On the 7 February 2024, Fortitude Gold announced the acquisition of two new gold properties in Nevada. This weekend I took a closer look at one of these, the Dauntless gold property, located in Esmeralda County, approximately 30 kilometers southwest of Tonopah. According to the news release, the Dauntless claims acquired ‘includes the historic Weepah gold mine’.

My first port of call was the Nevada Division of Minerals website for Mining Claims. It’s a fairly clunky website but once you get the hang of it, it has a wealth of information.

Location

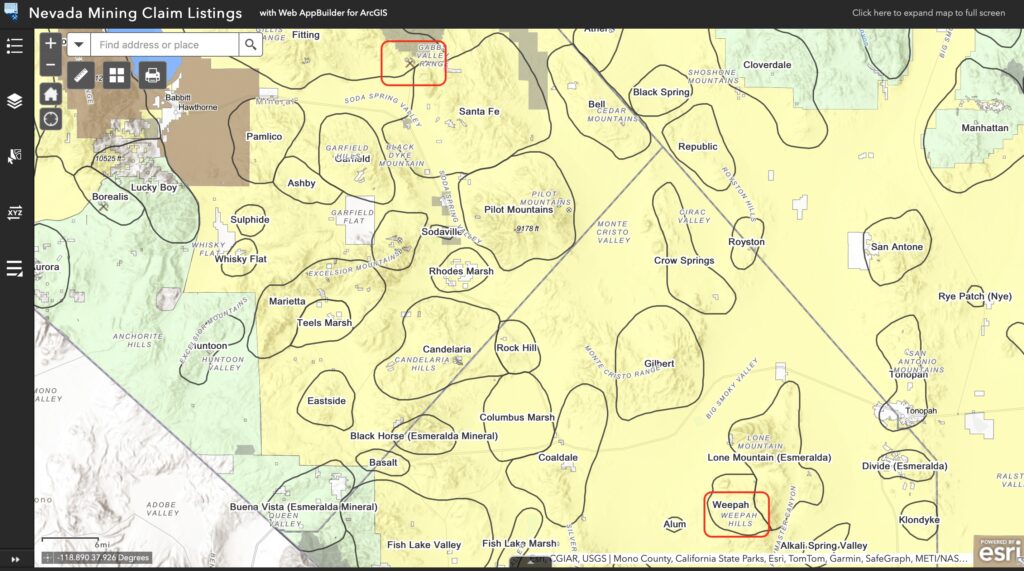

The red rectangle in the top of the image below is Fortitude Gold’s Isabella Pearl gold operation. You might be able to see the ‘pick and shovel’ indicating the location of the mine. To the bottom of the image is another red rectangle that I’ve added to highlight the Weepah Mining District. I calculate the distance between Isabella Pearl and the Weepah Mining District, as the crow flies, to be approximately 58 miles or 93 kilometres.

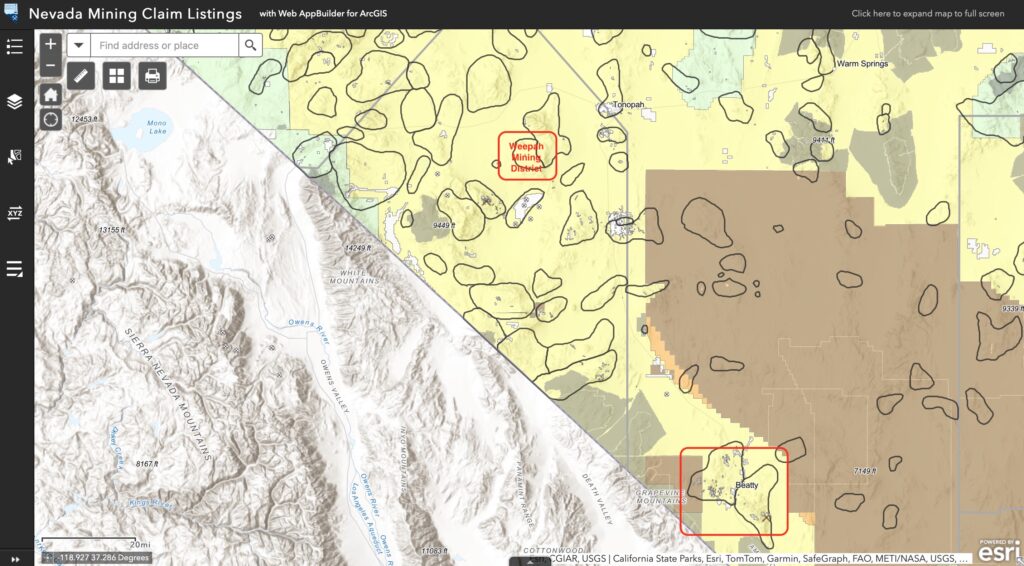

To further help us get our bearings, I’ve added another image below, that shows the Weepah Mining District relative to the Beatty Mining District, further to the south west in Nevada. The Beatty Mining District is where AngloGold Ashanti announced on 23 February 2024, with their Preliminary Financial Results for the year to 31 December 2023, that they’ve;

“made an important new gold discovery in the United States, declaring a gold Inferred Mineral Resource of 9.1Moz at an average grade of 0.99g/t, at the Merlin deposit in Nevada. This new find takes AngloGold Ashanti’s total gold Mineral Resource in the Beatty District in Nevada to a total of 16.6Moz at 31 December 2023. “This is the largest new discovery in the United States in more than a decade,” said CEO Alberto Calderon. “We’ve found a lot of gold, at a very good grade, in one of the best jurisdictions in the world; it’s potentially a game changer.”

While the Beatty District is some 120km to the south east of the Dauntless gold project at Weepah, it’s a good reminder of why Fortitude Gold have made Nevada their base for operations and exploration. These are proven mining districts and significant discoveries continue to be made.

The Acquisition

Fortitude’s news release explained that “The Dauntless claim package was purchased from Nevada Select Royalty Inc, a wholly owned subsidiary of Gold Royalty Corp.” and that “The Company purchased 100% interest in the Dauntless claim package for total consideration of US$725,000. Nevada Select Royalty Inc retained a maximum net smelter return royalty (NSR) of 3% on future production from the property claims.“. The size of the land package acquired is approximately 2,105-acres. However, Fortitude Gold have staked further ground ‘to strengthen the land position and exploration potential‘. The total acreage acquired AND staked comes to approximately 4,680 acres. This is approximately 19km2.

Now that I’d located the Weepah Mining district and understood the broad terms of the deal, I looked for more information about the historic Weepah gold mine and the Dauntless claims.

Sonderman’s 1971 Masters Thesis

One of the first things I came across was the following document called ‘The Geology of the Weepah Mining District‘ from the Mines Library, University of Nevada, Reno. It was authored by Frank Sonderman in June 1971, as his thesis for a Master of Science in Geology.

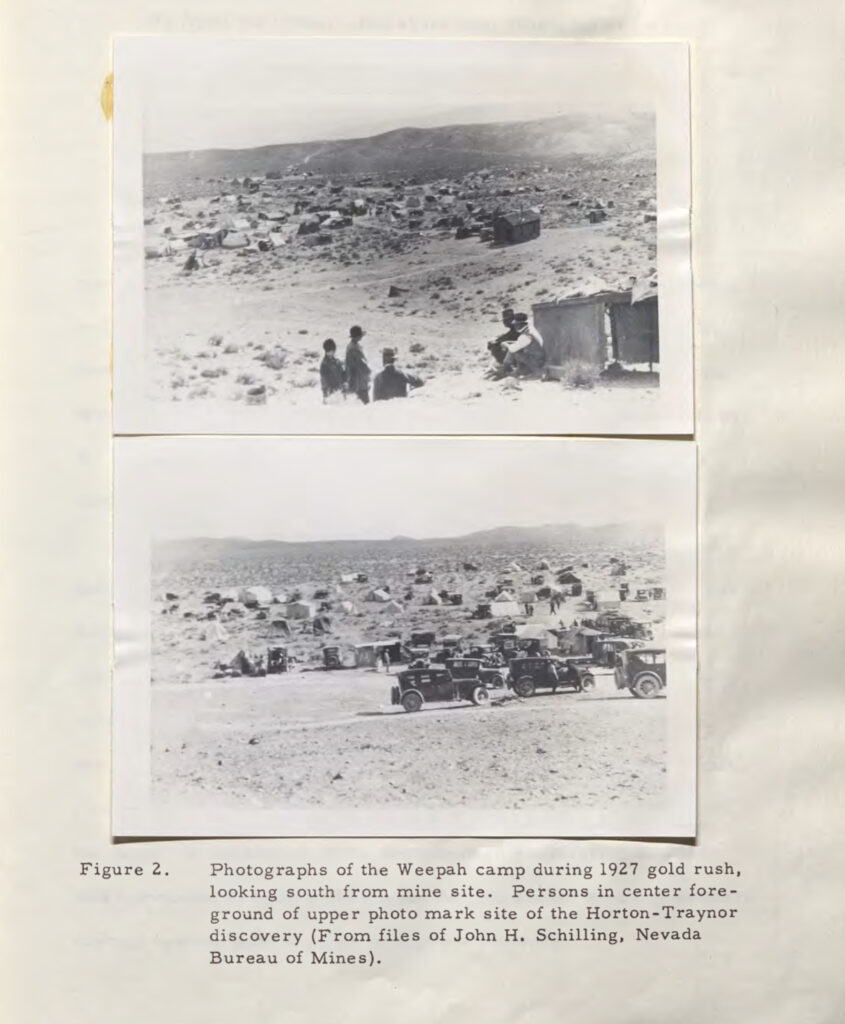

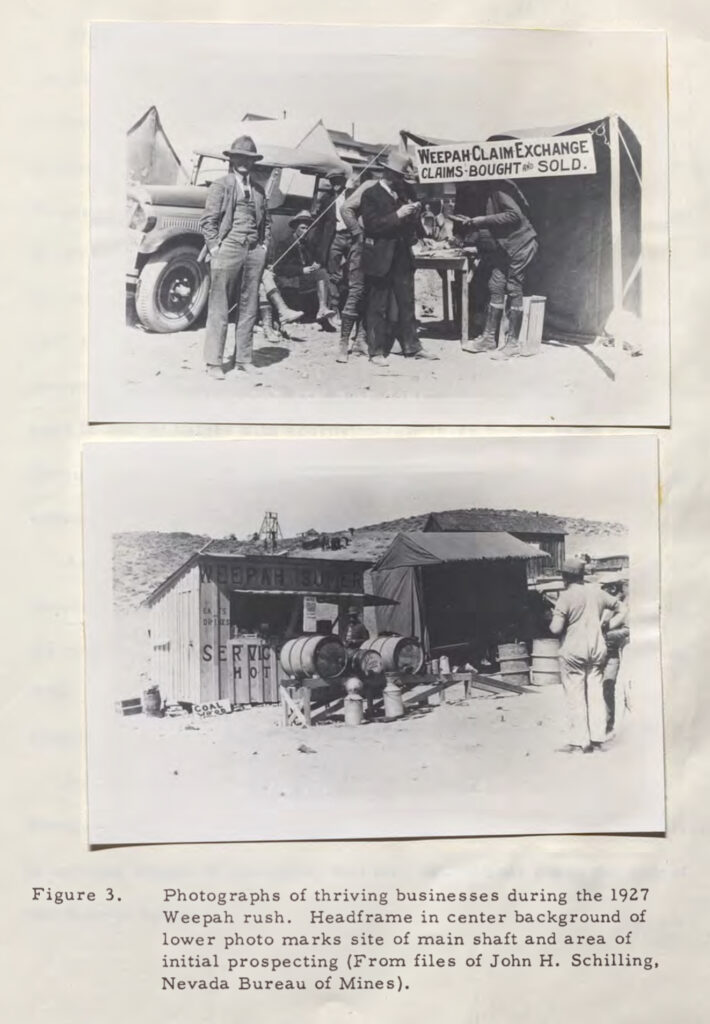

The document, which I’ve uploaded in full, has some excellent old photos of the gold rush that took place at Weepah around 1927.

On page 6, Sonderman provides a history of the gold discovery. Originally, gold was found in 1902 but mining was abandoned only for gold to be rediscovered again in March 1927 by Leonard Trainer and Frank Horton Jr.. Notice the part that mentions ‘The discovery reportedly assayed around $70,000 (sic) per ton.‘

$70,000 per ton is a staggering value and almost unbelievable. Paher, the source cited, wrote his book in 1970. I’m not quite sure if he was referring to 1927 metal prices or 1970 metal prices when he mentions this value. If we look at historical gold prices that you can find here, gold was $20.64 in 1927 and $36.02 in 1970. If we go with 1927 prices and assume the initial discovery was all gold, then a ton of rock would have contained 3,391 ounces of gold!

I looked a little closer at this 1927 gold discovery and found another thesis, ‘The History of the Tonopah Area’ by Lucile Berg who wrote this paper in May 1942. The document was reproduced in 2011 by Nye County Press.

The thesis refers to the Weepah gold discovery in Chapter 10. (Footnotes (2) and (3) cite various articles in the Tonopah Daily Times in March and April 1927 as the source) Leonard Trainer and Frank Horton Jr are both attributed to the find as in the previous paper. This time the article suggests the find assayed at $78,000, which if sourced from the Tonopah newspapers must be at 1927 metal prices. What’s interesting is the comment about “A 2-foot rock 10 inches thick revealed a mass of yellow metal when broken open.“

What might have happened is Traynor and Horton found a large rock laiden with gold and that the figure of ‘$70,000 (sic) per ton’ quoted in Paher’s book was perhaps an extrapolation of the gold content to a ton of rock. This is just a guess. None-the-less, a rich pocket of gold seems to have driven this gold rush, suggesting a powerful geological system.

An article that I found in Desert magazine (February 1973) on the 1927 Weepah gold rush provides further insight. Here are some screenshots from the article:

The article went onto say the following:

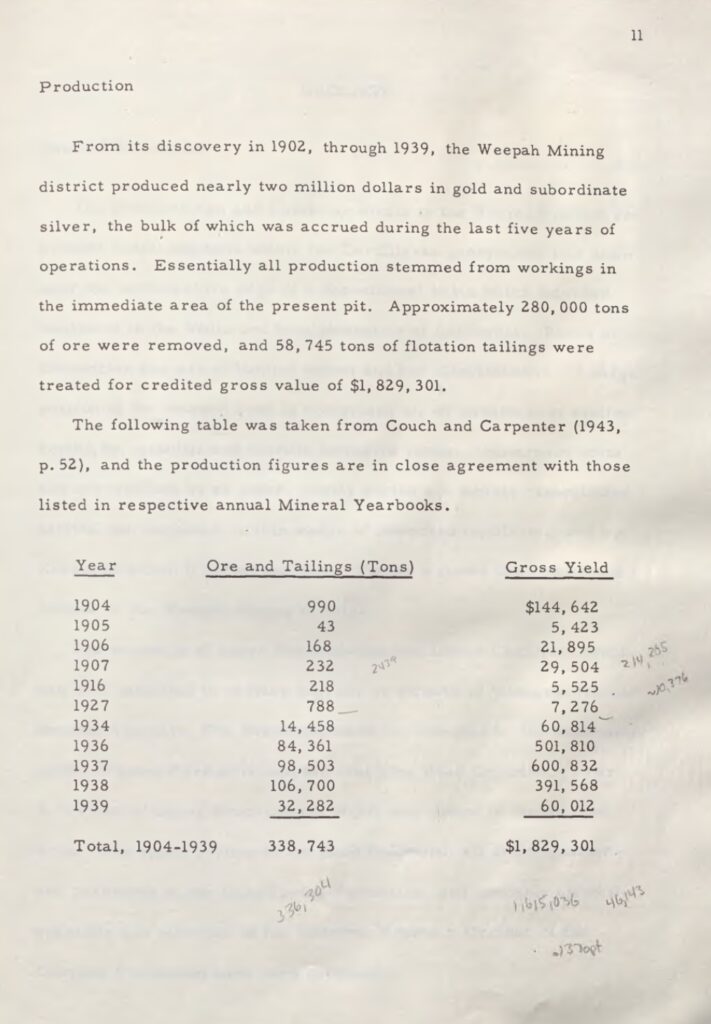

On page 11 of Sonderman’s thesis, production figures are set out. What’s helpful here is the mention of gold AND ‘subordinate silver’. Also, notice how it took 10 years, after the rediscovery of gold in 1927, for production to peak. The Great Crash of 1929 would likely have slowed down any capital investment. But in late 1935 the construction of a 250 ton per day flotation plant started and milling operations began in October 1935.

Production in 1937, suggests a grade of between 5-6 g/t gold, if we assume just gold was produced and at 1937 gold prices of US$34.79/ounce.

Production came to a halt in 1939. Sonderman states, ‘According to the Minerals Yearbook (1939, p.405), known ore reserves of the Weepah Nevada Mining Company were depleted, and the company began retreating the impounded flotation tailings during 1938. In 1939, operation was suspended after cyanidization of the remainder of the flotation tailings.’

It’s also worth remembering that Germany’s invasion of Poland began in September 1939, which might have played a role in deciding to suspend operations, rather than search for more reserves.

Weepah Technical Report (NI43-101) – Amended 2016

I then located a technical report on the Weepah Gold Project, with an effective date of 2016.

On page 8 of the technical report it mentions the find in 1927 describing, ‘Weepah was first discovered by the Shoshone Indians in 1902 and became well-known in 1927 when a local man discovered a large gold nugget.‘

Interestingly, the technical report provides some further information after the mine suspended operations in 1939.

“In the 1950s, the late prospector/developer Paul Burkett acquired a large area of strategic patented and unpatented claims in and around the Weepah mine. On and off during the next several decades he continued to conduct prospecting and geological exploration aimed at establishing the true extent of the Weepah vein system. An open pit mine was developed and worked at 250 tons/day. It was listed as an active open pit silver-gold mine employing 10 persons in 1983. The property was drilled by Pacific Realm in 1984-85.

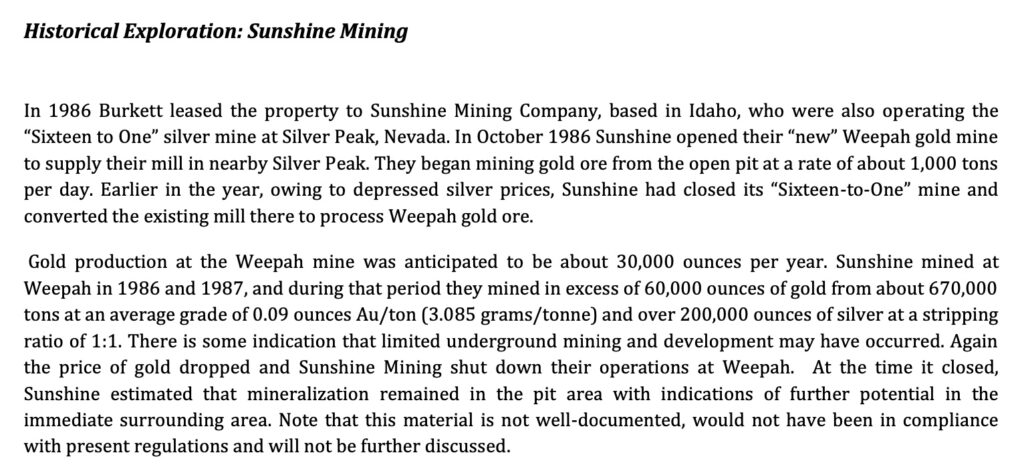

Sunshine Mining Company – The 1980’s

The Weepah technical report also discusses the activity that took place during the 1980’s.

As Fortitude Gold’s Dauntless-related news release on 7 February 2024 stated, ‘Historic gold production grade estimated at 3.1 grams per tonne (g/t) gold (Sunshine Mining Company)‘

The Geology

The Technical report describes the Mineralisation of the Weepah Deposit as follows:

“The Weepah deposit appears to be an oxidized shear zone hosted epigenetic gold-silver deposit, possibly emplaced along a high angle or low angle fault. An historical description follows:

‘The main Weepah deposit is located along a quartz-filled northeast-trending, right-lateral shear zone. Shallow, high-grade pockets of auriferous sulfide ore occurs as, replacement deposits in the carbonate rocks adjacent to the quartz veins. Gold occurs free in a quartz matrix intergrown with hematite after pyrite and chalcopyrite altered to gossan. Low grade gold ore occurs in granulated fault gouge. Alteration zones are minimal within the deposits (Sonderman, 1971).’ “

Tingley and Maldonado, referring to Sonderman (1971), also describe the mineral deposits in the area as follows (1983):

“Mineralization in the district occurs in the skarn zones along or adjacent to the contacts of the intrusive bodies; as replacement bodies along bedding shears in the carbonates, primarily dolomites; or in shear zones in the tactite bodies. Sonderman (1971) suggests that the Weepah deposits are epithermal, precious metal veins of gold-silver type, probably emplaced in the Late Mesozoic.”

Nugget Effect

A comment from the technical report that I want to highlight is on page 14 where it describes historical exploration in 2010-2011 by Mount Royal Resources Corp. The report states, “Two hundred and twenty three (223) rock samples including 10 blanks were taken from the Weepah Pit area, Quist area* and scattered across the property, these were submitted for geochemical analysis by ALS Chemex Labs in Sparks, Nevada. A total of 11 samples returned greater than 1 ppm gold supporting the historical comments that the gold was erratic with strong nugget effect.

A strong nugget effect might explain why the geology of the Weepah area hasn’t been unlocked yet.

There’s plenty to read in the Technical Report. But the most recent information that I could find on Weepah led me to Eminent Gold Corp.

Eminent Gold Corp’s Exit

On 14 November 2023, Eminent Gold Corp (TSX-V: EMNT) terminated their “option agreement on the Weepah property with Optionor, Nevada Select Royalty Inc.“. The reason they gave; “The Company plans to remain focused on its flagship asset, Hot Springs Range Project (HSRP) which we believe has world class Carlin style deposit potential.”

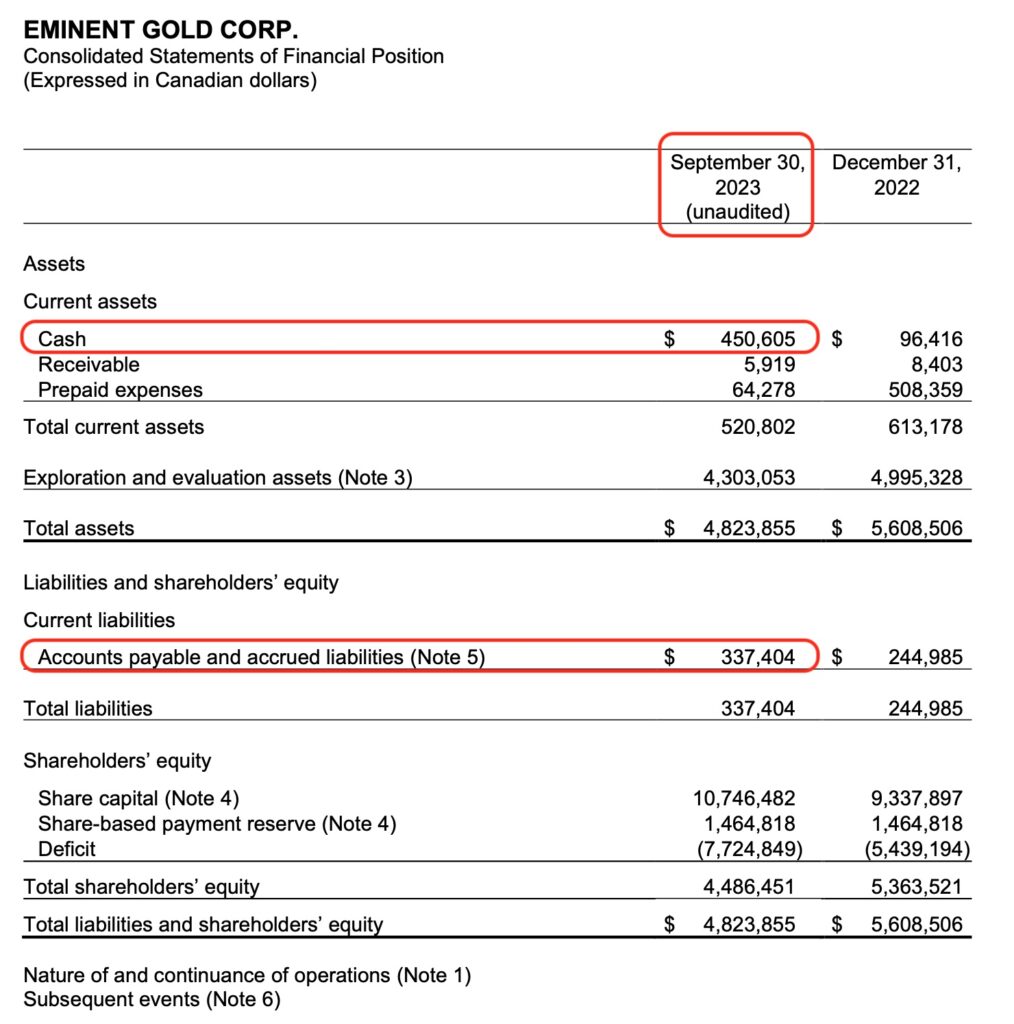

On closer inspection of Eminent Gold, this seems reasonable. I found Eminent’s Balance Sheet as at 30 September 2023 and they had C$450,605 in cash, with Accounts Payable and Accrued Liabilities of C$337,404.

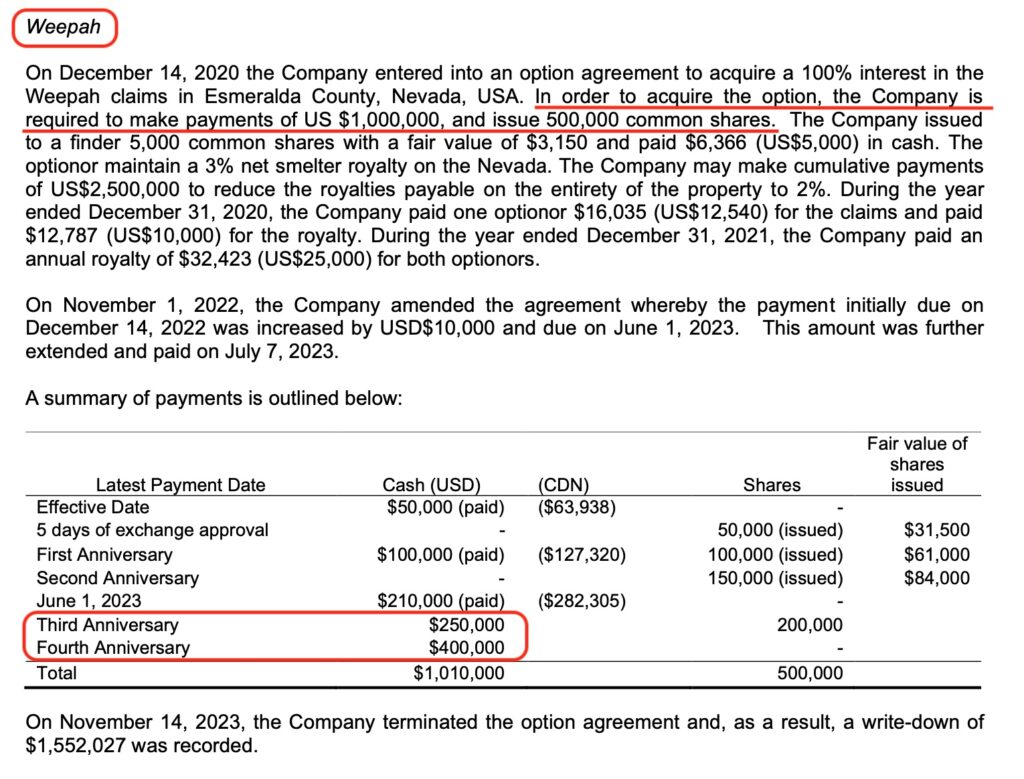

On page 11 of Eminent Gold’s Interim Financial Statements at 30 September 2023, Eminent laid out the terms of the option deal on the Weepah project with Nevada Select Royalty, that was entered into on 14 December 2020. The purchase option involved staged payments of US$1,000,000 as well as the issue of 500,000 Eminent Gold shares. If you look at the summary of payment details, the third anniversary of the deal (14 December 2023) was getting close, with a payment due of US$250,000 cash and 200,000 shares.

Given Eminent’s cash levels at 30 September 2023 and their desire to focus their efforts on two of their four gold projects in Nevada, it’s understandable that they dropped Weepah when they did.

The other thing that I noticed, was that while Eminent were due to pay US$1,000,000 in cash and 500,000 shares for the project. Fortitude Gold only paid US$750,000 in cash and no shares. CEO Jason Reid and the board of Fortitude Gold are fiercely protective of their share count. It’s no surprise to me that Fortitude Gold’s deal with Nevada Select for Dauntless was cash only.

Noting that Eminent Gold made a C$1,552,027 write down on the Weepah property, once the option was dropped, I wanted to learn more about the work that had been done.

Eminent Gold – 22 June 2021

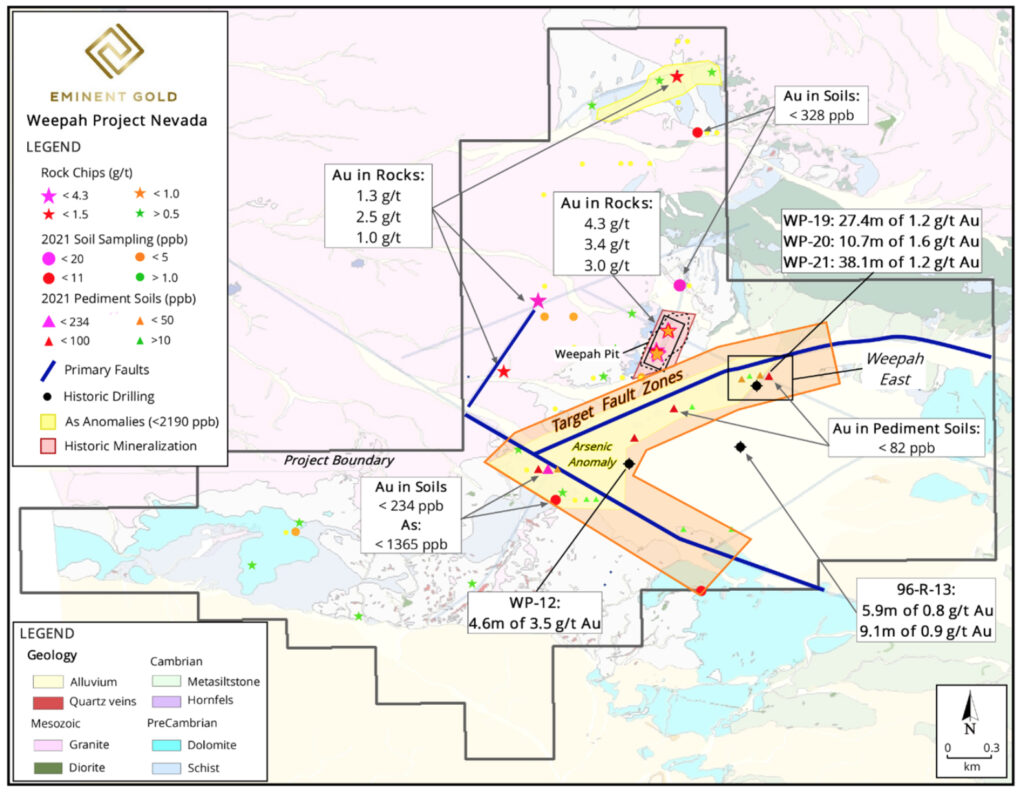

An Eminent news release on Weepah in mid-2021 discussed the soil and rock sampling work they’d conducted as well as discussing the newly identified fault zones;

“Phase 1: Surface Field Work – Complete

The Company took 1,665 soil samples from colluvium and 443 pediment soil samples, at 50-meter by 200-meter spacing as well as 295 rock samples. Through mapping and sampling the entire property the Company’s technical team identified two primary fault zones that indicate mineralization outside of the historic Weepah pit. Importantly these two fault zones bound an area of pediment (cover) immediately south of the Weepah pit. Both gold and arsenic show stronger anomalies in pediment soil samples along these fault zones. Arsenic is one of the best pathfinder elements for gold mineralization and is particularly effective in revealing mineralization under post-mineral cover. It is believed by the Company’s technical team that historic drilling, which focused on a trend subparallel to Weepah, missed the opportunity to intercept stronger mineralization that correlates with these newly identified faults.”

The news release also provided this map of the tenement highlighting the fault zones and the areas of anomalous arsenic:

Eminent’s current website has little to read on Weepah, other than the previous news releases. But thanks to archiving systems that can be found on the internet, I was able to retrieve old data from their website.

In the section on Weepah, Eminent Gold described the following (as at 18 August 2022);

“The Property has produced 117,000 ounces of gold at grades between 3 and 6 g/t Au and has two main exploration targets that have only recently been consolidated into one package by the Company: thus the Company will be the first to explore the district as a single project. The Property has 126 known exploration drillholes with the vast majority positioned solely in the known occurrences: step-out drilling from these occurrences has been limited, erratic, poorly documented, and often off-trend, especially in the intermontane basin south of the known occurrences. Many of the holes no longer have assays attached to them and/or are shallow rotary holes.

A plethora of historical prospect pits, shafts and adits occur away from the known occurrences, yet there appears to have been extremely limited rock sampling of these occurrences in modern times: even pits that appear to be on trend with the existing mineralization have experienced markedly little modern sampling.

Prior to the Company’s acquisition of the project, no soil surveys had been conducted in either the intramontane basin that bounds the occurrences to the south, nor in the colluvial zones over existing bedrock.“

Eminents Gold’s estimate of between 3 and 6 g/t sounds about right, if we include both the gold mined in the 1930’s and the gold mined by Sunshine Mining Company in the 1980’s.

Eminent Gold – 28 October 2021

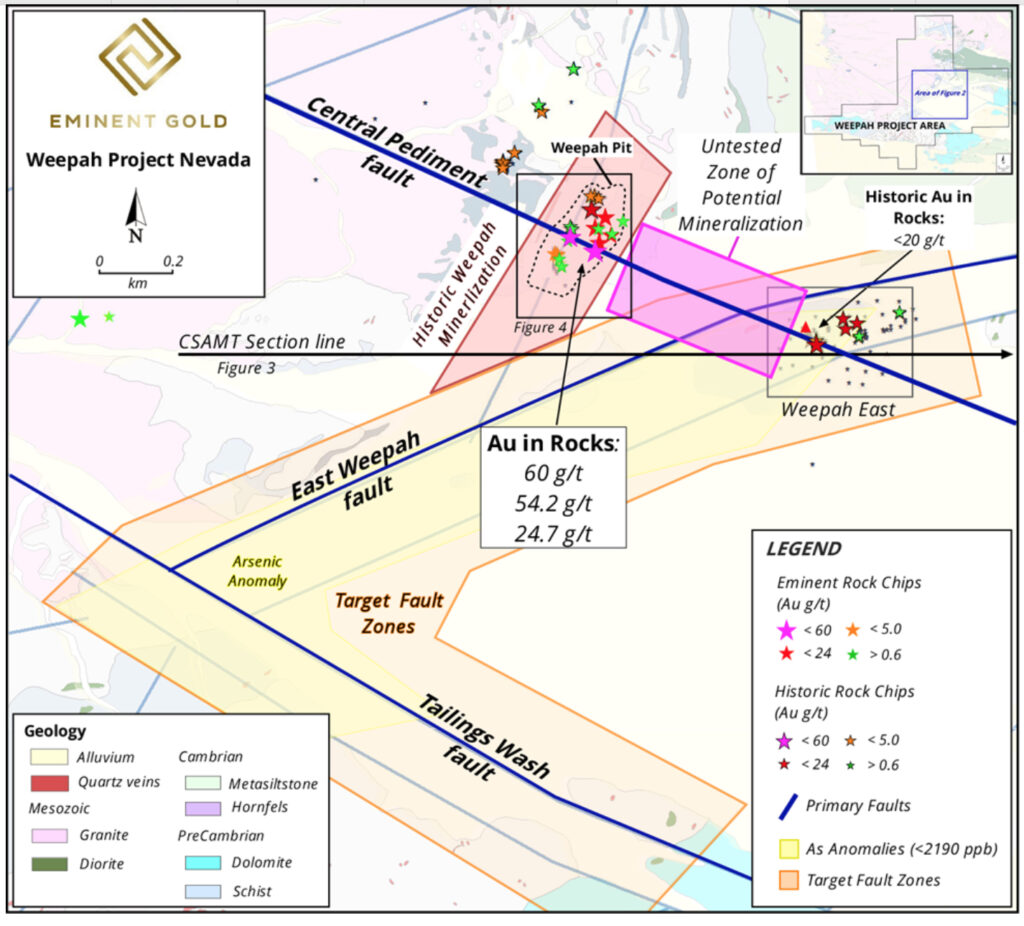

In October 2021, Eminent Gold put put another news release highlighting further work on structural geology and highlighting a potential feeder fault linking the Weepah Main and East Deposits. They indicated that ‘The fault has not been historically drilled and now represents a primary target on the property.’ They also announced rock chips up to 54.2 g/t gold across 1.2 meters and 60 g/t gold across 0.3 meters. A map of the newly discovered Central Pediment Fault was provided.

It seems to me that Eminent did a fair bit of work on the Weepah Gold Project but I’ve not found any evidence that they drilled their targets before they dropped their option. Perhaps constrained by budgets, or their attention was drawn elsewhere. Maybe both.

But this provides plenty of opportunity for Fortitude Gold.

Conclusion

There are several reports of a significant gold find at Weepah in the early 1900’s. Rich gold finds like these suggest a highly mineralised geological system. The Sonderman thesis mentions gold, silver, copper, lead and even zinc. Copper, in fact, is mentioned five times in the thesis, as well as ‘supergene’ processes that might have mobilised mineralisation. It makes me wonder if the gold find was simply part of a larger geological system at work at Weepah and on the wider Dauntless claims. Eminent Gold, to their credit, appear to have done some significant work in 2021 on the structural geology but don’t appear to have tested their thesis. They appear to have dropped the option due to financial constraints, which unfortunately is the perpetual challenge for most explorers. Fortitude Gold, on the other hand, already have a base in Nevada AND have the cash to test the system to greater depths. I’m looking forward to hearing further news on their exploration efforts at Dauntless and the historic Weepah mining claims.

Roger I’m 100% invested in ftco with dividends annualized over 100 k – I have been traumatized with last 12 mos price drops when all I see is phenomenal returns with lots of upside potential – your report adds so much hope – it’s an incredible report – another theory that I have is if you invested 1 mm in a 5% treasury – and somehow lived on the 50 k a year interest – what’s 1mm in cash worth in 10 years – but ftco value may go 3-4x in value – moving forward I will continue to 100% invested buying what i can accumulate with the stock under 6 bucks – thanks again – hope you bought some snacks at worlds greatest bulk store in Beatty – bill Schonsheck

Hi Bill,

Thanks for reading my article and your feedback. Much appreciated.

The market has certainly been tough and I understand the trauma of the last 12 months. Isabella Pearl has been a great, profitable project. It’s a shame that permitting seems to have caused delays with County Line and Golden Mile etc. It’ll be a relief to see resolution of these permits.

I understand your comment on cash in 10 years time, which is why I like Fortitude Gold strategy of dividends paid out of gold mining profits!

I’ve not been to Beatty yet but I hope to visit Nevada some day. You guys have some GREAT stores over there in the USA!

Best wishes,

Roger

Very interesting article. Yes FTCO insiders own over 10% of the stock. My fellow investors which includes family and Illinois corn farmer friends are very aware of the 24 million shares that will not get diluted any time soon. Well written article. And the maps were very helpful to understand where everything is. If possible please send me any updates on future FTCO.

One serious FTCO investor here who appreciates anything you do on this miner. Are you also an investor in FTCO ? Thanks again for your work.

John,

Many thanks for your message and the feedback on the article. It’s much appreciated.

I was a Fortitude Gold investor but I’m currently not invested. My fiancé and I have moved to cash for a property move. Which is taking far longer than we had hoped. It’s frustrating because in my opinion the market has provided an opportunity here. I also miss the monthly dividends. Once the house move goes through, I can see what money is left over. Fortitude Gold will be reviewed again then.

Separately, I think the news released earlier this week about East Camp Douglas is very interesting indeed. I had started this article on Dauntless before the drill results on East Camp Douglas came out. Otherwise, I would have written about East Camp Douglas first.

As for share count, I think Jason and Greg are excellent guardians of capital.

Best wishes,

Roger

Excellent research

Thank you

William,

Many thanks for reading my article and for your feedback.

Best wishes,

Roger

Thank you. A great article, and understandable for a non-technical investor.

Chris

Thanks Chris,

Many thanks for reading my article and for your feedback.

Much appreciated.

Roger

Thank you for providing the hours of research to give us a better understanding of the potential value of this property. $750,000 seems like a very reasonable, if not absolute bargain basement, price for this property! 3 grams per ton would make this another Isabella Pearl. however the distance concerns me. 60 miles seems too far to truck ore, which means this would be similar to golden mile, taking the ore to a certain stage and then trucking that to isabella for final processing. Golden Mile still isn’t approved, which means caution is warranted for how quickly Weepah would be permitted as well.

Hi Peter,

Many thanks for your comment. I agree that $750,000 seems like a reasonable price. At the same time, Golden Royalty Corp, the parent company of Nevada Select Royalty, will be looking to find an explorer and operator who can put this project into production so that the 3% NSR produces cash, rather than remains unproductive. With Isabella Pearl, Fortitude Gold have proved they can do this. I think both parties benefit and money needs to be provided to explore too. Fortitude Gold shareholders will be providing this capital.

On trucking, as you’ll have read, Fortitude Gold suggested in the acquisition news release that the project is ‘within trucking distance to the Company’s Isabella Pearl gold processing facility.’

If we think about Isabella Pearl as an operation, it produced 38,787 ounces of gold Equivalent in FY 2023 at an All In Sustaining Cost of US$656 per ounce, with gold currently above US$2,100/oz. The gold grade mined was 2.52 g/t Au. Although studies will be needed on Dauntless, there seems to be enough margin to cover the cost of trucking this distance, should decent oxide grade be found there. If the grade found is 2.5g/t Au and we estimate 85% recovery, we’d need to truck roughly (31.103 grams per ounce/(2.5g/t Au*0.85)) = 14.6 tonnes of ore per ounce of gold.

Ideally enough gold is found that a whole plant is built and loaded carbon is simply trucked up to Isabella Pearl for ADR stripping of the gold. Time will tell.

On permitting, I also agree, caution is required. It’s a shame that processing of applications seems to have slowed down so much. Hopefully there’s some progress soon on County Line and Golden Mile.

Best wishes,

Roger

Wow! You really dug deep (pardon the pun.) Very well researched and written; maybe more than I ever wanted to know, but a good history. Thank you And yes, I’ve been an FTCO holder from GORO days.

Harvey,

Many thanks for your feedback. And yes, there’s a lot of information in those reports. You can easily get lost in them!

Thanks for stopping by to read the article.

Best wishes,

Roger