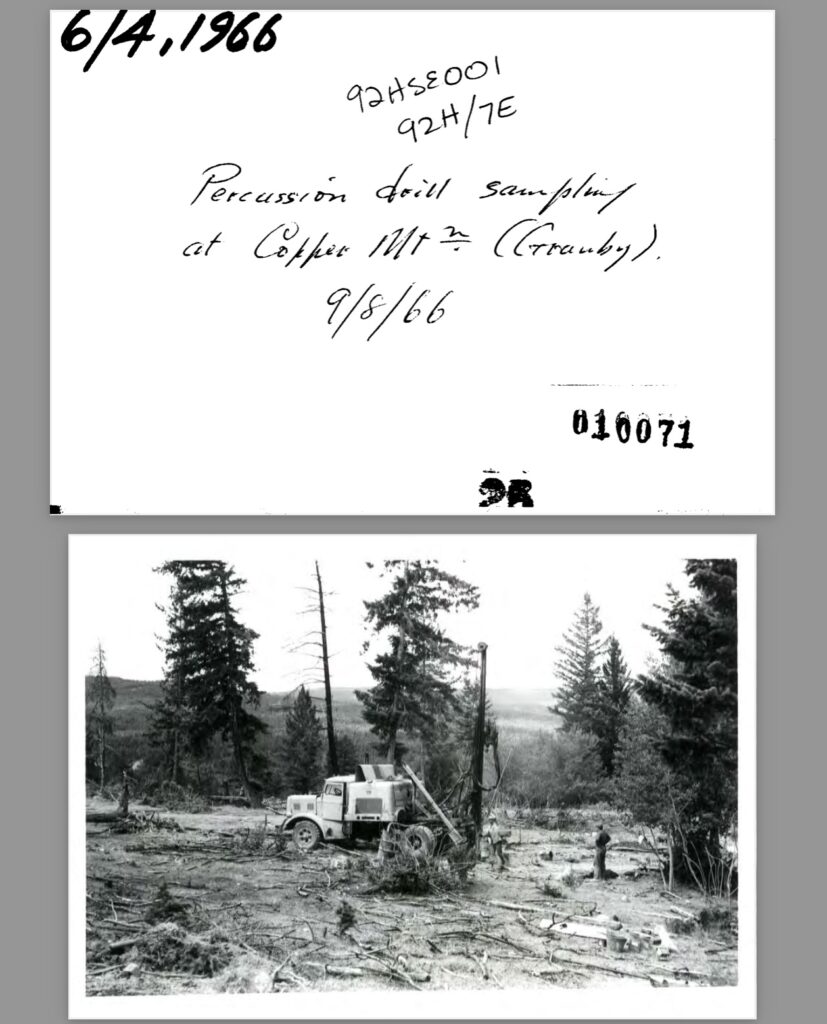

I then visited the British Columbia Geological Survey website to see what I could find about this area of British Columbia. I started with a search of Copper Mountain and found the following old photo, dated 1966. It’s described as ‘Percussion Drill Sampling at Copper Mountain (Granby)’.

It’s just around the time that this photo was taken in 1966 that Newmont Mining optioned claims opposite the historical Granby Mine, on the west side of Similkameen River. The following year, Newmont bought-out all of Granby’s mining interests in the area and eventually started open-pit mining in 1972.

Prime Group of Claims – D.C. Malcolm Report – 5 August 1976

Further searches of the British Columbia Geological Survey website around the Missezula Lake, near to Kodiak Copper’s current MPD project, led me to this old report:

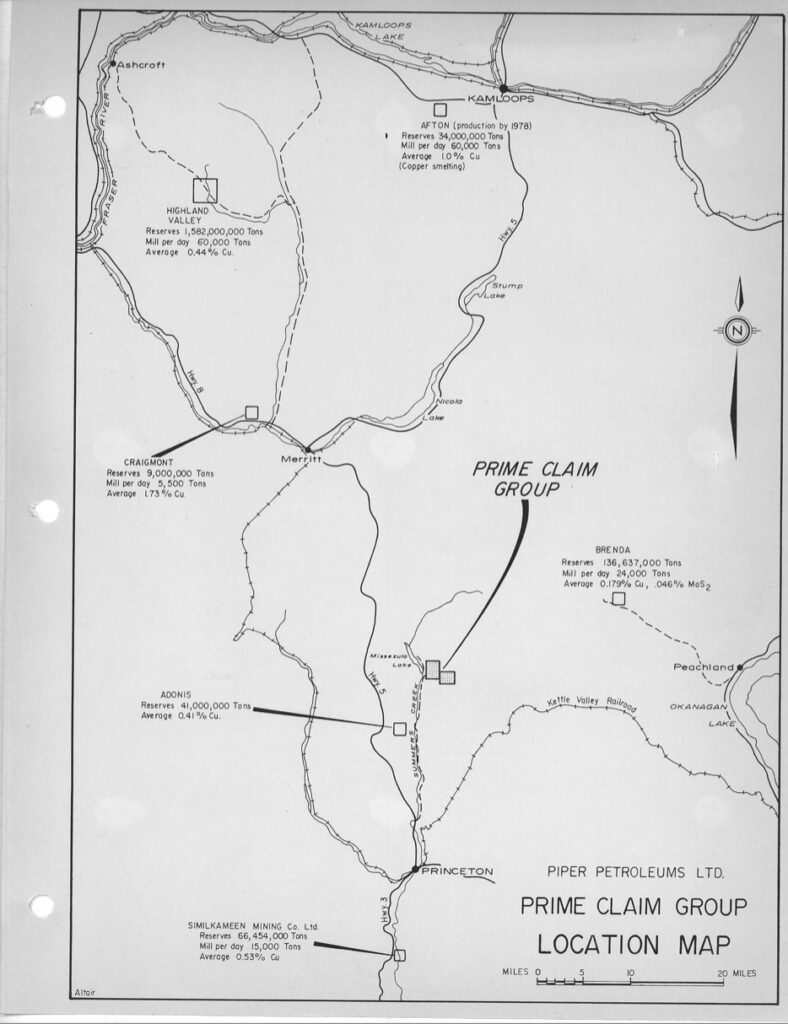

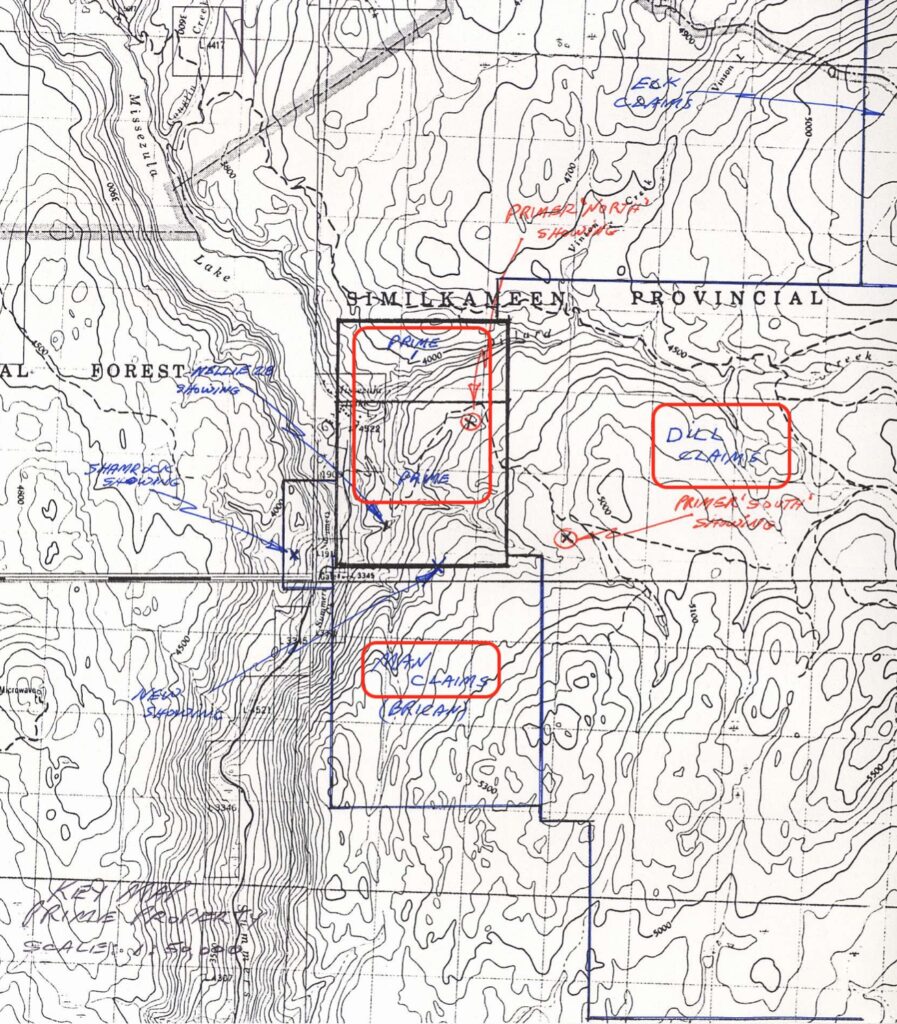

The report is from 1976 and covers the ‘Prime Group of Claims’ to the southeast of Missezula Lake. These claims are now the ‘P’ in Kodiak’s consolidated MPD project. There’s plenty to read here but I’ve reproduced the following map from the report which shows our main area of interest.

Copper Mountain is labelled at the bottom of the map as Similkameen Mining Co which was Newmont Mining’s 100% subsidiary that owned Copper Mountain. Notice the reserve grade of 0.53% Cu. More than double its reserve grade today.

The huge Highland Valley is shown on the top left of the image, along with the former Craigmont mine, with a copper reserve grade shown of 1.73% copper.

Craigmont Mine

According to Nicola Mining which owns the old mine tenements ‘The Craigmont deposit is a Cu-Fe skarn originally mined from 1958-1982, extracting 34 Mt of ore averaging 1.28% Cu: one of the highest-grade copper mines in British Columbia to date. Craigmont is adjacent to the southern margin of the Guichon Creek Batholith, host to numerous calc-alkalic Cu-Mo-Au porphyry deposits of the Highland Valley District.”

The mine closed in 1982 due to low copper prices but Nicola Mining are currently re-exploring the area.

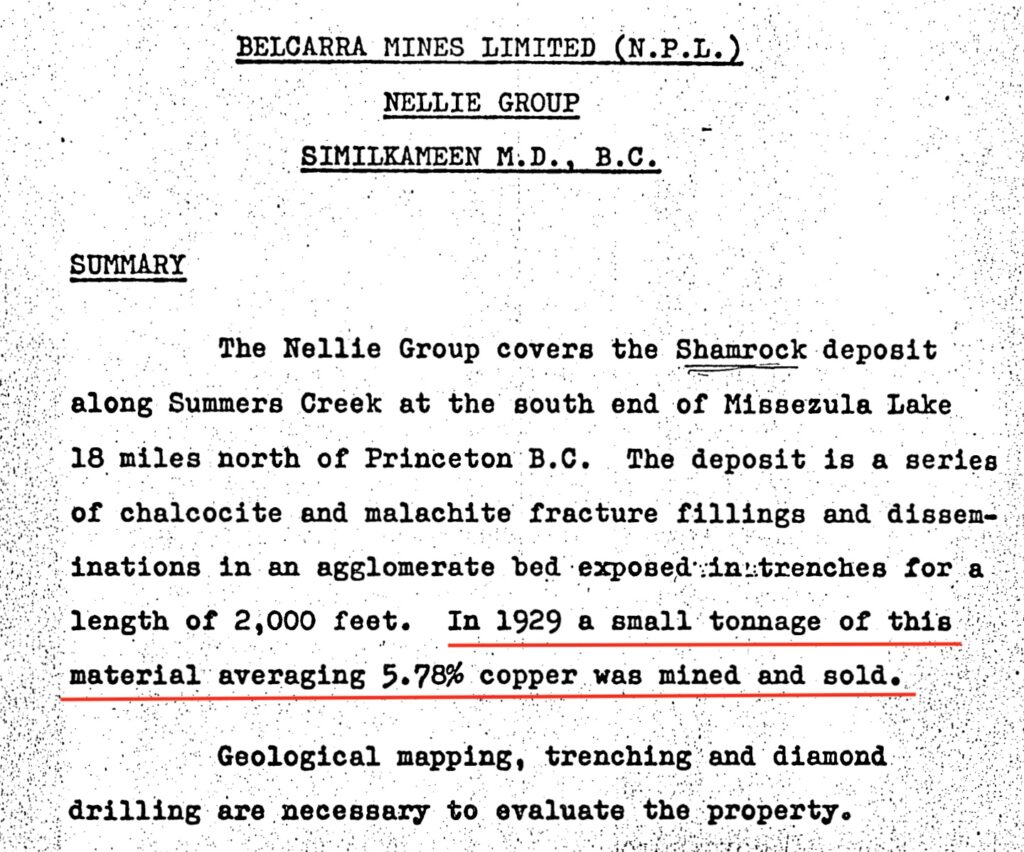

Nellie Group of Claims (Shamrock Deposit) Belcarra Mines – D.C. Malcolm – 9 June 1971

Further searches around Missezula Lake led me to this report, commissioned by Belcarra Mines on the Nellie Group of claims.

These claims are also located ‘at the south end of Missezula Lake’ near the Prime claims. But what’s interesting is the mention of a small tonnage of material ‘averaging 5.78% copper‘ that was mined in 1929!

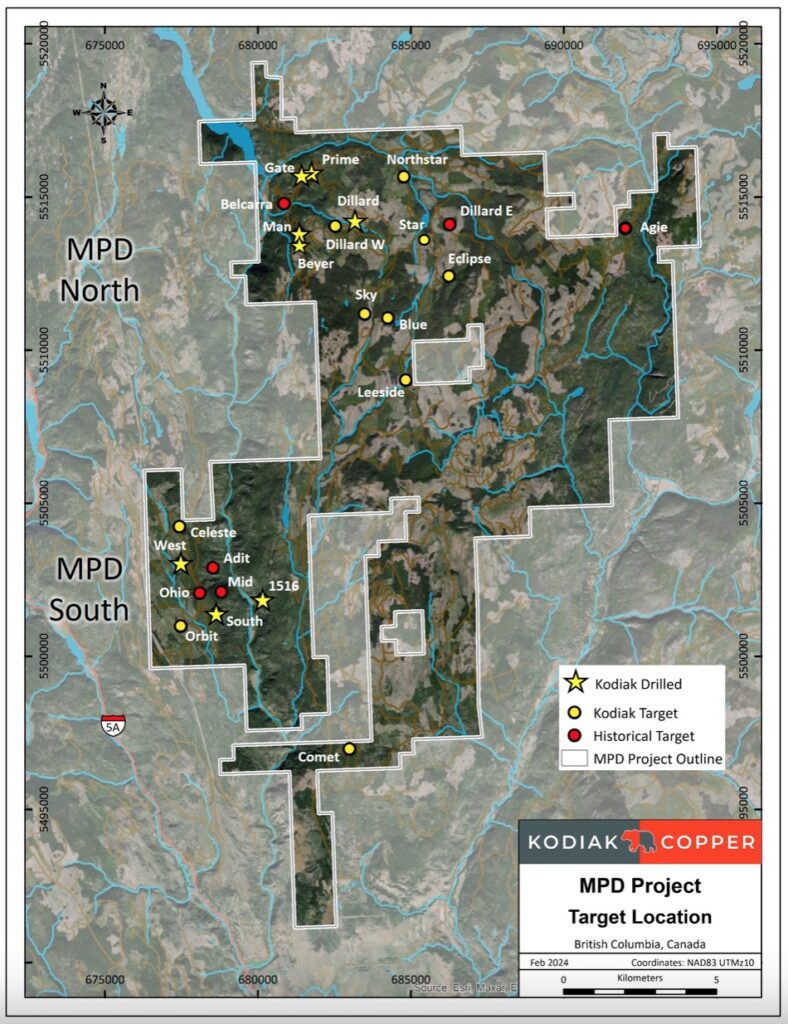

If we look at Kodiak Copper’s map of claims from their website, you can see a historical target (red dot) called Belcarra, in the northeast of the property, near the Gate zone.

The following technical report by James M. Dawson on the Prime Property for Exaton Resources has an excellent chronology of the property including mention of Rio Tinto’s involvement in the 1970’s;

“In 1972-73, the Primer property and the adjacent (to the west) Belcarra Explorations property were optioned to Rio Tinto Canadian Exploration Ltd who carried out surface mapping, magnetometer and induced polarisation surveys and drilled five core holes totalling 2,103 feet.“

Prime Property – James M. Dawson, P. Eng. 31 December 1991

I’ve reproduced the following map from the report, which shows the Man, Prime and Dill Claims, the ‘M’, ‘P’ + ‘D’ from Kodiak’s MPD project. Notice the hand-written annotation showing the ‘Shamrock Showing’ on the left of the map.

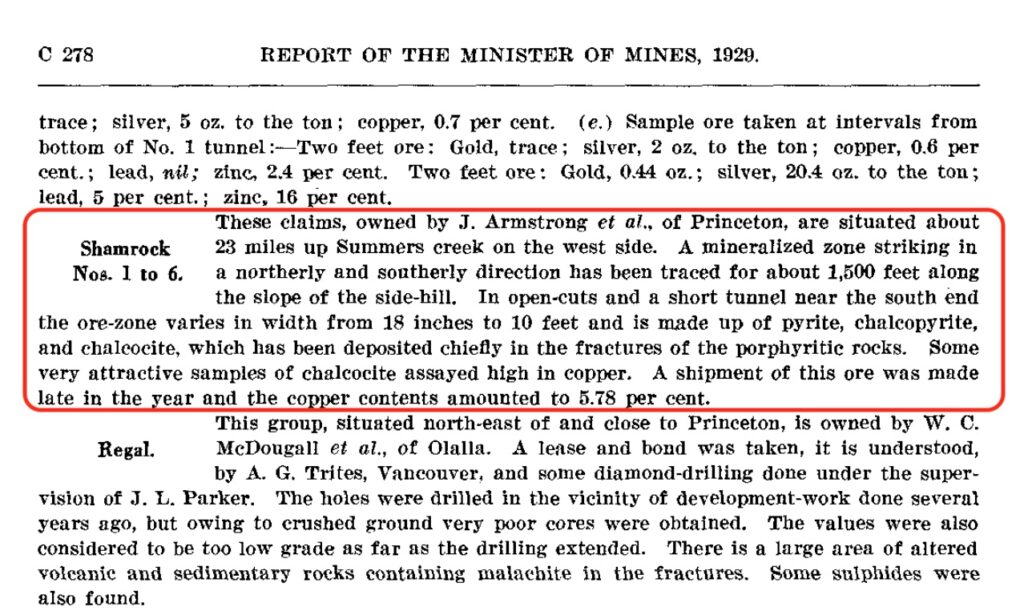

Annual Report of the Minister of Mines – 1929

I wanted to locate more evidence of this remarkably high-grade shipment of copper ore that’s reported to have taken place in 1929, and eventually came across this staggering report. It’s 570 pages and goes into a vast amount of detail. It remarkable how much work must have gone into producing it and how meticulously it’s been typed up. All before wordprocessors!

After getting lost a few times. I eventually found what I was looking for. Evidence that mining 5.78% copper at the Shamrock claims wasn’t just a tall story!

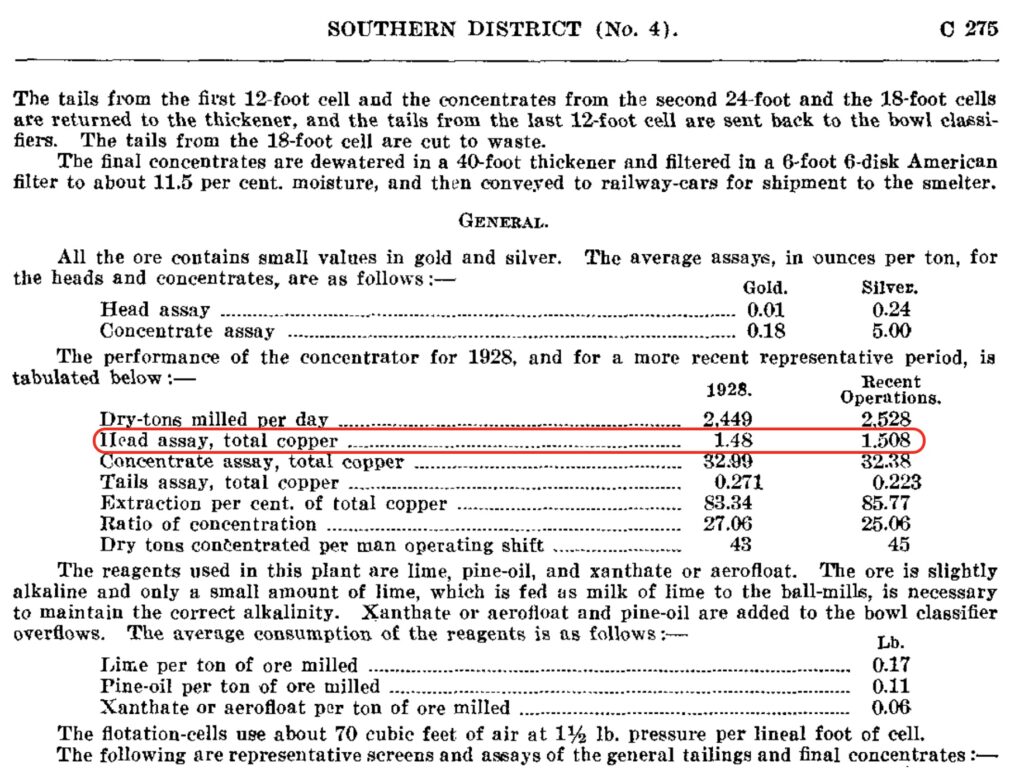

Additionally, starting on page 269 is a detailed description of the operations at Copper Mountain. I might be reading this wrongly but it seems to suggest that the copper head grade in 1928 was 1.48(%)?!

On the mineralogy present at Copper Mountain it states; “The principal minerals in the ore are chalcopyrite and bornite, with very little chalocite present, and the grain is extremely fine, irrespective of the grade of ore. These copper sulphides are intimately associated with and finely disseminated throughout the gangue, which is very hard. Other metallic minerals present are haematite, limonite, and a small amount of pyrite, but these are for the most part associated with the gangue and are usually well separated from the copper minerals.”

Conclusion

Kodiak Copper have located themselves ‘along trend’ from two of the largest copper mines in Canada, Copper Mountain and Highland Valley. Both with long histories of production. The region is a low-cost environment in which to operate, with existing infrastructure. There’s no need for desalination plants, as often required in the copper belts of the Andes.

While the current head grades of Copper Mountain and Highland Valley are relatively low compared to global peers. This was not always the case. Granby Consolidated are reported to have extracted 31.5Mt of ore at 1.08% copper from Copper Mountain during their decades of operation. The Annual Report of the Minister of Mines (1929) even suggests that 1.48(%) copper head grade was delivered to the plant in 1928.

Craigmont Mines Limited mined a Cu-Fe skarn deposit just south of Highland Valley between 1958 and 1982, extracting 34Mt of ore averaging 1.28% copper. Further investigation of the region, has found reports of 5.78% copper being mined from the Shamrock claims in 1929, south of Missezula Lake, likely chalcocite ore.

In 2020, Kodiak gave us a glimpse of what their MPD project might have to offer when they drilled through 45.7m at 1.41% copper and 1.46 g/t gold within a 535m section of mineralisation.

This region can and has produced high-grade copper mineralisation.

Intriguingly, Kodiak have announced that they’ve “identified five new targets at MPD: Agie, Leeside, Celeste, Orbit and Comet. This brings the total number of prospective areas to 24, of which only eight have been drilled by Kodiak to date.” They’ve also announced that they’re using VRIFY’s artificial intelligence (AI) software to prioritise the targets. There’s plenty more for Claudia, Chris and the team to drill here, amongst this cluster of porphyries. AI might just assist with the efficiency of the search.

If they can locate more high-grade ore, amongst the apparently pervasive bulk tonnage mineralisation, in this premier North American jurisdiction, then Kodiak Copper won’t stay independent for long.